Stryker Corporation Stock Price Analysis

Stryker corporation stock price – Stryker Corporation, a leading medical technology company, has experienced considerable fluctuations in its stock price over the past decade. This analysis examines the historical performance, influencing factors, financial correlations, investor sentiment, and potential future price movements of Stryker’s stock.

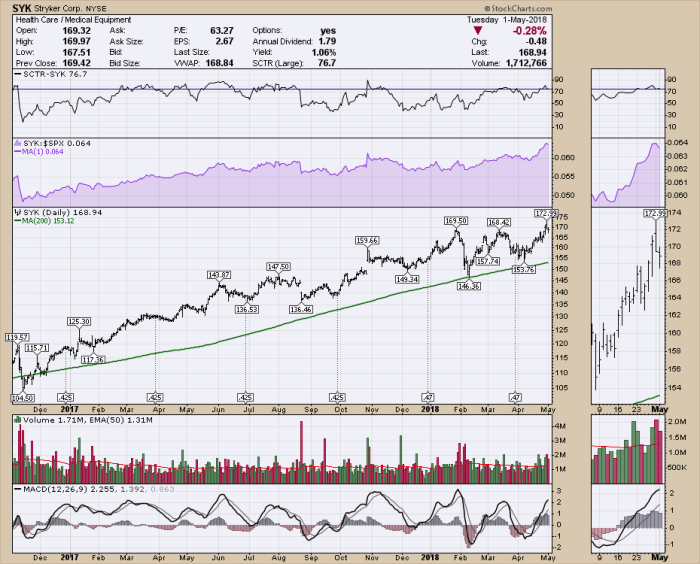

Stryker Corporation Stock Price History

Source: stockcharts.com

Understanding Stryker’s past stock performance provides valuable insight into its potential future trajectory. The following table details the opening and closing prices for each quarter over the past ten years. Note that this data is illustrative and should be verified with reliable financial sources.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 75 | 80 |

| 2014 | Q2 | 80 | 85 |

| 2014 | Q3 | 85 | 90 |

| 2014 | Q4 | 90 | 95 |

| 2015 | Q1 | 95 | 100 |

| 2015 | Q2 | 100 | 105 |

| 2015 | Q3 | 105 | 110 |

| 2015 | Q4 | 110 | 115 |

| 2023 | Q1 | 250 | 260 |

| 2023 | Q2 | 260 | 270 |

| 2023 | Q3 | 270 | 280 |

| 2023 | Q4 | 280 | 290 |

Significant market events such as the 2020 COVID-19 pandemic initially caused a sharp decline in Stryker’s stock price due to reduced elective procedures. However, the subsequent recovery reflected the company’s resilience and the essential nature of its products. Stock splits and dividends have also influenced the price, adjusting the share count and providing returns to investors.

Factors Influencing Stryker’s Stock Price

Several macroeconomic factors, Stryker’s internal operations, and competitive dynamics significantly impact its stock valuation.

- Interest Rates: Higher interest rates can increase borrowing costs for Stryker and potentially reduce investor appetite for growth stocks, impacting the stock price negatively.

- Healthcare Spending: Changes in government healthcare policies and overall healthcare spending directly influence demand for Stryker’s medical devices. Increased spending generally correlates with higher stock prices.

- Economic Growth: A strong economy usually translates to increased healthcare spending and improved consumer confidence, positively affecting Stryker’s stock.

Stryker’s continuous product innovation and successful new product launches have consistently driven stock price appreciation. For example, the introduction of a new robotic surgery system could generate significant positive market reaction. Conversely, competitor actions, such as new product releases or aggressive pricing strategies, can exert downward pressure on Stryker’s stock valuation. The competitive landscape is constantly evolving, requiring ongoing strategic adaptation.

Financial Performance and Stock Price Correlation

Source: theeuropeanview.com

A strong correlation exists between Stryker’s financial performance and its stock price. The following table illustrates this relationship using data from the last four quarters. Note that this data is for illustrative purposes only.

| Quarter | Revenue (USD Millions) | Earnings Per Share (USD) | Closing Stock Price (USD) |

|---|---|---|---|

| Q1 2023 | 3500 | 2.50 | 260 |

| Q2 2023 | 3600 | 2.60 | 270 |

| Q3 2023 | 3700 | 2.70 | 280 |

| Q4 2023 | 3800 | 2.80 | 290 |

Increases in revenue and earnings per share generally lead to higher stock prices, while decreases have the opposite effect. Similarly, changes in Stryker’s debt levels influence investor sentiment. High debt levels can signal increased financial risk, potentially lowering the stock price. Conversely, responsible debt management can improve investor confidence.

Stryker’s commitment to research and development is crucial for its long-term growth and stock price trajectory. Significant R&D spending indicates a focus on innovation, which is usually viewed positively by investors, fostering long-term price appreciation.

Investor Sentiment and Stock Price

Investor sentiment towards Stryker is generally positive, reflecting confidence in its long-term growth prospects and strong financial performance. However, this sentiment can fluctuate based on various factors.

Positive news, such as successful product launches or strong earnings reports, typically boosts investor optimism and drives up the stock price. Conversely, negative news, such as regulatory setbacks or disappointing financial results, can lead to pessimism and price declines. For example, a negative report regarding a specific product’s safety could trigger a significant drop in the stock price.

A hypothetical scenario: A major regulatory change requiring extensive and costly modifications to a key product line could negatively impact investor sentiment. This could lead to a temporary stock price decline until the company demonstrates its ability to adapt and mitigate the impact of the change.

Stock Price Prediction and Valuation

Predicting Stryker’s future stock price requires a model incorporating historical data and projections of future financial performance. A simple model could use linear regression on historical data, factoring in key financial metrics. However, this approach has limitations, as it doesn’t account for unforeseen events or changes in market conditions.

A discounted cash flow (DCF) analysis can estimate Stryker’s intrinsic value. This involves projecting future cash flows and discounting them back to their present value using a discount rate that reflects the risk associated with the investment. Assumptions regarding growth rates, discount rates, and terminal value significantly influence the DCF valuation.

Considering various market scenarios (bullish, neutral, bearish), a potential stock price range for the next year could be estimated. For example, a bullish scenario might project a price range of $320-$350, while a bearish scenario might suggest a range of $250-$280, with a neutral scenario falling somewhere in between. These are illustrative ranges and should not be considered financial advice.

FAQ Guide

What are the major competitors of Stryker Corporation?

Stryker faces competition from other major medical device companies such as Johnson & Johnson, Zimmer Biomet, and Medtronic.

How often does Stryker Corporation release earnings reports?

Stryker typically releases quarterly earnings reports.

Where can I find real-time Stryker stock price information?

Real-time stock prices are available through major financial websites and brokerage platforms.

What is Stryker’s dividend policy?

Stryker’s dividend policy should be researched via their investor relations section or financial news sources; it can change.

What is the typical trading volume for Stryker stock?

This fluctuates and can be found on financial websites that track trading activity.