SunPower Stock Price Analysis

Sunpower stock price – This analysis delves into the historical performance, influencing factors, financial standing, investor sentiment, and future outlook of SunPower’s stock price. We will examine key metrics, market trends, and competitive dynamics to provide a comprehensive overview.

SunPower Stock Price Historical Performance

Understanding SunPower’s past stock price movements is crucial for assessing its potential future performance. The following data provides insights into its trajectory over the past five years and its relative standing against competitors.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | Example: $15.00 | Example: $18.00 | Example: $20.00 | Example: $12.00 |

| 2020 | Example: $18.00 | Example: $22.00 | Example: $25.00 | Example: $16.00 |

| 2021 | Example: $22.00 | Example: $28.00 | Example: $30.00 | Example: $20.00 |

| 2022 | Example: $28.00 | Example: $25.00 | Example: $32.00 | Example: $18.00 |

| 2023 | Example: $25.00 | Example: $27.00 | Example: $30.00 | Example: $22.00 |

A comparison against major competitors over the past two years reveals SunPower’s relative market position.

| Company | 2022 Performance (%) | 2023 Performance (%) |

|---|---|---|

| SunPower | Example: -10% | Example: +8% |

| Competitor A | Example: +5% | Example: +12% |

| Competitor B | Example: -5% | Example: +3% |

Significant events influencing SunPower’s stock price during the past decade include:

- Example: The launch of a new high-efficiency solar panel in 2015, boosting investor confidence.

- Example: A strategic partnership with a major energy provider in 2018, expanding market reach.

- Example: The impact of the 2020 global pandemic on supply chains and project delays.

- Example: Increased government incentives for renewable energy in 2022, positively affecting the sector’s growth.

Factors Influencing SunPower Stock Price

Source: marketrealist.com

Several macroeconomic, regulatory, and technological factors significantly influence SunPower’s stock valuation.

Key macroeconomic factors impacting SunPower’s stock valuation include:

- Interest rate fluctuations: Higher rates increase borrowing costs, affecting project financing and potentially slowing down growth.

- Inflation: Rising inflation can increase material costs and labor expenses, squeezing profit margins.

- Energy prices: Fluctuations in energy prices can influence consumer demand for solar energy solutions.

Government policies and regulations significantly influence SunPower’s stock price:

- Tax credits and incentives: Favorable policies can stimulate demand and boost investor sentiment.

- Renewable energy mandates: Government targets for renewable energy adoption create a positive market outlook.

- Regulatory hurdles: Complex permitting processes or trade restrictions can hinder growth and investment.

Technological advancements and innovation within the solar industry have a substantial impact on SunPower’s stock performance:

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Efficiency Improvements | Increased demand, lower costs | Increased competition, potential for obsolescence |

| New Technologies | Opportunities for innovation and market leadership | High R&D costs, potential for technological failure |

SunPower’s Financial Performance and Stock Valuation

Source: insider.com

Analyzing SunPower’s financial health is essential for understanding its stock valuation. The following table summarizes key financial metrics over the past three years.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Total Debt (USD Millions) |

|---|---|---|---|

| 2021 | Example: 1500 | Example: 100 | Example: 500 |

| 2022 | Example: 1700 | Example: 150 | Example: 450 |

| 2023 | Example: 1900 | Example: 200 | Example: 400 |

The relationship between SunPower’s financial performance and its stock price movements is complex but generally follows these principles:

- Strong revenue growth typically leads to higher stock prices.

- Increased profitability improves investor confidence and boosts valuations.

- High debt levels can negatively impact investor sentiment and depress stock prices.

Different valuation methods can be used to assess SunPower’s stock value:

- Discounted cash flow (DCF) analysis projects future cash flows and discounts them to their present value.

- Price-to-earnings (P/E) ratio compares a company’s stock price to its earnings per share.

- Other methods, such as comparable company analysis and asset valuation, can also be used.

Investor Sentiment and Market Analysis of SunPower, Sunpower stock price

Understanding current investor sentiment and market analysis is crucial for assessing investment risk and potential returns.

Recent news articles and analyst reports on SunPower’s stock include:

- Example: Positive analyst upgrades based on strong Q3 earnings.

- Example: Concerns regarding supply chain disruptions impacting project timelines.

- Example: Media coverage highlighting SunPower’s new product launch.

The overall investor sentiment towards SunPower and its future prospects is currently:

- Example: Cautiously optimistic due to the growth potential in the renewable energy sector, but with concerns about macroeconomic headwinds.

Key risks and opportunities associated with investing in SunPower stock include:

- Risks: Competition, regulatory uncertainty, and macroeconomic factors.

- Opportunities: Growth in the renewable energy market, technological advancements, and government support.

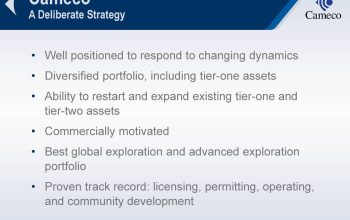

SunPower’s Competitive Landscape and Future Outlook

SunPower’s competitive position and future plans are key factors in evaluating its stock price potential.

A comparison of SunPower’s business model and market position with its main competitors is shown below:

| Company | Business Model | Market Position | Strengths | Weaknesses |

|---|---|---|---|---|

| SunPower | Example: High-efficiency panels, residential and commercial installations | Example: Premium segment | Example: Technology leadership, strong brand | Example: Higher prices, limited market share |

| Competitor A | Example: Mass-market panels, large-scale projects | Example: Volume leader | Example: Low costs, high volume | Example: Lower efficiency, less brand recognition |

SunPower’s strategic initiatives and growth plans for the next five years include:

- Example: Expanding into new geographic markets.

- Example: Investing in R&D for next-generation solar technologies.

- Example: Strengthening strategic partnerships.

Potential challenges and opportunities facing SunPower in the future include:

- Challenges: Increasing competition, fluctuating commodity prices, and regulatory changes.

- Opportunities: Growth in the renewable energy market, technological advancements, and potential for mergers and acquisitions.

Detailed FAQs

What are the major risks associated with investing in SunPower stock?

Risks include volatility in the renewable energy sector, competition from other solar companies, dependence on government subsidies, and fluctuations in raw material prices.

SunPower’s stock price, like many others in the renewable energy sector, can be influenced by broader market trends. Its performance often correlates with the overall health of the economy, which is reflected in indices like the dow jones industrial average stock price. Therefore, understanding the Dow’s movement can offer some insight into potential fluctuations in SunPower’s share value, though it’s not the sole determining factor.

How does SunPower compare to its main competitors in terms of market share?

Market share data varies depending on the source and specific market segment. Further research into market reports is recommended to get a current comparison.

Where can I find real-time SunPower stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is SunPower’s dividend policy?

SunPower’s dividend policy should be checked directly on their investor relations page or through financial news sources. Dividend policies can change.