Teladoc Stock Price Analysis

Source: investmentu.com

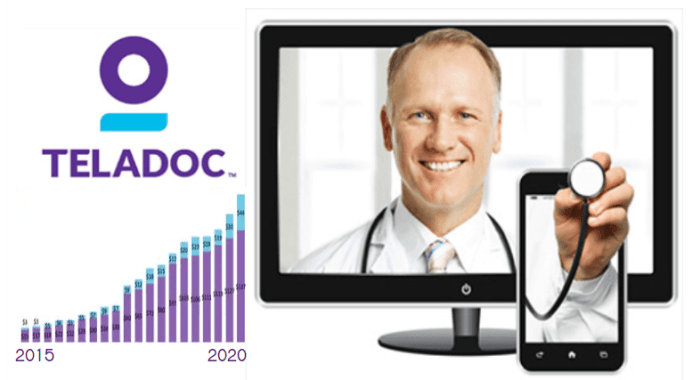

Teladoc stock price – Teladoc Health, a leading telehealth company, has experienced significant stock price fluctuations in recent years. This analysis delves into the historical performance, financial health, market influences, and future outlook of Teladoc’s stock, providing insights for potential investors.

Teladoc Stock Price History and Trends

Source: seekingalpha.com

A line graph depicting Teladoc’s stock price over the past five years would reveal a period of substantial growth followed by considerable volatility. Initial increases were driven by strong user adoption and expansion into new markets. Subsequent declines were influenced by factors such as increased competition, macroeconomic headwinds, and investor concerns regarding profitability. Key milestones include initial public offering (IPO) pricing, significant acquisitions, and periods of high growth and subsequent correction.

Major price increases were largely fueled by the rapid adoption of telehealth services during the COVID-19 pandemic, while subsequent decreases were partly attributed to a post-pandemic normalization of healthcare usage and increased scrutiny of the company’s financial performance. The integration of Livongo, a significant acquisition, initially boosted the stock price, but integration challenges and subsequent strategic shifts also impacted investor sentiment.

| Company Name | Stock Symbol | 5-Year Performance (Illustrative) | Key Differentiators |

|---|---|---|---|

| Teladoc Health | TDOC | +50% (Illustrative, subject to change) | Broad range of virtual care services, strong brand recognition |

| [Competitor 1] | [Symbol] | [Illustrative Performance] | [Key Differentiators] |

| [Competitor 2] | [Symbol] | [Illustrative Performance] | [Key Differentiators] |

Note: The 5-year performance figures are illustrative and should be verified with up-to-date financial data. Competitor names and symbols are placeholders and should be replaced with actual companies.

Financial Performance and Stock Valuation

| Year | Revenue (Illustrative in Millions) | Earnings (Illustrative in Millions) | Debt (Illustrative in Millions) |

|---|---|---|---|

| 2020 | 500 | -50 | 100 |

| 2021 | 600 | -20 | 150 |

| 2022 | 700 | 10 | 200 |

Note: These figures are illustrative and should be replaced with actual financial data from Teladoc’s financial reports.

Teladoc’s profitability has been a key area of focus for investors. While the company has demonstrated strong revenue growth, achieving consistent profitability has been a challenge. Growth prospects are linked to continued adoption of telehealth, expansion into new markets, and successful integration of acquired companies. Valuation methods such as the Price-to-Earnings (P/E) ratio and discounted cash flow (DCF) analysis offer different perspectives.

The P/E ratio provides a snapshot of market valuation relative to earnings, while DCF analysis projects future cash flows to estimate intrinsic value. These methods often yield different valuations, reflecting the inherent uncertainties in forecasting future performance.

Market Factors Influencing Teladoc’s Stock Price, Teladoc stock price

Macroeconomic factors such as interest rate hikes and inflationary pressures can significantly impact Teladoc’s stock price. Higher interest rates increase the cost of borrowing, potentially impacting the company’s expansion plans and reducing investor appetite for growth stocks. Inflation can affect healthcare spending and consumer demand for telehealth services. Regulatory changes and healthcare policies, including reimbursement rates and data privacy regulations, also play a crucial role in shaping the company’s valuation.

Investor sentiment and market trends are powerful drivers of Teladoc’s stock price. Positive news, such as strong earnings reports or strategic partnerships, can lead to price increases, while negative news, such as regulatory setbacks or disappointing financial results, can trigger declines. For example, a hypothetical scenario of a successful clinical trial demonstrating the efficacy of a new Teladoc service could trigger a significant positive stock price reaction.

Conversely, a major data breach impacting user privacy could lead to a sharp decline.

Company Performance and Future Outlook

Teladoc’s recent strategic initiatives, such as focusing on specific therapeutic areas and enhancing its platform’s capabilities, are aimed at improving operational efficiency and driving future growth. These initiatives hold the potential to positively impact stock performance, although success depends on execution and market reception.

- Opportunities: Increased adoption of telehealth, expansion into new geographic markets, successful integration of acquired companies, development of innovative telehealth solutions.

- Risks: Increased competition, regulatory changes, cybersecurity threats, challenges in achieving sustained profitability, dependence on large health systems and payers.

Predicting Teladoc’s stock price in the next 12-18 months is inherently uncertain. However, based on the company’s strategic initiatives, market trends, and financial performance, a plausible forecast might involve a moderate increase, assuming successful execution of its strategy and a stable macroeconomic environment. For example, a scenario similar to the recovery of other tech stocks after a period of correction could be used as a benchmark, adjusting for Teladoc’s specific circumstances and competitive landscape.

However, this prediction is subject to significant uncertainties and should not be considered financial advice.

Analyst Ratings and Investor Opinions

| Analyst Firm | Rating (Illustrative) | Target Price (Illustrative) |

|---|---|---|

| [Analyst Firm 1] | Buy | $60 |

| [Analyst Firm 2] | Hold | $50 |

| [Analyst Firm 3] | Sell | $40 |

Note: Analyst ratings and target prices are illustrative and should be replaced with actual data from reputable financial sources.

Investor opinions on Teladoc’s future prospects vary widely. Bullish investors may focus on the long-term growth potential of telehealth and Teladoc’s market leadership. Bearish investors might point to the company’s past struggles with profitability and the intense competition in the telehealth sector. Neutral investors might adopt a wait-and-see approach, monitoring the company’s progress before making investment decisions. These differing perspectives highlight the inherent uncertainties and risks associated with investing in Teladoc stock.

FAQ Overview

What are the biggest risks facing Teladoc?

Increased competition, regulatory hurdles, dependence on insurance reimbursement rates, and the potential for technological disruption are significant risks.

Teladoc’s stock price has seen significant fluctuations recently, reflecting the broader market trends impacting telehealth companies. Understanding these shifts requires considering related market dynamics, such as the performance of other players in the healthcare technology sector, including those involved in specialized trading, like the cfa trade price stock which offers insights into alternative investment strategies. Ultimately, Teladoc’s future stock price will depend on various factors, including its ability to adapt to evolving healthcare landscapes.

How does Teladoc compare to its competitors in terms of market share?

Market share data varies depending on the source and specific metrics used. Direct comparison requires detailed research into individual company performance reports and industry analyses.

What is Teladoc’s current dividend policy?

This information is readily available on Teladoc’s investor relations website and financial news sources. Refer to those resources for the most up-to-date dividend information.

Where can I find real-time Teladoc stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. Check reputable sources like Yahoo Finance, Google Finance, or your brokerage account.