Silver Market Overview

Silver stock price live – The silver market is a dynamic and complex ecosystem influenced by a multitude of factors. Recent price fluctuations reflect a delicate balance between industrial demand, investment sentiment, and macroeconomic conditions. Investor sentiment currently shows a mixed outlook, with some seeing silver as a safe haven asset while others remain cautious due to global economic uncertainty. The interplay of these elements significantly impacts silver’s price trajectory.

Current State of the Silver Market

The current silver market is characterized by moderate volatility, influenced primarily by industrial demand, investor speculation, and the overall state of the global economy. Recent price movements have been driven by a combination of factors, including fluctuating industrial demand, shifts in investor sentiment, and geopolitical events.

Recent Price Fluctuations Explained

Recent price fluctuations in silver are largely attributable to shifts in investor sentiment, changes in industrial demand (particularly from the solar and electronics sectors), and the overall macroeconomic climate. For example, periods of economic uncertainty often lead to increased investment in precious metals like silver, driving up prices. Conversely, periods of economic growth may lead to reduced investment demand, causing prices to fall.

Investor Sentiment Towards Silver, Silver stock price live

Investor sentiment towards silver is currently mixed. While some investors view silver as a hedge against inflation and economic uncertainty, others remain cautious due to concerns about global economic growth and potential interest rate hikes. This mixed sentiment contributes to the volatility observed in the silver market.

Impact of Global Economic Conditions

Global economic conditions significantly impact silver prices. Periods of economic expansion typically lead to increased industrial demand for silver, boosting prices. Conversely, economic downturns often reduce demand, leading to price declines. Inflationary pressures can also drive investment in silver as a hedge against the erosion of purchasing power.

Silver Price History (Last Year)

| Date | Opening Price (USD/oz) | High (USD/oz) | Low (USD/oz) | Closing Price (USD/oz) |

|---|---|---|---|---|

| 2023-10-26 | 23.50 | 23.75 | 23.25 | 23.60 |

| 2023-10-25 | 23.65 | 23.80 | 23.50 | 23.70 |

| 2023-10-24 | 23.40 | 23.70 | 23.30 | 23.65 |

Factors Influencing Silver Stock Prices

Several macroeconomic factors, supply and demand dynamics, and geopolitical events significantly influence silver stock prices. Understanding these factors is crucial for informed investment decisions.

Key Macroeconomic Factors

Macroeconomic factors such as inflation rates, interest rates, and overall economic growth significantly impact silver stock prices. High inflation often drives investment in precious metals like silver, increasing demand and pushing prices higher. Conversely, rising interest rates can make holding non-interest-bearing assets like silver less attractive, potentially leading to price declines.

Supply and Demand Dynamics

The interplay of supply and demand is a fundamental driver of silver prices. Increased industrial demand, particularly from sectors like solar energy and electronics, can lead to price increases. Conversely, a surplus in silver supply can put downward pressure on prices. Mining production levels and recycling rates also play significant roles.

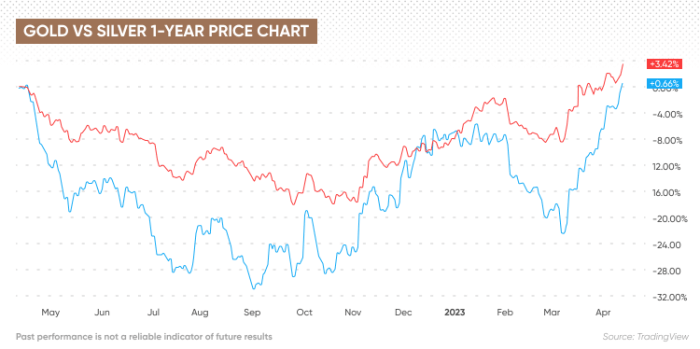

Industrial vs. Investment Demand

Source: dailyreckoning.com

Both industrial and investment demand influence silver prices. Industrial demand is relatively stable, driven by ongoing needs in various sectors. Investment demand, however, is more volatile and subject to market sentiment and economic conditions. The relative strength of each type of demand influences price movements.

Impact of Geopolitical Events

Geopolitical instability and uncertainty can significantly impact silver prices. Events such as wars, political upheavals, and trade disputes can create safe-haven demand for silver, pushing prices higher. Conversely, periods of relative geopolitical stability may lead to reduced investment demand and lower prices.

Top Five Factors Impacting Silver Prices

- Global inflation rates

- Interest rate changes

- Industrial demand (especially from solar and electronics)

- Investment sentiment and speculation

- Geopolitical risks and uncertainties

Analysis of Major Silver Mining Companies

Several leading silver mining companies play a significant role in the global silver market. Analyzing their financial performance, production output, and sustainability practices provides valuable insights into the industry’s health and future prospects.

Keeping an eye on the silver stock price live requires constant monitoring of market fluctuations. It’s helpful to compare it against the performance of other tech giants; for instance, you might want to check the current microsoft stock price to gauge overall market sentiment. Understanding these broader trends can provide valuable context when analyzing the silver market’s volatility and predicting potential future movements in silver stock price live.

Overview of Leading Silver Mining Companies

Companies like First Majestic Silver, Pan American Silver, and Hecla Mining are among the leading silver producers globally, boasting substantial market capitalizations and significant silver reserves. Their operations and financial performance influence the overall silver market.

Financial Performance Comparison

A comparison of the financial performance of these companies, considering factors like revenue, profitability, and debt levels, reveals their relative strengths and weaknesses. Analyzing these metrics provides insights into their resilience and growth potential within the industry.

Production Output and Reserves

Understanding the production output and reserves of major silver producers is crucial for assessing the overall supply dynamics of the silver market. Higher production levels can lead to lower prices, while dwindling reserves may signal future price increases.

Sustainability Practices

The sustainability practices of silver mining companies are increasingly important to investors and consumers. Companies demonstrating strong commitments to environmental, social, and governance (ESG) factors often attract greater investment and enjoy a better public image.

Key Performance Indicators (KPIs) Comparison

| Company | Market Cap (USD Billions) | Revenue (USD Millions) (Last Year) | Silver Production (Moz) (Last Year) |

|---|---|---|---|

| First Majestic Silver | [Insert Data] | [Insert Data] | [Insert Data] |

| Pan American Silver | [Insert Data] | [Insert Data] | [Insert Data] |

| Hecla Mining | [Insert Data] | [Insert Data] | [Insert Data] |

Investment Strategies for Silver Stocks

Investing in silver stocks offers both opportunities and risks. A well-defined investment strategy, incorporating diversification and risk management, is essential for maximizing returns and minimizing potential losses.

Long-Term and Short-Term Approaches

Long-term investors may focus on the underlying value and growth potential of silver mining companies, while short-term investors may employ more tactical strategies based on price fluctuations and market sentiment. Both approaches require careful analysis and risk assessment.

Risks and Rewards

Investing in silver stocks carries inherent risks, including price volatility, geopolitical uncertainties, and company-specific risks. However, potential rewards include capital appreciation, dividend income (if applicable), and diversification benefits within a broader portfolio.

Importance of Diversification

Diversification is crucial in any investment portfolio, including one focused on silver stocks. Spreading investments across multiple companies and asset classes reduces overall risk and improves the chances of achieving long-term growth.

Investment Vehicles

Investors can access the silver market through various vehicles, including direct stock purchases of silver mining companies, exchange-traded funds (ETFs) tracking silver prices, and silver futures contracts. The choice of vehicle depends on the investor’s risk tolerance and investment goals.

Potential Risks Associated with Silver Stock Investments

- Price volatility

- Geopolitical risks

- Company-specific risks (e.g., operational challenges, financial difficulties)

- Regulatory changes

- Market sentiment shifts

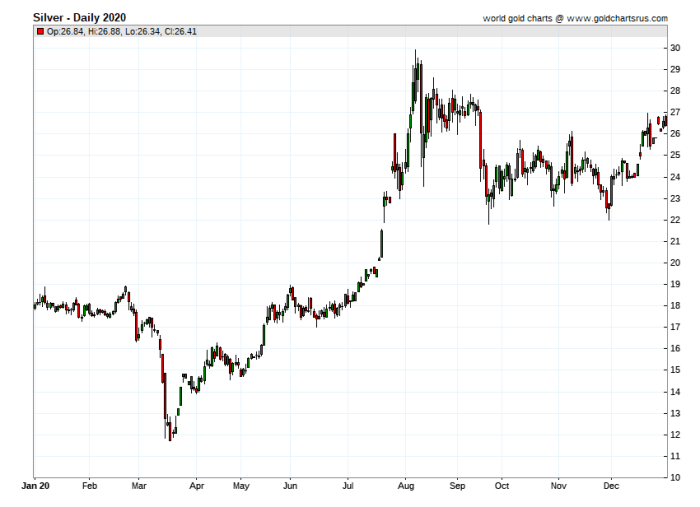

Visual Representation of Silver Price Data

Visual representations of silver price data, such as line graphs and candlestick charts, provide valuable insights into price trends, support and resistance levels, and potential trading opportunities. Understanding how to interpret these charts is crucial for informed investment decisions.

Interpreting Silver Price Charts

Line graphs show the price of silver over time, highlighting trends and fluctuations. Candlestick charts provide more detailed information, showing the opening, closing, high, and low prices for each period. Support and resistance levels, identified as areas where price tends to stall, are key features to watch.

Identifying Buying and Selling Opportunities

Chart patterns, such as head and shoulders, double tops, and triangles, can indicate potential buying or selling opportunities. However, it’s crucial to combine chart analysis with fundamental analysis to make informed decisions. These patterns are not foolproof predictors of future price movements.

Using Moving Averages

Source: sdbullion.com

Moving averages, calculated by averaging prices over a specific period, can smooth out price fluctuations and help identify trends. Different moving averages (e.g., 50-day, 200-day) can be used to confirm trends and identify potential support or resistance levels.

Hypothetical Silver Price Chart

Source: capital.com

Imagine a candlestick chart showing a significant price increase. The chart would initially show lower lows and lower highs, indicating a downtrend. Then, a breakout above a key resistance level would be followed by a series of higher highs and higher lows, signaling an uptrend. Increased volume during the breakout and subsequent price increase would confirm the strength of the move.

The candlestick bodies would predominantly be green (or white, depending on the chart’s color scheme), indicating closing prices above opening prices during the uptrend.

Questions and Answers: Silver Stock Price Live

What are the risks of investing in silver stocks?

Risks include price volatility, geopolitical instability impacting supply, and the financial performance of individual mining companies. Diversification is key to mitigating risk.

Where can I find reliable silver price data?

Reputable financial news websites and trading platforms provide real-time silver price data. Always verify information from multiple sources.

How often should I review my silver stock portfolio?

Regular review, at least monthly, allows for timely adjustments based on market changes and your investment goals.

What are the tax implications of silver stock investments?

Capital gains taxes apply to profits from selling silver stocks. Consult a financial advisor for specific tax advice related to your jurisdiction.