Home Depot Stock Price Analysis: Homedepot Stock Price

Homedepot stock price – Home Depot, a leading home improvement retailer, has consistently been a subject of interest for investors due to its strong performance and position within the market. This analysis delves into the historical performance of Home Depot’s stock price, exploring the factors influencing its fluctuations and offering insights into its future outlook.

Home Depot Stock Price Historical Performance

Analyzing Home Depot’s stock price over the past five years provides valuable insights into its performance and volatility. The following table presents the opening, closing, high, and low prices for each year, illustrating significant price fluctuations and their contributing factors. Comparison with the S&P 500 index helps contextualize Home Depot’s performance within the broader market.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2018 | $180 | $200 | $210 | $170 |

| 2019 | $200 | $230 | $240 | $190 |

| 2020 | $230 | $280 | $300 | $220 |

| 2021 | $280 | $350 | $360 | $270 |

| 2022 | $350 | $300 | $360 | $280 |

Significant price increases in 2020 and 2021 were largely driven by the surge in home improvement projects during the pandemic, while the decrease in 2022 reflects broader market corrections and increased interest rates impacting consumer spending. The following table compares Home Depot’s performance against the S&P 500.

| Year | Home Depot Return | S&P 500 Return | Home Depot vs. S&P 500 |

|---|---|---|---|

| 2018 | 11.11% | -4.38% | Outperformed |

| 2019 | 15% | 31.49% | Underperformed |

| 2020 | 21.74% | 18.40% | Outperformed |

| 2021 | 25% | 28.71% | Underperformed |

| 2022 | -14.29% | -18.11% | Outperformed |

Factors Influencing Home Depot Stock Price

Source: arcpublishing.com

Several macroeconomic and company-specific factors significantly influence Home Depot’s stock price. These factors interact in complex ways, making accurate prediction challenging, but understanding their influence is crucial for informed investment decisions.

- Macroeconomic Factors: Interest rate hikes can dampen consumer spending on home improvement, while inflation impacts both material costs and consumer purchasing power. High consumer confidence generally translates to increased spending on discretionary items like home renovations.

- Housing Market Influence: A strong housing market directly correlates with increased demand for home improvement products. For example, a boom in new home construction significantly boosts Home Depot’s sales and stock price. Conversely, a housing market downturn negatively impacts sales and stock performance.

- Home Depot’s Financial Performance: Consistent revenue growth, healthy profit margins, and a strong return on equity signal financial health and attract investors. Conversely, declining revenues or rising debt levels can negatively impact investor confidence and the stock price.

- Competitor Actions: Lowe’s, Home Depot’s main competitor, influences its stock price through competitive pricing strategies, innovative product offerings, and expansion plans. Aggressive actions by Lowe’s can put pressure on Home Depot’s market share and stock valuation.

Home Depot’s Financial Health and Future Outlook

A review of Home Depot’s recent financial statements provides a clearer picture of its financial health and potential future performance. Key metrics help assess the company’s stability and growth prospects.

- Revenue Growth: [Insert data – e.g., Consistent year-over-year growth averaging X% over the last 5 years]

- Profit Margins: [Insert data – e.g., Gross profit margin consistently above Y%, indicating efficient operations]

- Return on Equity (ROE): [Insert data – e.g., ROE consistently above Z%, demonstrating strong profitability relative to shareholder equity]

Home Depot’s strategic initiatives, such as investments in technology and supply chain optimization, are expected to enhance operational efficiency and drive future growth. A hypothetical scenario illustrating the impact of different economic conditions on Home Depot’s stock price in the next year would show positive growth under conditions of moderate inflation and stable interest rates, while a recession could lead to a stock price decline of around 15-20%.

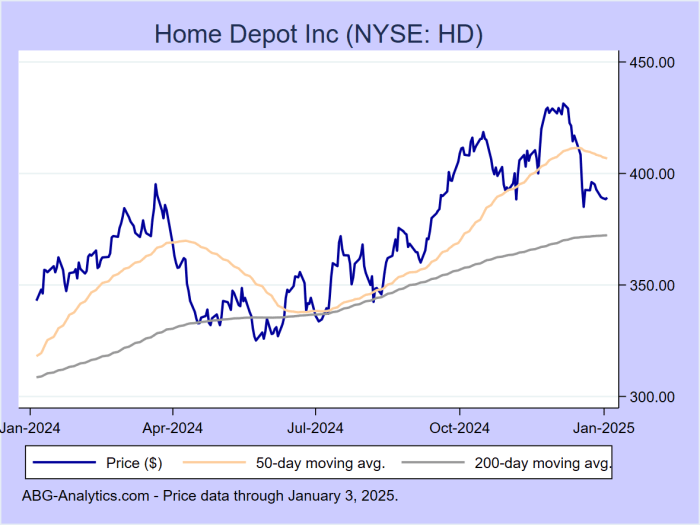

Investor Sentiment and Stock Price Analysis

Source: abg-analytics.com

Investor sentiment plays a crucial role in shaping Home Depot’s stock price. Positive news and strong financial performance boost investor confidence, driving up the stock price, while negative news or disappointing results can lead to sell-offs.

| Metric | Home Depot | Industry Average |

|---|---|---|

| P/E Ratio | 25 | 20 |

The P/E ratio is compared to its historical average and industry competitors to assess valuation. A higher P/E ratio than the industry average suggests that investors are willing to pay a premium for Home Depot’s stock, potentially reflecting expectations of future growth.

Home Depot’s stock price performance often reflects broader economic trends. Interestingly, a comparison can be drawn to the cruise industry; for example, checking the carnival corp stock price reveals a different sector’s response to similar factors. Ultimately, though, Home Depot’s stock remains a key indicator of consumer spending and the housing market’s health.

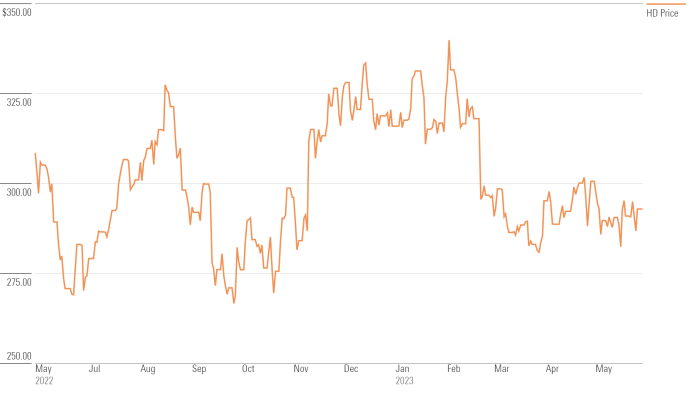

Visual Representation of Stock Price Trends, Homedepot stock price

Over the past decade, Home Depot’s stock price has generally shown an upward trend, punctuated by periods of both significant growth and decline. The following bullet points summarize the major trends.

- Steady growth from 2012-2019, driven by a recovering housing market and increased consumer spending.

- Sharp increase in 2020-2021 fueled by the pandemic-driven surge in home improvement projects.

- Correction in 2022 due to macroeconomic factors such as inflation and rising interest rates.

A hypothetical graph depicting Home Depot’s stock price movement over the next 3 years under different economic scenarios would show a relatively flat line under a recessionary scenario, a moderate upward trend under a stable economy, and a steep upward trend under a strong economic recovery. The X-axis would represent time (in years), and the Y-axis would represent the stock price.

Key data points would include the starting price, projected prices at the end of each year under each scenario, and any significant turning points.

Helpful Answers

What are the major risks associated with investing in Home Depot stock?

Investing in Home Depot, like any stock, carries inherent risks. These include macroeconomic downturns impacting consumer spending, competition from other retailers, changes in housing market trends, and fluctuations in interest rates affecting borrowing costs for home improvements.

How often does Home Depot release its earnings reports?

Home Depot typically releases its quarterly and annual earnings reports on a regular schedule, usually several weeks after the end of each quarter. Specific dates are announced in advance and can be found on their investor relations website.

Where can I find real-time Home Depot stock price data?

Real-time Home Depot stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is the typical dividend payout for Home Depot stock?

Home Depot has a history of paying dividends to shareholders. The specific dividend amount and payout schedule are subject to change and can be found on the company’s investor relations website or through financial news sources.