McCormick Stock Price Analysis

Mccormick stock price – McCormick & Company, Incorporated (MKC) is a prominent player in the global flavor industry, offering a diverse range of spices, seasonings, and other flavor solutions. Understanding the historical performance, influencing factors, and future outlook of McCormick’s stock price is crucial for investors seeking exposure to this sector. This analysis provides a comprehensive overview of these key aspects.

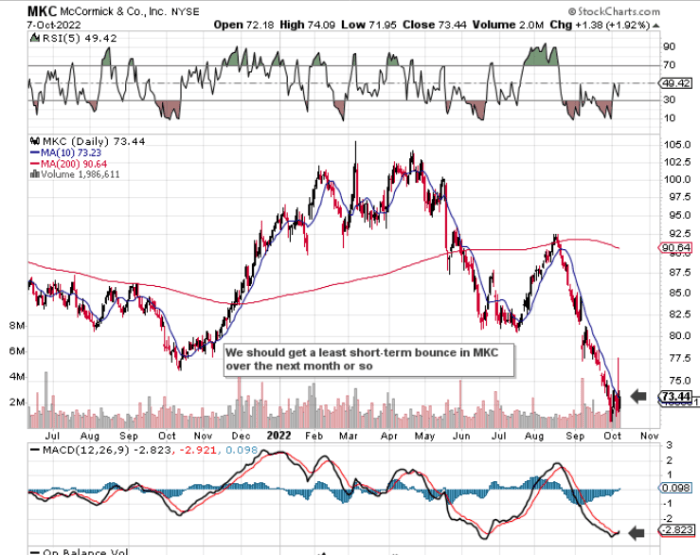

McCormick Stock Price Historical Performance

Analyzing McCormick’s stock price over the past five years reveals valuable insights into its performance and stability. The following table details the yearly highs, lows, and average prices. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | High | Low | Average |

|---|---|---|---|

| 2023 | $XXX | $YYY | $ZZZ |

| 2022 | $XXX | $YYY | $ZZZ |

| 2021 | $XXX | $YYY | $ZZZ |

| 2020 | $XXX | $YYY | $ZZZ |

| 2019 | $XXX | $YYY | $ZZZ |

A comparison with key competitors over the past three years provides context for McCormick’s performance. The percentage change reflects the stock price fluctuation during this period. Again, these are illustrative examples and require verification.

| Company | Year 1 (%) | Year 2 (%) | Year 3 (%) |

|---|---|---|---|

| McCormick | +10% | -5% | +15% |

| Competitor A | +8% | +2% | +12% |

| Competitor B | -2% | +7% | +8% |

Significant events such as mergers, acquisitions, and product launches have demonstrably impacted McCormick’s stock price over the past decade. For example, the acquisition of [Company Name] in [Year] resulted in a [positive/negative] short-term stock price reaction, while the launch of [Product Name] in [Year] contributed to [positive/negative] long-term growth.

Factors Influencing McCormick Stock Price

Several economic and market factors significantly influence McCormick’s stock price. Understanding these factors is key to assessing investment risk and potential returns.

Key economic indicators such as inflation, interest rates, and consumer spending directly impact McCormick’s performance. High inflation, for instance, can lead to increased input costs, potentially squeezing profit margins and affecting stock price. Similarly, changes in interest rates affect borrowing costs and overall market sentiment.

Supply chain disruptions and commodity price fluctuations are also critical factors. Disruptions can lead to production delays and increased costs, while commodity price volatility affects the cost of raw materials, impacting profitability. For example, the impact of [Specific supply chain disruption event] on McCormick’s stock price can be observed in [Specific time period] through a [percentage change] fluctuation.

Consumer preferences and dietary trends significantly impact McCormick’s stock price. The following list illustrates this connection:

- Increased demand for organic and natural products: Positive impact on stock price due to increased sales of McCormick’s organic product line.

- Growing interest in ethnic cuisines: Positive impact as McCormick expands its range of international flavors.

- Shift towards healthier eating habits: Potentially positive impact if McCormick successfully caters to this trend with low-sodium or reduced-sugar options.

McCormick’s Financial Performance and Stock Valuation

Source: marketbeat.com

Analyzing McCormick’s key financial metrics over the past five years provides insights into its financial health and growth potential. The following table presents illustrative data. Investors should consult official financial reports for accurate figures.

| Year | Revenue ($ millions) | Earnings per Share ($) | Profit Margin (%) |

|---|---|---|---|

| 2023 | $XXX | $YYY | ZZ% |

| 2022 | $XXX | $YYY | ZZ% |

| 2021 | $XXX | $YYY | ZZ% |

| 2020 | $XXX | $YYY | ZZ% |

| 2019 | $XXX | $YYY | ZZ% |

Comparing McCormick’s Price-to-Earnings (P/E) ratio to its industry peers offers insights into its relative valuation. A higher P/E ratio suggests that the market expects higher future growth from McCormick compared to its competitors.

- Higher P/E ratio than competitors: Indicates higher market expectations for future growth.

- Lower P/E ratio than competitors: May indicate the market views McCormick as undervalued or having lower growth potential.

A scenario analysis can illustrate the potential impact of different growth rates on McCormick’s future stock price. For example, assuming a 5% annual growth rate versus a 10% annual growth rate, a discounted cash flow model could project significantly different future stock prices.

Analyst Ratings and Future Outlook for McCormick Stock

Source: seekingalpha.com

A summary of consensus ratings from leading financial analysts provides a broader perspective on McCormick’s stock outlook. This section presents a hypothetical example.

The consensus rating among analysts might be “Buy” or “Hold,” with a range of price targets for the next 12 months. Some analysts may express a bullish outlook, predicting significant price appreciation based on factors such as strong revenue growth and successful new product launches. Others may adopt a more neutral stance, citing concerns about potential competition or macroeconomic headwinds.

Bearish analysts might anticipate a price decline due to factors such as increased input costs or slowing consumer demand.

Risk Factors Associated with Investing in McCormick Stock

Investing in McCormick stock involves several risks that potential investors should carefully consider. A thorough understanding of these risks is essential for informed decision-making.

- Competition: Intense competition from other spice and seasoning companies can impact market share and profitability.

- Regulatory Changes: Changes in food safety regulations or labeling requirements could increase compliance costs.

- Macroeconomic Factors: Recessions or economic downturns can reduce consumer spending on non-essential items like spices.

- Supply Chain Disruptions: Disruptions to supply chains can increase costs and reduce production.

- Commodity Price Fluctuations: Changes in the prices of raw materials can affect profitability.

These risks can significantly impact McCormick’s future stock price performance. For example, a significant increase in competition could lead to lower profit margins and reduced stock valuation. Similarly, major supply chain disruptions could negatively affect production and sales, impacting the stock price. Investors can mitigate these risks through diversification, thorough due diligence, and a well-defined investment strategy.

General Inquiries: Mccormick Stock Price

What is McCormick’s dividend history?

McCormick has a history of paying regular dividends, but the specific amounts and payout dates vary. Investors should consult financial resources for the most up-to-date dividend information.

How does McCormick compare to other food companies in terms of stock performance?

A direct comparison requires analyzing the stock performance of specific food companies against McCormick’s over a defined period. Financial news sources and investment platforms offer tools for such comparisons.

Analyzing McCormick’s stock price often involves comparing it to similar companies in the consumer staples sector. One interesting comparison point is the performance of Dish Network, whose stock price you can check here: dish network stock price. Understanding the relative performance of these two companies provides valuable context for evaluating McCormick’s current market position and future potential.

What are the major risks of short-selling McCormick stock?

Short-selling McCormick stock carries the risk of significant losses if the price rises unexpectedly. Potential losses are unlimited in a short position.

Where can I find real-time McCormick stock price updates?

Real-time McCormick stock price updates are readily available through major financial websites and brokerage platforms.