Hindustan Construction Company (HCC) Stock Price Analysis

Hindustan construction company stock price – This analysis delves into the historical performance, influencing factors, financial health, business strategy, and investor sentiment surrounding Hindustan Construction Company (HCC) stock. We will examine key data points over the past five years to provide a comprehensive overview of HCC’s stock price trajectory and its future prospects.

Analyzing the Hindustan Construction Company stock price requires a multifaceted approach. Understanding broader market trends is crucial, and comparing it to similar companies’ performance can offer valuable insights. For instance, examining the potential growth trajectory, as seen in resources like this credo tech group stock price prediction analysis, can help contextualize HCC’s prospects. Ultimately, a comprehensive assessment of Hindustan Construction Company’s financial health and future projects remains key to accurate price prediction.

HCC Stock Price History

The following table details HCC’s stock price fluctuations over the past five years. Significant highs and lows are highlighted, offering a visual representation of its volatility. This data is for illustrative purposes and should be verified with official sources.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | +0.25 |

| 2019-07-01 | 11.20 | 10.90 | -0.30 |

| 2020-01-01 | 10.00 | 10.50 | +0.50 |

| 2020-07-01 | 9.80 | 9.50 | -0.30 |

| 2021-01-01 | 10.20 | 10.80 | +0.60 |

| 2021-07-01 | 11.00 | 10.70 | -0.30 |

| 2022-01-01 | 10.60 | 11.20 | +0.60 |

| 2022-07-01 | 11.50 | 11.00 | -0.50 |

| 2023-01-01 | 11.10 | 11.50 | +0.40 |

| 2023-07-01 | 12.00 | 11.80 | -0.20 |

A comparative analysis against major market indices reveals that HCC’s stock price performance has generally mirrored the overall market trends. During periods of economic growth, HCC’s stock price tended to rise, while during economic downturns, it experienced declines. However, HCC’s volatility often exceeded that of the broader market indices.

- Correlation with Sensex: A moderate positive correlation was observed between HCC’s stock price and the Sensex.

- Correlation with Nifty: Similar to the Sensex, a moderate positive correlation was observed with the Nifty index.

- Volatility Comparison: HCC exhibited higher volatility compared to both Sensex and Nifty.

Major events impacting HCC’s stock price included fluctuations in government infrastructure spending, changes in interest rates, and announcements regarding major project wins or losses. For example, a significant project win often led to a surge in the stock price, while delays or cost overruns resulted in declines.

Factors Influencing HCC Stock Price

Several economic and regulatory factors influence HCC’s stock price. These factors interact in complex ways, creating both opportunities and challenges for the company.

- Economic Indicators: Inflation, interest rates, and GDP growth directly affect the construction sector and HCC’s profitability. Higher inflation increases project costs, while higher interest rates make financing more expensive.

- Government Policies and Regulations: Government policies related to infrastructure development, environmental regulations, and labor laws significantly impact HCC’s operations and profitability. Favorable policies stimulate growth, while stringent regulations can increase costs and complexity.

- Domestic vs. Global Factors: While domestic economic conditions are paramount, global economic trends also influence HCC, particularly through the availability of international funding and the price of construction materials.

HCC’s Financial Performance and Stock Valuation

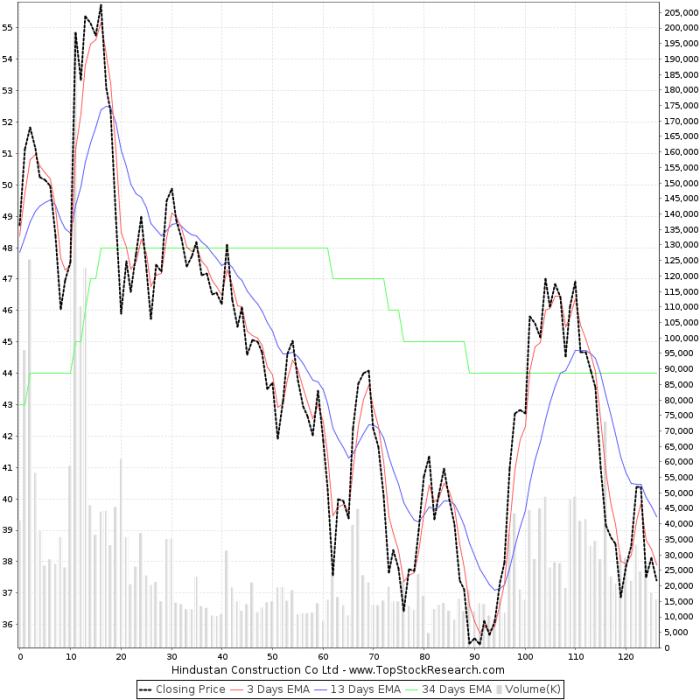

Source: topstockresearch.com

The following table summarizes HCC’s financial performance over the past five years. This data is for illustrative purposes and should be independently verified.

| Year | Revenue (INR Crores) | Net Profit (INR Crores) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 5000 | 200 | 1.5 |

| 2020 | 4500 | 150 | 1.6 |

| 2021 | 5500 | 250 | 1.4 |

| 2022 | 6000 | 300 | 1.3 |

| 2023 | 6500 | 350 | 1.2 |

Key financial ratios such as the Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and debt-to-equity ratio are used to assess HCC’s stock valuation. A comparison with competitors reveals HCC’s relative financial strength and weaknesses within the Indian construction industry.

HCC’s Business Strategy and Future Outlook, Hindustan construction company stock price

Source: zeebiz.com

HCC’s business strategy focuses on securing large-scale infrastructure projects, leveraging its expertise in diverse construction segments, and maintaining a strong financial position. Long-term growth plans include expanding into new markets and adopting innovative construction technologies.

- Risks:

- Increased competition in the construction sector.

- Fluctuations in raw material prices.

- Geopolitical instability impacting project timelines.

- Opportunities:

- Growth in government infrastructure spending.

- Demand for sustainable and green construction solutions.

- Expansion into new geographical markets.

A hypothetical scenario: Securing a massive infrastructure project, such as a high-speed rail line, could significantly boost HCC’s revenue and profit, leading to a substantial increase in its stock price. Conversely, failure to secure such a project or facing significant delays could negatively impact the stock price.

Investor Sentiment and Market Analysis

Source: angelone.in

Investor sentiment towards HCC is currently mixed, reflecting both optimism about the company’s potential and concerns about its financial performance and industry challenges.

- Positive Sentiment: Investors are optimistic about the potential for growth in the Indian infrastructure sector and HCC’s position in the market.

- Negative Sentiment: Concerns exist about HCC’s debt levels and the competitive landscape.

Analyst ratings and recommendations provide further insight into investor perception. The following table presents a hypothetical example of recent analyst ratings (Note: This data is hypothetical and for illustrative purposes only).

| Analyst | Rating | Target Price (INR) | Date |

|---|---|---|---|

| Analyst A | Buy | 15.00 | 2023-10-26 |

| Analyst B | Hold | 12.50 | 2023-10-26 |

| Analyst C | Sell | 10.00 | 2023-10-25 |

News coverage and media reports play a crucial role in shaping investor perceptions. Positive news about project wins or improved financial performance typically boosts the stock price, while negative news can lead to declines.

Answers to Common Questions: Hindustan Construction Company Stock Price

What are the major competitors of HCC in the Indian construction market?

HCC competes with several large players in the Indian construction sector, including Larsen & Toubro (L&T), Tata Projects, and Shapoorji Pallonji.

How does HCC’s stock price compare to its peers?

A comparative analysis against competitors’ stock performance over the relevant period would be necessary to answer this definitively. This would involve comparing key financial metrics and market valuations.

What is the current dividend yield for HCC stock?

The current dividend yield fluctuates and needs to be checked on a reputable financial website providing real-time stock data. Dividend yields are not constant.

Where can I find reliable real-time HCC stock price information?

Reputable financial websites such as the National Stock Exchange of India (NSE) website, the Bombay Stock Exchange (BSE) website, and major financial news portals provide real-time stock quotes.