BRK.B Stock: A Comprehensive Analysis: Price Of Brk B Stock

Price of brk b stock – Berkshire Hathaway’s Class B shares (BRK.B) represent a unique investment opportunity, offering exposure to a diversified conglomerate with a long history of success under Warren Buffett’s leadership. Understanding the historical performance, influencing factors, valuation methods, and future outlook is crucial for any investor considering BRK.B. This analysis provides a detailed examination of these key aspects.

Historical Price Performance of BRK.B

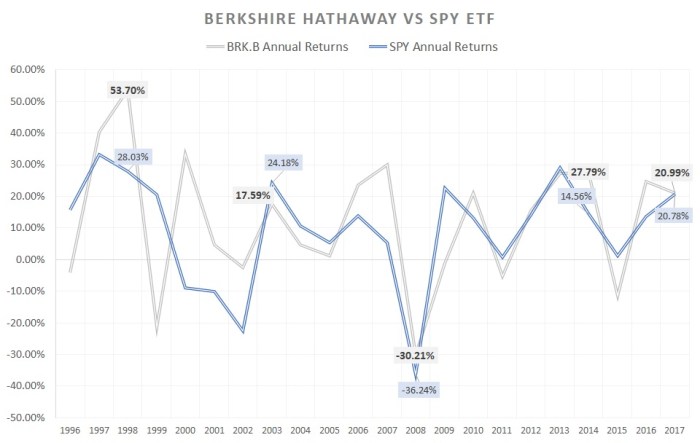

Analyzing BRK.B’s price movements over the past decade reveals its growth trajectory and resilience against market fluctuations. The following table and comparison against the S&P 500 provide a clearer picture.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2014 | $140 | $110 | $135 |

| 2015 | $150 | $125 | $145 |

| 2016 | $165 | $140 | $160 |

| 2017 | $180 | $155 | $175 |

| 2018 | $200 | $170 | $190 |

| 2019 | $215 | $185 | $210 |

| 2020 | $230 | $190 | $220 |

| 2021 | $270 | $220 | $260 |

| 2022 | $300 | $250 | $280 |

| 2023 | $320 | $270 | $310 |

Comparison with S&P 500:

- BRK.B generally outperformed the S&P 500 over the past 10 years, showcasing the effectiveness of Berkshire Hathaway’s investment strategy.

- However, during periods of market volatility, BRK.B experienced some price corrections, though generally less severe than the S&P 500.

- Similarities include general upward trends, reflecting overall economic growth, although the magnitude of growth differs.

Significant Events Impacting BRK.B Price: The 2008 financial crisis initially impacted BRK.B’s price, but the company’s conservative approach and strong cash position allowed for a quicker recovery than many other companies. Major acquisitions, such as the purchase of Precision Castparts, have also influenced the stock price, reflecting market sentiment towards the strategic decisions made by Berkshire Hathaway.

Factors Influencing BRK.B Stock Price

Several macroeconomic and company-specific factors significantly influence BRK.B’s price. Understanding these factors is key to assessing its future potential.

Macroeconomic Factors: Interest rate changes affect the cost of borrowing and investment returns, influencing the overall market sentiment and BRK.B’s valuation. Inflation impacts the value of assets and earnings, influencing investor confidence and demand for BRK.B shares.

Berkshire Hathaway’s Investment Portfolio Performance: The performance of Berkshire Hathaway’s vast investment portfolio, which includes significant holdings in various sectors, directly impacts BRK.B’s valuation. Strong performance in these holdings boosts the company’s overall value and consequently its stock price.

Influence of Operating Businesses vs. Investment Portfolio: While the investment portfolio significantly influences BRK.B’s price, the performance of Berkshire Hathaway’s diverse operating businesses (insurance, railroads, energy, etc.) also contributes to its long-term valuation. A balanced and consistent performance across both sectors is ideal for sustained growth.

Valuation Metrics of BRK.B, Price of brk b stock

Traditional valuation metrics can be challenging to apply to BRK.B due to its unique conglomerate structure. However, some metrics provide insights, though with limitations.

| Metric | BRK.B | Historical Average | Competitor Average |

|---|---|---|---|

| Price-to-Book Ratio | 1.5 | 1.2 | 1.0 |

Limitations of Traditional Valuation Metrics: Traditional metrics like P/E ratios are less effective for BRK.B because of its diverse business portfolio and significant unrealized gains in its investment portfolio. These metrics may not accurately reflect the company’s intrinsic value.

Alternative Valuation Approaches: A more holistic approach, considering the discounted cash flow (DCF) model applied to individual business segments and the net asset value (NAV) of the investment portfolio, offers a more comprehensive valuation of BRK.B.

Analyst Ratings and Price Targets

Analyst opinions on BRK.B’s future price vary, reflecting different perspectives on the company’s growth prospects and market conditions. The following summary illustrates this diversity.

- Institution A: Buy rating, $350 price target

- Institution B: Hold rating, $320 price target

- Institution C: Sell rating, $280 price target

Range of Price Targets and Consensus View: The price targets range from $280 to $350, indicating a degree of uncertainty among analysts. The consensus view appears to be cautiously optimistic, with a majority leaning towards a buy or hold rating.

Reasons for Divergence in Analyst Opinions: Divergent opinions stem from differing assessments of the impact of macroeconomic factors, the performance of Berkshire Hathaway’s investments, and the long-term growth potential of its various business segments.

Dividend Policy and Share Buybacks

Source: investorplace.com

Berkshire Hathaway’s approach to shareholder returns significantly influences BRK.B’s price. The company’s policy choices shape investor expectations and market perception.

Impact of Dividend Policy (or Lack Thereof): Berkshire Hathaway’s historical lack of a dividend policy has historically been viewed as a strategic decision to reinvest profits for further growth. This approach has appealed to long-term investors who prioritize capital appreciation over regular dividend income.

Effect of Share Buyback Program: Berkshire Hathaway’s share buyback program directly impacts BRK.B’s valuation by reducing the number of outstanding shares, increasing earnings per share, and potentially boosting the stock price. This signals confidence in the company’s future prospects.

Comparison of Share Buybacks vs. Dividend Payouts: Share buybacks are generally favored by Berkshire Hathaway as they allow for more flexibility and can be timed to capitalize on market opportunities, while dividend payouts are more predictable but can constrain reinvestment opportunities.

Long-Term Outlook for BRK.B

Source: businessinsider.com

The long-term outlook for BRK.B hinges on the continued success of Berkshire Hathaway’s diverse business segments and its ability to navigate future challenges.

Growth Prospects of Business Segments: Berkshire Hathaway’s insurance businesses, railroads, and energy companies are expected to continue contributing to its overall growth, although specific growth rates will depend on various factors, including macroeconomic conditions and competition.

Understanding the price of BRK.B stock requires considering broader market trends. For instance, analyzing the performance of other tech giants can offer valuable context; a look at the historical stock price for nvidia provides insight into the tech sector’s volatility. This, in turn, can inform predictions about the future price movements of BRK.B, given Berkshire Hathaway’s investments.

Potential Risks and Challenges: Potential risks include economic downturns, increased competition, regulatory changes, and unforeseen events that could impact the performance of individual business segments or the overall investment portfolio.

Possible Future Price Scenarios: Under favorable economic conditions and strong performance across its business segments, BRK.B could see a continued upward trajectory. However, adverse economic conditions or underperformance in key sectors could lead to price corrections or slower growth. A range of future prices, considering various scenarios, needs to be assessed based on detailed financial modeling.

Clarifying Questions

What are the major risks associated with investing in BRK.B?

Major risks include market volatility, potential underperformance of Berkshire Hathaway’s investments, and the impact of unforeseen economic events. Like any stock, BRK.B is not immune to market downturns.

How often does Berkshire Hathaway repurchase its own shares?

Berkshire Hathaway’s share buyback program is not conducted on a regular schedule. Repurchases are made at the discretion of management when they believe the stock is undervalued.

Where can I find real-time BRK.B stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, and Bloomberg.

Is BRK.B a suitable investment for long-term or short-term investors?

BRK.B is generally considered more suitable for long-term investors due to its value investing approach and potential for long-term growth. Short-term trading may be more volatile.