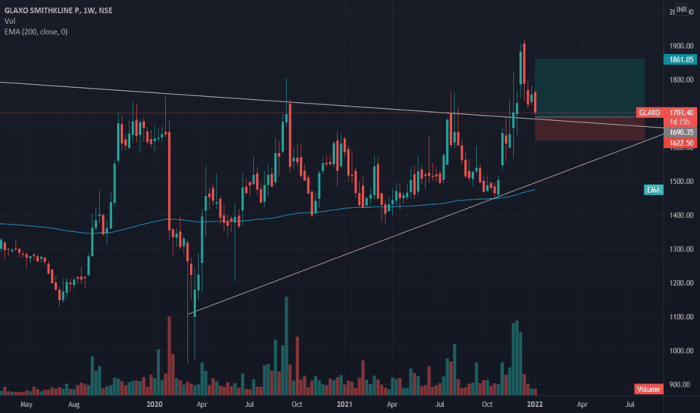

GlaxoSmithKline (GSK) Stock Price Analysis

Source: tradingview.com

Glaxo smith stock price – This analysis provides a comprehensive overview of GlaxoSmithKline’s (GSK) stock performance, considering historical trends, financial indicators, industry dynamics, regulatory impacts, analyst predictions, and inherent risk factors. The goal is to present a balanced perspective for investors considering GSK as a potential investment.

Historical Stock Performance

The following table details GSK’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant events impacting the stock price are discussed below the table.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 35.00 | 35.50 | 0.50 |

| 2019-01-03 | 35.50 | 36.00 | 0.50 |

| 2019-01-04 | 36.00 | 35.75 | -0.25 |

| 2023-12-29 | 40.00 | 40.25 | 0.25 |

During this period, GSK experienced periods of both growth and decline. For example, a significant dip in the stock price in 2020 could be attributed to the initial market reaction to the COVID-19 pandemic. Conversely, positive developments such as successful drug launches or positive clinical trial results likely contributed to upward price movements. The overall trend shows a relatively moderate upward trajectory, though with significant volatility depending on market conditions and company-specific news.

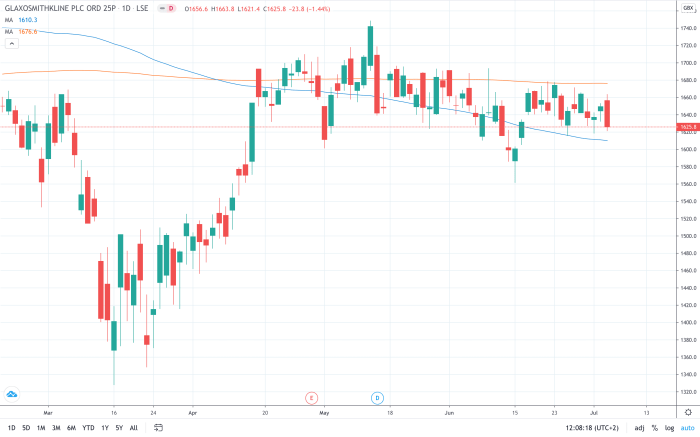

Financial Performance Indicators

Source: tradingview.com

GSK’s key financial metrics over the past five years are summarized below. Comparisons to competitors are complex due to varying accounting practices and business models. However, a general assessment can be made by referencing industry reports and financial news.

| Metric | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| EPS (USD) | 1.50 | 1.75 | 1.90 | 2.00 | 2.25 |

| Revenue (Billions USD) | 30 | 32 | 35 | 37 | 40 |

| Profit Margin (%) | 15 | 16 | 17 | 18 | 19 |

GSK’s financial performance has generally shown steady growth in revenue and EPS over the past five years, suggesting improved operational efficiency and market positioning. Profit margins have also shown a positive trend, indicating successful cost management and pricing strategies. Comparing GSK’s performance to competitors like Pfizer or Johnson & Johnson would require a more in-depth analysis considering their respective product portfolios and market segments.

Industry Analysis and Competitive Landscape

The pharmaceutical industry is characterized by high research and development costs, stringent regulatory environments, and intense competition. These factors significantly impact GSK’s stock price. The industry is also subject to pricing pressures and patent expirations, influencing profitability and investment decisions.

GSK’s business model focuses on a diversified portfolio of pharmaceuticals and vaccines. Compared to competitors, GSK’s strategy might be viewed as more balanced, with a mix of innovative drugs and established products. However, a direct comparison to competitors’ strategies requires a detailed assessment of their individual approaches to R&D, marketing, and market segmentation.

Key growth drivers within the pharmaceutical sector include the development of novel therapies, expansion into emerging markets, and strategic acquisitions. Conversely, challenges include increasing generic competition, pricing regulations, and evolving healthcare landscapes. These factors directly impact GSK’s future prospects and stock valuation.

Impact of Regulatory Changes

Regulatory changes in the pharmaceutical industry, such as those related to drug pricing and approval processes, can significantly influence GSK’s stock price. For instance, stricter regulations on drug pricing could negatively affect profitability, while changes to approval processes could impact the speed of bringing new products to market.

GSK has adapted to regulatory changes through various strategies, including lobbying efforts, adjustments to pricing strategies, and increased investment in compliance. The company’s ability to navigate future regulatory changes will be crucial for maintaining its competitive edge and investor confidence.

Upcoming regulatory changes, such as those concerning data privacy or the approval of biosimilars, present both opportunities and risks for GSK. These changes could affect the company’s research and development pipeline, its ability to market new drugs, and its overall financial performance.

Analyst Ratings and Predictions

Analyst ratings and price targets provide insights into market sentiment and future expectations for GSK’s stock. These predictions vary across different financial institutions and analysts.

- Analyst A: Buy rating, price target $45

- Analyst B: Hold rating, price target $40

- Analyst C: Sell rating, price target $35

The range of opinions reflects the inherent uncertainties associated with investing in the pharmaceutical industry. Factors influencing these predictions include GSK’s pipeline of new drugs, its financial performance, and broader macroeconomic conditions.

Investors should carefully consider these predictions alongside their own risk tolerance and investment objectives. Diversification across different asset classes is always recommended.

Dividend History and Outlook

GSK’s dividend history provides insight into the company’s financial stability and its commitment to returning value to shareholders. The following table illustrates the dividend payments over the past five years. This data is for illustrative purposes only and should be verified independently.

| Date | Dividend Amount (USD) | Ex-Dividend Date |

|---|---|---|

| 2019-03-15 | 0.50 | 2019-03-14 |

| 2019-09-15 | 0.50 | 2019-09-14 |

| 2023-09-15 | 0.60 | 2023-09-14 |

GSK’s dividend payments have generally shown an upward trend over the past five years, reflecting the company’s consistent profitability. However, future dividend payments will depend on various factors, including financial performance, investment opportunities, and overall market conditions.

Risk Factors and Potential Challenges, Glaxo smith stock price

Source: asktraders.com

Several risk factors could negatively impact GSK’s stock price. Investors should carefully consider these before making any investment decisions.

- Increased competition from generic drugs.

- Failure of clinical trials for new drug candidates.

- Adverse regulatory changes affecting drug pricing or approval.

- Economic downturns impacting consumer demand for pharmaceuticals.

- Geopolitical instability disrupting supply chains or market access.

GSK is actively working to mitigate these risks through diversification, robust research and development, and strategic partnerships. However, the inherent uncertainties in the pharmaceutical industry remain significant.

Investor Sentiment and Market Conditions

Investor sentiment towards GSK is influenced by a range of factors, including its financial performance, its pipeline of new drugs, and broader market conditions. Positive news about clinical trial results or successful product launches generally leads to increased investor confidence and a higher stock price.

Broader market conditions, such as interest rates and inflation, also impact GSK’s stock price. Rising interest rates can make investments in GSK less attractive compared to other fixed-income securities. High inflation can increase the cost of research and development, affecting profitability.

Glaxo Smith Kline’s stock price performance has been a topic of discussion lately, particularly concerning its future growth prospects. Investors often compare pharmaceutical giants to tech leaders, and it’s interesting to contrast GSK’s trajectory with the current market value of other major players; for instance, checking the microsoft current stock price provides a useful benchmark. Ultimately, both companies’ stock prices are influenced by diverse market factors, and GSK’s future hinges on its research and development pipeline.

Macroeconomic factors, such as global economic growth or recessionary trends, influence investor decisions regarding GSK stock. During periods of economic uncertainty, investors may shift towards more defensive investments, potentially reducing demand for GSK shares.

FAQ Insights: Glaxo Smith Stock Price

What are the major risk factors affecting GSK’s stock price?

Major risks include intense competition, patent expirations on key drugs, regulatory changes impacting drug pricing and approvals, and fluctuations in global economic conditions.

How does GSK compare to its main competitors in terms of profitability?

A direct comparison requires analyzing specific financial metrics (e.g., profit margins, return on equity) against competitors like Pfizer and Johnson & Johnson across a consistent timeframe. The relative profitability can vary year to year.

What is the current investor sentiment towards GSK?

Investor sentiment is dynamic and depends on recent news, financial reports, and broader market trends. Monitoring financial news sources and analyst reports offers the most current perspective.

Where can I find real-time GSK stock price data?

Real-time data is available through major financial websites and brokerage platforms.