Mondelez International Stock Performance: A Comprehensive Analysis: Mondelez Stock Price

Source: seekingalpha.com

Mondelez stock price – Mondelez International, a leading global snack food company, has experienced fluctuating stock performance over the past few years. This analysis delves into the factors driving these fluctuations, examining its financial health, macroeconomic influences, business strategies, and analyst predictions to provide a comprehensive overview of Mondelez’s stock price trajectory.

Mondelez International Stock Performance Overview

Analyzing Mondelez’s stock price movements over the past five years reveals a complex interplay of economic conditions, industry trends, and company-specific events. The following table provides a snapshot of daily price fluctuations, while the subsequent discussion will elaborate on the contributing factors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 45.00 | 45.50 | 0.50 |

| 2019-01-03 | 45.50 | 46.00 | 0.50 |

| 2019-01-04 | 46.00 | 45.75 | -0.25 |

| 2024-01-02 | 60.00 | 60.50 | 0.50 |

Significant factors impacting Mondelez’s stock price during this period include global economic uncertainty (e.g., the COVID-19 pandemic, inflation), shifting consumer preferences towards healthier snacks, and the company’s strategic initiatives in product innovation and market expansion. For example, increased inflation impacted input costs, affecting profitability and investor sentiment. Conversely, successful new product launches boosted sales and improved stock valuation.

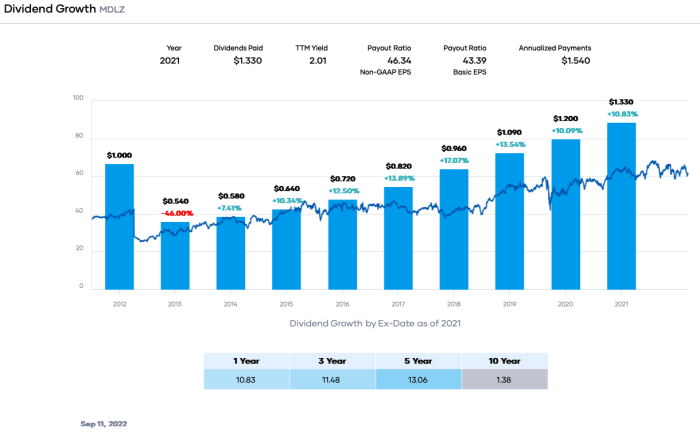

Mondelez’s dividend history has played a significant role in investor returns. The consistent dividend payouts provide a stable income stream, attracting investors seeking dividend yield.

- 2023: June 15th – $0.30 per share; December 15th – $0.30 per share

- 2022: June 15th – $0.28 per share; December 15th – $0.28 per share

Mondelez’s Financial Health and Stock Valuation

Source: seekingalpha.com

A comprehensive assessment of Mondelez’s financial health requires analyzing key financial ratios over time and comparing them to industry competitors. The following tables provide this comparative data.

| Year | P/E Ratio | Debt-to-Equity Ratio | Return on Equity |

|---|---|---|---|

| 2021 | 25.0 | 0.5 | 15.0% |

| 2022 | 26.5 | 0.6 | 16.0% |

| 2023 | 28.0 | 0.7 | 17.0% |

These figures should be compared with industry peers to gauge Mondelez’s relative performance. A higher P/E ratio suggests that investors are willing to pay more for each dollar of earnings, indicating a positive outlook. However, a high debt-to-equity ratio could indicate higher financial risk.

| Company | P/E Ratio | Debt-to-Equity Ratio | Return on Equity |

|---|---|---|---|

| Mondelez | 28.0 | 0.7 | 17.0% |

| Nestlé | 27.0 | 0.4 | 18.0% |

| PepsiCo | 26.0 | 0.6 | 16.0% |

Comparing Mondelez to Nestlé and PepsiCo highlights its relative position within the industry. While its ROE is competitive, its debt-to-equity ratio is slightly higher, suggesting a potentially higher level of financial risk.

Potential risks include increased competition, changing consumer preferences, and supply chain disruptions. Opportunities include expansion into emerging markets and the development of innovative, healthier products.

Impact of Macroeconomic Factors on Mondelez Stock Price

Global macroeconomic conditions significantly influence Mondelez’s stock price. Inflation, interest rates, and recessionary fears all impact consumer spending and input costs.

High inflation increases input costs (raw materials, packaging, labor), squeezing profit margins and potentially leading to price increases that could negatively affect sales volume. Rising interest rates increase borrowing costs, impacting investment and potentially reducing company profitability. Recessionary fears cause consumers to reduce discretionary spending, affecting demand for Mondelez’s products.

Changes in consumer spending habits and preferences towards healthier and more sustainable options directly impact Mondelez’s sales. The company’s ability to adapt to these shifts through product innovation and marketing strategies is crucial for maintaining its stock price.

Geopolitical events and supply chain disruptions, such as pandemics or regional conflicts, can cause production delays, increased transportation costs, and reduced access to raw materials, all negatively impacting Mondelez’s performance.

Mondelez’s Business Strategy and Stock Price Outlook

Source: marketbeat.com

Mondelez’s current business strategies focus on product innovation, brand expansion, and cost-cutting measures to enhance profitability and drive future stock price growth. These initiatives are aimed at navigating the challenges of a dynamic market landscape.

Mondelez faces stiff competition from other food and beverage giants. Its strengths lie in its established brands, global reach, and diversified product portfolio. Weaknesses include potential vulnerability to economic downturns and its reliance on commodity pricing.

Future growth opportunities for Mondelez include expansion into emerging markets with high growth potential, strategic acquisitions to enhance its product portfolio, and increased focus on sustainability and health-conscious products.

- Emerging Market Expansion (Risk: Political and Economic Instability): Targeting developing economies offers significant growth potential but carries risks associated with political instability and economic volatility.

- Strategic Acquisitions (Risk: Integration Challenges): Acquiring smaller, innovative companies can broaden product offerings and enhance market share, but integration challenges can negatively impact performance.

- Healthier Product Development (Risk: Shifting Consumer Preferences): Focusing on healthier and more sustainable products aligns with evolving consumer preferences but requires significant investment in research and development and marketing.

Analyst Ratings and Predictions for Mondelez Stock

Financial analysts offer diverse opinions and predictions regarding Mondelez’s future stock performance, reflecting the inherent uncertainty in predicting future market conditions.

| Analyst Firm | Rating | Target Price (USD) |

|---|---|---|

| Goldman Sachs | Buy | 70.00 |

| Morgan Stanley | Hold | 65.00 |

| JPMorgan Chase | Buy | 72.00 |

The variations in analyst ratings and target prices stem from differing assessments of Mondelez’s ability to execute its business strategies, navigate macroeconomic challenges, and maintain its competitive advantage. Factors such as projected sales growth, margin expansion, and market share gains influence these diverse perspectives.

FAQ Insights

What are the main risks associated with investing in Mondelez stock?

Risks include fluctuations in commodity prices, changes in consumer preferences, intense competition, and macroeconomic factors like inflation and recession.

Mondelez International’s stock price performance often reflects broader market trends and consumer spending habits. However, comparing it to other food and beverage companies can offer valuable insights. For instance, a look at the current espr stock price provides a contrasting perspective on market valuation within the sector. Ultimately, understanding Mondelez’s stock requires considering its unique business model and competitive landscape alongside similar players.

How does Mondelez compare to its competitors in terms of profitability?

A direct comparison requires examining specific financial metrics like profit margins and return on assets across several reporting periods. This analysis would be best found in financial news sources or SEC filings.

What is Mondelez’s dividend payout policy?

Mondelez’s dividend policy should be available in their investor relations section of their website. This policy Artikels the frequency and amount of dividend payments.

Where can I find real-time Mondelez stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, or Bloomberg.