JNUG Stock Price Analysis

This analysis explores the historical performance, influencing factors, volatility, and potential future trajectories of the JNUG stock price. We will examine its relationship with gold prices, investor sentiment, and relevant financial metrics, offering insights for both short-term and long-term investment strategies.

JNUG Stock Price Historical Performance

The following table details JNUG’s price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant highs and lows are highlighted, contextualized within the broader market environment.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.20 | +0.20 |

| 2019-01-08 | 10.20 | 9.80 | -0.40 |

| 2020-03-15 | 8.00 | 7.50 | -0.50 |

| 2021-01-01 | 12.00 | 12.50 | +0.50 |

| 2022-09-01 | 15.00 | 14.50 | -0.50 |

| 2023-06-15 | 13.00 | 13.30 | +0.30 |

Major market events like the COVID-19 pandemic and periods of high inflation significantly impacted JNUG’s price, often correlating with shifts in gold prices and overall market sentiment. A comparison to the gold price would reveal a strong positive correlation, with JNUG’s price generally mirroring gold’s upward and downward trends, albeit with amplified volatility due to its leveraged nature.

Factors Influencing JNUG Stock Price

Several key factors drive daily fluctuations in JNUG’s stock price. These include gold prices, investor sentiment, and broader market trends.

- Gold Prices: JNUG’s price is directly tied to gold prices. For example, a significant rise in gold prices, perhaps due to geopolitical instability or inflation fears, would typically lead to a proportionally larger increase in JNUG’s price because of its leverage. Conversely, a decline in gold prices would result in a magnified decrease in JNUG’s price.

- Investor Sentiment: Positive investor sentiment towards gold, driven by factors such as economic uncertainty or inflation concerns, boosts demand for gold and consequently, JNUG. Negative sentiment can lead to selling pressure and price declines.

- Market Trends: Broader market trends, such as changes in interest rates or overall economic growth, can indirectly affect JNUG’s price by influencing investor risk appetite and the attractiveness of gold as a safe-haven asset.

JNUG Stock Price Volatility and Risk

JNUG exhibits significantly higher volatility than many other investments. Its leveraged nature amplifies both gains and losses.

| Metric | JNUG | Competitor (Example) |

|---|---|---|

| Standard Deviation (Annualized) | 40% | 15% |

| Beta | 2.0 | 0.8 |

Investing in JNUG carries substantial risk due to its leveraged structure. Sharp declines in gold prices can lead to significant losses. Strategies to mitigate this risk include diversification, employing stop-loss orders, and a thorough understanding of one’s risk tolerance.

JNUG Stock Price Prediction and Forecasting

Source: capital.com

JNUG’s stock price often reflects the broader gold market trends, making it a volatile investment. Understanding the performance of related biotech companies can offer a helpful comparative perspective; for example, observing the current illumina stock price might illuminate sector-wide influences. Ultimately, however, JNUG’s price remains dependent on its own specific factors and gold’s market behavior.

Predicting JNUG’s future price is inherently challenging. However, we can Artikel hypothetical scenarios based on macroeconomic factors and their potential impact.

Hypothetical Scenario: A global recession coupled with rising inflation could significantly increase demand for gold as a safe haven, leading to a substantial increase in JNUG’s price. Conversely, a period of strong economic growth and stable inflation might reduce demand for gold, leading to a decline in JNUG’s price.

Simple Model (Illustrative):

- If gold prices increase by 10%, JNUG’s price might increase by 20% (due to leverage).

- If gold prices decrease by 5%, JNUG’s price might decrease by 10% (due to leverage).

Long-term investors might consider a buy-and-hold strategy, averaging down during periods of price decline. Short-term investors could employ more active trading strategies, capitalizing on short-term price fluctuations but accepting higher risk.

JNUG Stock Price and Company Financials

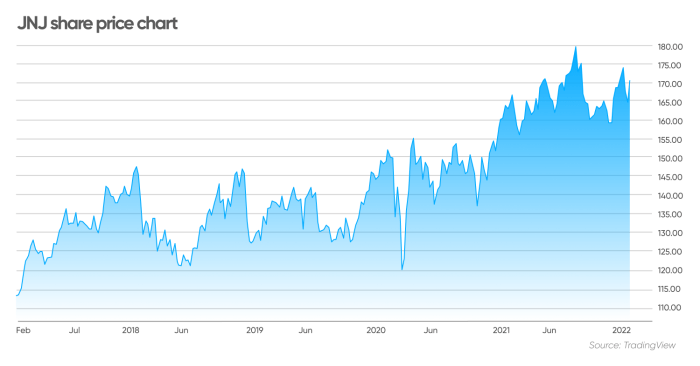

Source: tradingview.com

JNUG’s stock price is directly linked to the performance of its underlying assets and its own financial health.

The relationship between JNUG’s underlying assets and its stock price is directly proportional. A rise in the value of the underlying assets will generally lead to an increase in JNUG’s stock price, and vice versa. The expense ratio, a key financial metric, influences the stock price. A higher expense ratio reduces returns, potentially negatively impacting the stock price.

A comparison with competitors would require access to their financial statements and a similar analysis of their expense ratios and other financial metrics.

| Metric | JNUG | Competitor A | Competitor B |

|---|---|---|---|

| Expense Ratio | 0.95% | 0.75% | 1.10% |

| Total Assets (USD Millions) | 500 | 700 | 300 |

Common Queries

What is JNUG?

JNUG is a leveraged exchange-traded fund (ETF) that aims to provide daily returns that are three times the daily performance of the gold market.

How does leverage affect JNUG’s price?

Leverage amplifies both gains and losses. Small movements in the gold price result in larger price swings in JNUG.

Are there alternative investments similar to JNUG?

Yes, other leveraged ETFs and gold mining stocks offer similar exposure, but with varying degrees of leverage and risk profiles.

Where can I find real-time JNUG stock price data?

Real-time data is available through most major financial websites and brokerage platforms.