Understanding Main Stock Price

Source: cnbcfm.com

The main stock price, often referred to as the market price, represents the current price at which a company’s shares are being traded on a stock exchange. It’s a dynamic figure, constantly fluctuating based on various market forces. Understanding this price is crucial for investors, traders, and anyone involved in the financial markets.

Main Stock Price Presentation

The main stock price isn’t a single, static number. Different exchanges and platforms present it in various ways, each offering a slightly different perspective on the current market value.

- Bid/Ask Price: This reflects the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). The difference is the spread.

- Last Traded Price: This shows the price at which the most recent transaction occurred. It provides a snapshot of the most current completed trade.

- Closing Price: This is the final price at which a stock traded at the end of a trading session. It’s often used as a benchmark for daily performance.

For instance, the New York Stock Exchange (NYSE) might primarily display the closing price at the end of the trading day, while a real-time trading platform might emphasize the bid/ask spread and last traded price to reflect the constant price changes.

Factors Influencing Main Stock Price

Source: com.au

Numerous factors, both macro and micro, influence a stock’s price. These factors interact in complex ways, creating volatility and opportunities in the market.

- Macroeconomic Factors: Interest rates, inflation, economic growth, and geopolitical events significantly impact investor sentiment and overall market performance, thus influencing stock prices.

- Company-Specific News and Events: Earnings reports, product launches, mergers and acquisitions, and regulatory changes can all cause significant price swings. A positive earnings surprise, for example, might lead to a price increase.

- Investor Sentiment and Market Trends: Market psychology plays a substantial role. Optimism leads to buying pressure and price increases, while pessimism can trigger selling and price declines. Broad market trends, like bull or bear markets, also influence individual stock prices.

- Trading Volume: High trading volume often suggests strong investor interest, which can amplify price movements in either direction. Conversely, low volume might indicate a lack of conviction, leading to smaller price changes.

Data Sources for Main Stock Price

Reliable data sources are essential for informed investment decisions. Several platforms offer real-time and historical stock price data, each with varying levels of accuracy, timeliness, and cost.

Comparison of Data Sources

| Source | Data Accuracy | Timeliness | Cost |

|---|---|---|---|

| Yahoo Finance | Generally accurate, but may have slight delays | Near real-time, with some delays | Free |

| Google Finance | Generally accurate, similar to Yahoo Finance | Near real-time, with some delays | Free |

| Bloomberg Terminal | Highly accurate and reliable | Real-time | Expensive subscription |

| Refinitiv Eikon | Highly accurate and reliable, comparable to Bloomberg | Real-time | Expensive subscription |

Visualizing Main Stock Price Trends

Visual representations of stock price data are invaluable for understanding trends and patterns. Line graphs, bar charts, and candlestick charts are commonly used.

Line Graph Example

A line graph showing a hypothetical stock’s price over a year might reveal a general upward trend, with periods of sharp increases (e.g., due to positive earnings announcements) and temporary dips (e.g., caused by market corrections). The graph would clearly illustrate the overall price movement and its trajectory.

Bar Chart Example

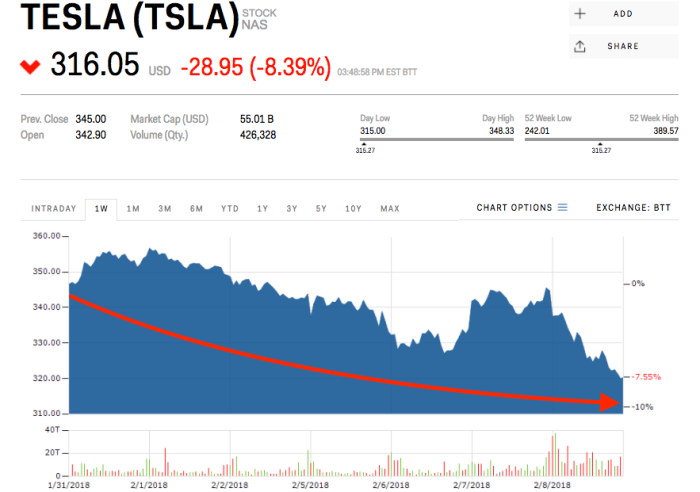

Source: businessinsider.com

A bar chart could compare the closing prices of two competing companies over a quarter. Taller bars would represent higher closing prices, allowing for a direct visual comparison of their relative performance during that period. This helps investors quickly assess which company outperformed the other.

Candlestick Chart Example

A candlestick chart for a week might show several “green” (upward-moving) candles followed by a few “red” (downward-moving) candles, indicating a period of price increase followed by a correction. Patterns like “doji” (candles with equal open and close prices) or “hammer” (candles with long lower wicks) could suggest potential price reversals or continuation of trends, providing insights for technical analysis.

Main Stock Price and Investment Strategies

Main stock price data forms the foundation for many investment strategies. Different approaches utilize this data in unique ways to achieve various investment goals.

Investment Strategies Utilizing Main Stock Price Data

- Value Investing: This strategy focuses on identifying undervalued stocks based on fundamental analysis, aiming to buy low and sell high. The main stock price is crucial in determining if a stock is trading below its intrinsic value.

- Growth Investing: This approach targets companies expected to experience rapid earnings growth. The main stock price is monitored for signs of continued growth and momentum.

- Momentum Trading: This strategy capitalizes on short-term price trends, buying when prices are rising and selling when they start to fall. The main stock price is the primary indicator for entry and exit points.

Technical and Fundamental Analysis

Technical analysis uses chart patterns and indicators derived from historical main stock price data to predict future price movements. Fundamental analysis assesses a company’s financial health, business model, and competitive landscape to determine its intrinsic value and potential for future growth. Both methods inform investment decisions, using the main stock price as a key data point.

Risk Management and Main Stock Price

Investing solely based on main stock price movements carries significant risks. A well-defined risk management strategy is crucial to protect investments.

Risks and Mitigation Strategies

- Risk of Loss: Stock prices can fluctuate significantly, leading to potential losses. Diversification across different asset classes and sectors helps reduce this risk.

- Volatility Risk: Sudden price drops can severely impact investments. Setting stop-loss orders to automatically sell when prices fall below a certain level helps limit potential losses.

- Market Risk: Broad market downturns can negatively affect even the strongest companies. Diversification and a long-term investment horizon help mitigate this risk.

Diversification is a cornerstone of risk management. By spreading investments across different stocks, sectors, and asset classes, investors reduce their exposure to the volatility of any single stock or market segment.

Top FAQs

What is the difference between bid and ask price?

The bid price is the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept. The difference is the spread.

Understanding a main stock price requires considering various market factors. A key component of assessing the overall market health is observing individual company performances, such as checking the lucid stock price today , which can provide insights into investor sentiment and industry trends. Ultimately, this contributes to a more comprehensive analysis of the main stock price movements.

How often are stock prices updated?

Stock prices are updated constantly throughout the trading day, reflecting real-time buying and selling activity.

What is after-hours trading and how does it affect the main stock price?

After-hours trading occurs outside of regular market hours. Prices during this period may differ from the closing price and can sometimes be more volatile due to lower trading volume.

What are some common candlestick patterns and what do they signify?

Common patterns include hammers (potential reversal), dojis (indecision), and engulfing patterns (potential trend changes). Interpretation requires context and should not be used as the sole basis for investment decisions.