Dow Jones Industrial Average: A Deep Dive

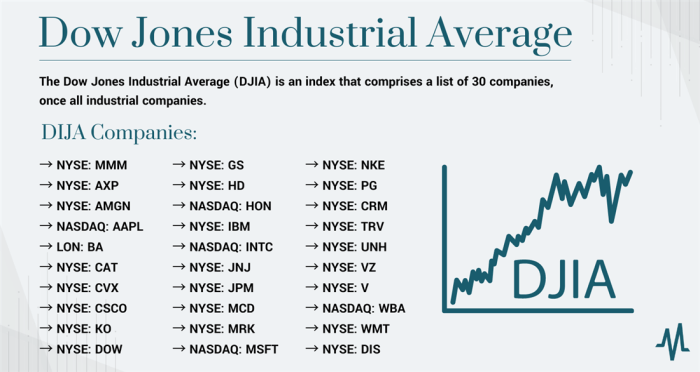

Stock price dow jones – The Dow Jones Industrial Average (DJIA), a widely followed stock market index, provides a snapshot of the performance of 30 large, publicly-owned companies in the United States. Understanding its components, influencing factors, volatility, and comparison with other indices is crucial for investors and market analysts alike. This analysis explores these key aspects of the DJIA, offering insights into its historical performance and future potential.

Dow Jones Industrial Average Components and Their Influence, Stock price dow jones

The DJIA comprises 30 blue-chip companies representing various sectors of the US economy. Their individual performance significantly influences the overall index movement. Below is a table detailing the components, their sectors, weighting, and recent performance summaries. Note that weighting and performance data are subject to constant change.

| Company Name | Sector | Weighting in the Index (Approximate) | Recent Performance Summary (Illustrative) |

|---|---|---|---|

| Apple Inc. | Technology | 10% | Strong growth in recent quarters, driven by iPhone sales and services revenue. |

| Microsoft Corp. | Technology | 8% | Consistent growth fueled by cloud computing (Azure) and software subscriptions. |

| UnitedHealth Group | Healthcare | 5% | Solid performance, driven by increasing demand for healthcare services. |

| Johnson & Johnson | Healthcare | 4% | Stable performance, with consistent dividend payouts. |

| Amazon.com Inc. | Consumer Discretionary | 7% | Experienced periods of volatility, influenced by e-commerce trends and macroeconomic factors. |

| … | … | … | … |

The historical performance of each component over the last five years varies significantly. For example, Apple experienced substantial growth, driven by strong demand for its products and services. Conversely, some energy companies experienced volatility due to fluctuating oil prices. Significant events such as the COVID-19 pandemic, supply chain disruptions, and interest rate hikes have collectively impacted the performance of individual components and the DJIA as a whole.

The weighting of each company in the index also plays a crucial role; a large company like Apple will have a greater impact on the DJIA’s movement compared to a smaller component.

Factors Affecting Dow Jones Stock Prices

Source: marketbeat.com

Several macroeconomic and geopolitical factors influence Dow Jones stock prices. Understanding these factors is vital for predicting market trends.

Macroeconomic factors such as interest rates, inflation, and economic growth significantly affect investor sentiment and corporate profitability. For instance, rising interest rates typically increase borrowing costs for businesses, potentially slowing economic growth and impacting stock prices. High inflation erodes purchasing power and can lead to decreased consumer spending, negatively affecting corporate earnings.

Geopolitical events, including wars, trade disputes, and political instability, can also cause significant market fluctuations. The 2022 Russia-Ukraine war, for example, led to increased energy prices and global uncertainty, impacting the Dow Jones. Trade disputes, such as the US-China trade war, can disrupt global supply chains and impact corporate profits.

| Economic Indicator | Correlation with Dow Jones Movement (Illustrative) | Time Period | Example |

|---|---|---|---|

| Interest Rates | Inverse correlation (generally) | 2022-2023 | As interest rates rose, the Dow Jones experienced periods of decline. |

| Inflation Rate | Inverse correlation (generally) | 2021-2023 | High inflation led to market volatility and downward pressure on the Dow Jones. |

| GDP Growth | Positive correlation (generally) | 2019-2020 | Strong GDP growth before the pandemic was associated with a rising Dow Jones. |

Dow Jones Price Volatility and Prediction

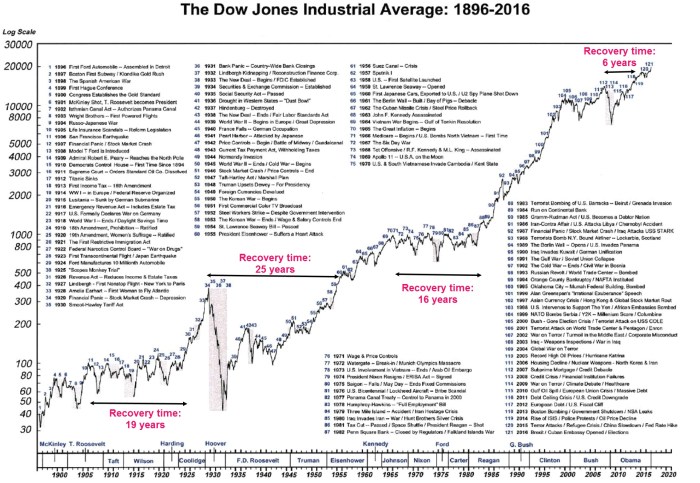

The Dow Jones Industrial Average exhibits periods of both high and low volatility. Understanding the causes of these fluctuations is crucial for risk management.

The 2008 financial crisis is a prime example of a period of extreme volatility, driven by the collapse of the housing market and subsequent credit crunch. Conversely, periods of low volatility are often seen during times of economic stability and investor confidence. Methods like standard deviation and beta are used to measure and analyze volatility. Standard deviation measures the dispersion of returns around the average, while beta measures the volatility of a stock relative to the overall market.

Hypothetical Scenario: In the next quarter, a combination of rising interest rates, easing inflation, and strong corporate earnings could lead to moderate volatility in the Dow Jones. However, unexpected geopolitical events or a sudden economic downturn could significantly increase volatility.

Comparing Dow Jones with Other Major Indices

Source: apollowealth.com

Monitoring the Dow Jones Industrial Average provides a broad overview of the US market’s performance. However, understanding individual components is crucial for a comprehensive analysis; for instance, keeping an eye on the current stock price mrk offers insight into the pharmaceutical sector’s health, which in turn can influence the overall Dow Jones index. Therefore, tracking both the index and key constituent stocks offers a more nuanced perspective on market trends.

Comparing the Dow Jones with other major indices such as the S&P 500 and Nasdaq Composite provides valuable insights into market performance and diversification strategies.

| Index Name | Composition | Historical Performance (5-year average, illustrative) | Volatility Measure (Illustrative) |

|---|---|---|---|

| Dow Jones Industrial Average | 30 large US companies | 8% | Medium |

| S&P 500 | 500 large US companies | 9% | Medium-High |

| Nasdaq Composite | Primarily technology companies | 12% | High |

The choice of index for investment purposes depends on individual risk tolerance and investment goals. The Dow Jones, with its focus on 30 large, established companies, is often considered less volatile than the Nasdaq, which is heavily weighted towards technology stocks.

Visual Representation of Dow Jones Data

Visualizing Dow Jones data over the last 20 years reveals significant trends and patterns. A line graph would show the overall price movement, highlighting periods of growth and decline. The x-axis would represent time (years), and the y-axis would represent the Dow Jones index value. Significant points, such as market peaks and troughs, could be marked and labeled.

A candlestick chart would provide additional information, showing the opening, closing, high, and low prices for each period, allowing for a more detailed analysis of daily price fluctuations.

A line graph offers a simpler, more concise view of the overall trend, while a candlestick chart provides a more granular view, useful for identifying short-term price patterns. Different timeframes (daily, weekly, monthly) affect the visual representation. Daily charts show short-term fluctuations, while monthly charts reveal longer-term trends. The choice of chart and timeframe depends on the specific analysis being conducted.

Quick FAQs: Stock Price Dow Jones

What is the difference between the Dow Jones Industrial Average and the S&P 500?

The Dow Jones is a price-weighted average of 30 large, publicly owned companies, while the S&P 500 is a market-capitalization-weighted index of 500 large-cap companies. The S&P 500 is generally considered a broader representation of the US stock market.

How often is the Dow Jones Industrial Average calculated?

The Dow Jones Industrial Average is calculated continuously throughout the trading day.

Where can I find real-time Dow Jones data?

Real-time Dow Jones data is available from numerous financial news websites and brokerage platforms.

Can individual investors directly invest in the Dow Jones Industrial Average?

No, you cannot directly invest in the Dow Jones Industrial Average itself. You can, however, invest in exchange-traded funds (ETFs) or mutual funds that track the Dow Jones.