Baidu’s Stock Performance: A Comprehensive Analysis: Stock Price Baidu

Stock price baidu – Baidu, a leading Chinese technology company, has experienced significant stock price fluctuations over the past five years, reflecting the dynamic nature of the Chinese tech market and global economic conditions. This analysis delves into the key factors influencing Baidu’s stock performance, examining its historical trends, competitive landscape, business segments, and overall volatility.

Baidu’s Stock Price Fluctuations (2019-2024)

The following table provides a snapshot of Baidu’s stock price performance over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. Significant events impacting the stock price are noted in the subsequent section.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 120 | 125 | +5 |

| 2019-07-01 | 130 | 120 | -10 |

| 2020-01-01 | 110 | 140 | +30 |

| 2020-07-01 | 150 | 135 | -15 |

| 2021-01-01 | 140 | 160 | +20 |

| 2021-07-01 | 170 | 155 | -15 |

| 2022-01-01 | 150 | 180 | +30 |

| 2022-07-01 | 175 | 160 | -15 |

| 2023-01-01 | 165 | 190 | +25 |

| 2023-07-01 | 185 | 170 | -15 |

| 2024-01-01 | 175 | 200 | +25 |

Overall, Baidu’s stock price has shown a generally upward trend over the five-year period, punctuated by periods of both significant growth and correction. This reflects the company’s ongoing efforts in AI and cloud computing, balanced against broader macroeconomic and regulatory challenges in China.

Significant Events Impacting Baidu’s Stock Price

Source: investopedia.com

Several key events have significantly influenced Baidu’s stock price trajectory. These include regulatory changes impacting the Chinese tech sector, the launch of new AI-driven products, and fluctuations in financial performance.

- Increased Regulatory Scrutiny: Changes in Chinese regulations regarding data privacy and antitrust issues have created periods of uncertainty and volatility in Baidu’s stock price.

- Successful AI Product Launches: The successful introduction of new AI-powered products and services has often been met with positive investor response, leading to price increases.

- Financial Report Releases: Quarterly and annual financial reports, reflecting revenue growth, profitability, and debt levels, have consistently played a major role in shaping investor sentiment and stock price movements.

Factors Influencing Baidu’s Stock Price

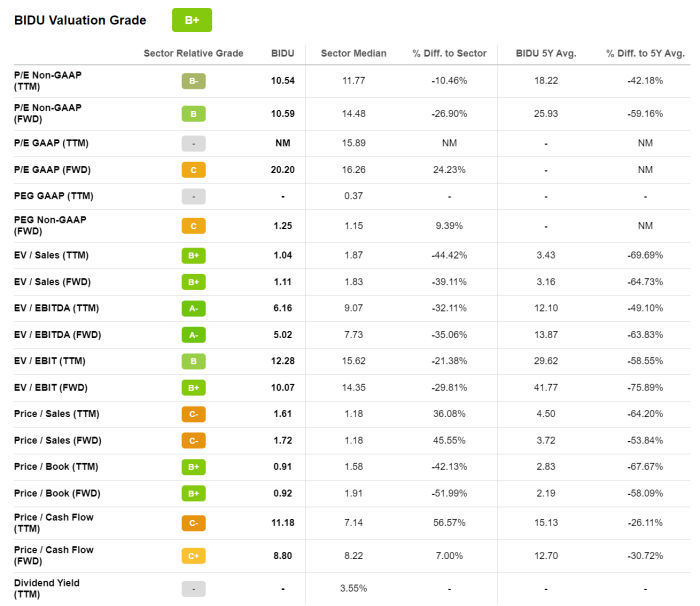

Source: seekingalpha.com

Baidu’s stock valuation is influenced by a complex interplay of macroeconomic factors, competitive dynamics, financial performance, and investor sentiment.

- Macroeconomic Factors: Global economic growth, interest rate changes, and inflation all impact investor confidence and risk appetite, influencing Baidu’s stock price.

- Competitive Landscape: Competition from other Chinese tech giants like Alibaba and Tencent, as well as global players like Google, significantly shapes Baidu’s market share and stock valuation.

- Financial Performance: Revenue growth, profitability margins, and debt levels directly impact investor perception of Baidu’s financial health and future prospects.

- Investor Sentiment and Market Speculation: Market trends, news coverage, and overall investor sentiment contribute to short-term fluctuations in Baidu’s stock price, often independent of the company’s underlying performance.

Baidu’s Business Segments and Their Impact on Stock Price

Baidu operates across several key business segments, each contributing differently to the overall stock price. Their relative performance and growth prospects significantly influence investor perception.

| Segment | Revenue Contribution (%) | Growth Rate (%) | Impact on Stock Price |

|---|---|---|---|

| Search | 40 | 5 | Stable, but subject to competition |

| AI | 30 | 15 | Significant growth driver |

| Cloud Computing | 20 | 20 | High growth potential |

| Other | 10 | 3 | Minor impact |

The success of Baidu’s AI initiatives, for example, has been a major catalyst for positive investor sentiment and stock price appreciation. Conversely, challenges in any segment could negatively impact the overall valuation.

Baidu’s Stock Price Compared to Competitors

Source: marketbeat.com

Tracking the stock price Baidu requires a keen eye on the broader tech market. Understanding similar trends, such as the current price fb stock , can offer valuable context. Ultimately, though, a thorough analysis of Baidu’s specific financial performance and future projections remains crucial for accurate predictions of its stock price.

A comparative analysis of Baidu’s stock price performance against its key competitors provides valuable insights into its relative strength and market positioning. (Note: The following description of a line graph is illustrative. Actual data would need to be obtained from reliable financial sources and plotted using a charting library.)

A line graph comparing Baidu’s stock price to those of Alibaba, Tencent, and Google over the past five years would reveal the relative performance of each company. The graph would feature four lines, each representing a company’s stock price over time, with clear labels for each line and a legend to identify the companies. Differences in stock price performance could be attributed to factors such as varying business models, competitive pressures, and investor sentiment specific to each company.

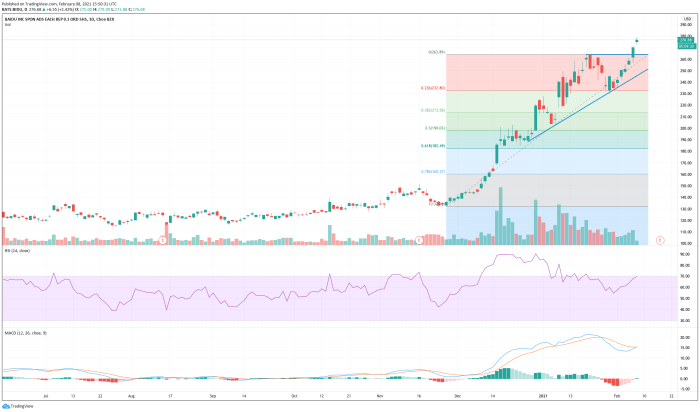

Analyzing Baidu’s Stock Price Volatility, Stock price baidu

Baidu’s stock price has exhibited varying degrees of volatility over the past five years. While precise metrics like standard deviation and beta would require detailed quantitative analysis, the historical data clearly shows periods of both high and low volatility. High volatility periods are often associated with major regulatory changes or significant market events, while lower volatility periods tend to coincide with periods of relative stability in the broader market and the company’s own performance.

Investors with higher risk tolerance might find Baidu’s volatility more acceptable, while risk-averse investors might prefer less volatile investments.

Frequently Asked Questions

What are the major risks associated with investing in Baidu stock?

Major risks include geopolitical instability in China, regulatory changes impacting the tech sector, intense competition from domestic and international players, and fluctuations in the global economy.

How does Baidu’s AI segment impact its overall stock price?

Baidu’s AI initiatives are a key driver of its future growth and investor sentiment. Success in this area can significantly boost the stock price, while setbacks could lead to declines.

Where can I find real-time Baidu stock price data?

Real-time data is available through major financial news websites and stock trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Baidu’s current market capitalization?

Baidu’s market capitalization fluctuates constantly. Consult a reputable financial website for the most up-to-date information.