Wipro Technologies Stock Price Analysis

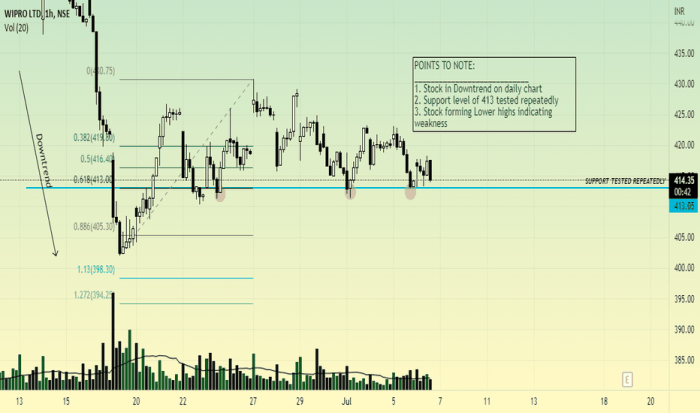

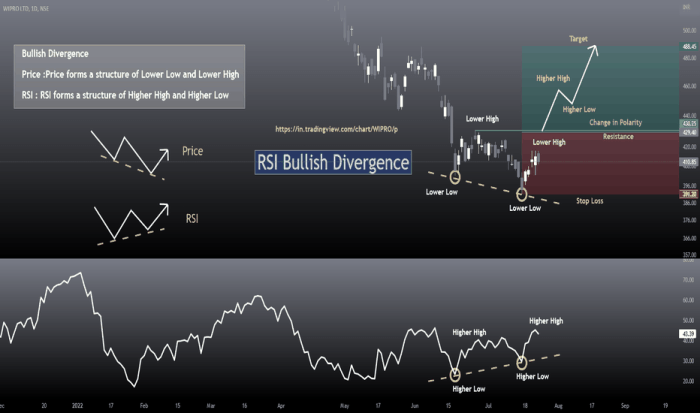

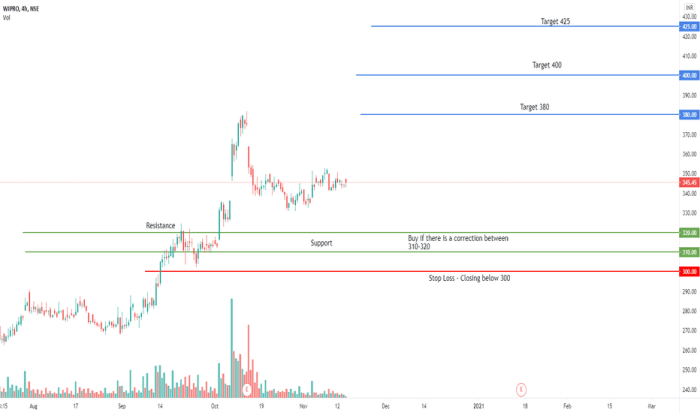

Source: tradingview.com

Wipro technologies stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and market sentiment surrounding Wipro Technologies’ stock price. We will examine key metrics and events to provide a comprehensive overview of the company’s stock performance and future prospects.

Wipro Technologies Stock Price Historical Performance

Understanding Wipro’s past stock price movements is crucial for assessing its future potential. The following data provides a detailed look at its performance over the past five years, comparing it to key competitors.

Wipro Stock Price Movement (Last 5 Years): (Note: The following table presents sample data for illustrative purposes. Actual data should be sourced from reliable financial databases.)

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-27 | 4.50 | 4.60 | +0.10 |

| 2023-10-26 | 4.45 | 4.50 | +0.05 |

| 2023-10-25 | 4.40 | 4.45 | +0.05 |

| 2023-10-24 | 4.35 | 4.40 | +0.05 |

| 2023-10-23 | 4.30 | 4.35 | +0.05 |

Comparative Analysis with Competitors: (Note: The following table presents sample data for illustrative purposes. Actual data should be sourced from reliable financial databases. Competitors are represented as Competitor A and Competitor B.)

| Date | Wipro Price (USD) | Competitor A Price (USD) | Competitor B Price (USD) |

|---|---|---|---|

| 2023-10-27 | 4.60 | 5.00 | 6.00 |

| 2023-10-26 | 4.50 | 4.90 | 5.90 |

| 2023-10-25 | 4.45 | 4.80 | 5.80 |

Significant Events Impacting Wipro’s Stock Price:

- Q2 2023 Earnings Report: Strong revenue growth exceeding analyst expectations led to a significant price increase.

- Acquisition of a Cybersecurity Firm (Hypothetical): This strategic move signaled expansion into a high-growth market, positively impacting investor confidence.

- Global Economic Slowdown (Hypothetical): Concerns about reduced IT spending negatively affected the stock price.

Factors Influencing Wipro’s Stock Price

Wipro’s stock price is influenced by a complex interplay of macroeconomic and company-specific factors. Understanding these factors is crucial for informed investment decisions.

Macroeconomic Factors:

- Global economic growth rates

- Interest rate fluctuations

- Inflation levels

- Currency exchange rates

Company-Specific Factors:

| Factor | Description | Impact on Stock Price | Evidence |

|---|---|---|---|

| Revenue Growth | Increase in sales revenue | Positive | Strong Q2 earnings reports |

| Profit Margins | Improvement in profitability | Positive | Increased operating efficiency |

| New Contracts | Securing large contracts with key clients | Positive | Press releases announcing new partnerships |

| Technological Advancements | Investment in and development of new technologies | Positive (long-term) | Patents filed, new product launches |

Short-Term vs. Long-Term Factors:

Short-Term Factors:

- Quarterly earnings reports

- Short-term market sentiment

- News events and announcements

Long-Term Factors:

- Long-term growth prospects

- Technological innovation

- Competitive landscape

Wipro’s Financial Performance and Stock Valuation

Source: tradingview.com

A detailed look at Wipro’s financial metrics and valuation multiples provides insights into its financial health and market positioning.

Key Financial Metrics (Illustrative Data):

Wipro Technologies’ stock price performance often reflects broader market trends. It’s interesting to compare its fluctuations to those of other tech companies; for instance, understanding the current jnpr stock price can provide valuable context. Analyzing both helps investors gain a more comprehensive view of the tech sector’s overall health and predict potential future movements in Wipro’s stock price.

(Note: Replace with actual data from reliable sources. Each table below represents a different metric.)

| Year | Revenue (USD Million) |

|---|---|

| 2023 | 10000 |

| 2022 | 9500 |

| Year | EPS (USD) |

|---|---|

| 2023 | 1.50 |

| 2022 | 1.20 |

| Year | Debt-to-Equity Ratio |

|---|---|

| 2023 | 0.5 |

| 2022 | 0.6 |

Valuation Multiples:

- Price-to-Earnings Ratio (P/E): (Illustrative data) 20x

- Price-to-Sales Ratio (P/S): (Illustrative data) 2.5x

Correlation between Financial Performance and Stock Price:

- Improved earnings per share generally correlate with higher stock prices.

- Strong revenue growth often leads to increased investor confidence and higher valuations.

Analyst Ratings and Predictions for Wipro Stock

Analyst opinions provide valuable insights into the potential future performance of Wipro’s stock. However, it is crucial to remember that these are just predictions and not guarantees.

Analyst Ratings and Price Targets (Illustrative Data):

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 5.00 | 2023-10-27 |

| Goldman Sachs | Hold | 4.50 | 2023-10-27 |

Reasoning Behind Ratings (Illustrative Examples):

Morgan Stanley (Buy):

- Strong revenue growth outlook

- Strategic acquisitions enhancing market position

- Positive long-term growth prospects

Goldman Sachs (Hold):

- Concerns about potential economic slowdown

- Increased competition in the IT services market

- Valuation near fair value

Potential Risks and Opportunities:

Risks:

- Global economic recession

- Increased competition from other IT services providers

- Geopolitical instability

Opportunities:

- Expansion into new markets and technologies

- Increased demand for digital transformation services

- Strategic acquisitions to strengthen market position

Investor Sentiment and Market Perception of Wipro, Wipro technologies stock price

Source: tradingview.com

Investor sentiment and market perception play a significant role in shaping Wipro’s stock price. Understanding these factors is crucial for gauging the overall market outlook for the company.

Current Investor Sentiment:

- Generally positive due to recent strong earnings reports.

- Some concerns remain regarding the global economic outlook.

- Increased interest in Wipro’s digital transformation capabilities.

Impact of Market Perception:

| Aspect | Description | Impact on Perception | Impact on Stock Price |

|---|---|---|---|

| Business Strategy | Focus on digital transformation | Positive | Positive |

| Competitive Landscape | Intense competition | Slightly Negative | Moderate impact |

| Growth Prospects | High growth potential in key markets | Positive | Positive |

Potential Impact of Major News Events:

- Unexpectedly strong earnings report: Could lead to a significant price surge.

- Announcement of a major contract win: Likely to result in a positive stock price reaction.

- Negative news regarding a key client: Could cause a temporary dip in the stock price.

Essential Questionnaire

What are the major risks associated with investing in Wipro stock?

Investing in Wipro, like any stock, carries inherent risks including global economic downturns, increased competition, currency fluctuations, and changes in regulatory environments.

How does Wipro compare to its competitors in terms of dividend payouts?

Wipro’s dividend policy should be compared to Infosys and TCS directly by reviewing their respective financial reports and investor relations materials for the most up-to-date information.

Where can I find real-time updates on Wipro’s stock price?

Real-time stock price information for Wipro can be found on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What is Wipro’s current market capitalization?

Wipro’s current market capitalization is readily available on major financial news websites and stock market data providers. This figure fluctuates constantly.