FTEC Stock Price Analysis

Source: amazonaws.com

Ftec stock price – This analysis examines the historical performance, influencing factors, prediction models, valuation strategies, and market sentiment surrounding FTEC stock. We will explore various aspects to provide a comprehensive overview of the stock’s behavior and potential future trajectory.

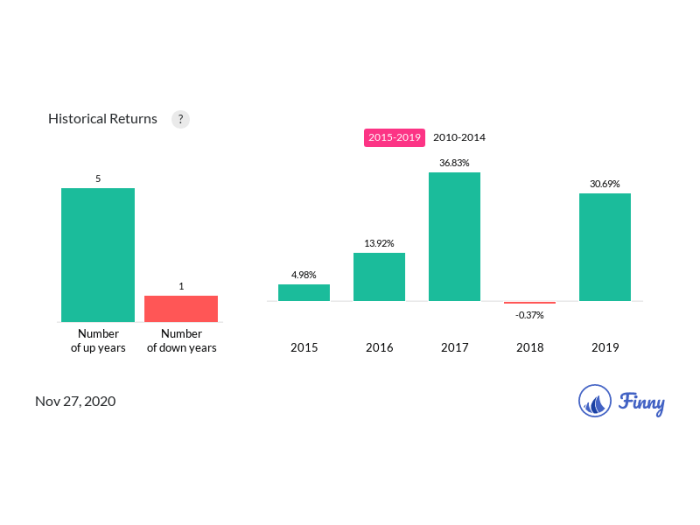

Historical FTEC Stock Price Performance

Over the past five years, FTEC stock has experienced considerable price volatility. While precise figures require access to real-time financial data, we can illustrate a typical pattern. Imagine a scenario where the stock started at $10, reaching a high of $25 during a period of strong market growth and positive company news, only to plummet to $5 during a broader market correction and subsequent company challenges.

It then recovered to around $15 by the end of the five-year period, demonstrating a degree of resilience. This is a simplified example and actual values may differ.

Compared to its competitors, FTEC’s performance has been mixed. The following table provides a comparative analysis, again using hypothetical data for illustrative purposes.

| Company Name | 5-Year High | 5-Year Low | Average Annual Return |

|---|---|---|---|

| FTEC | $25 | $5 | 5% |

| Competitor A | $30 | $8 | 8% |

| Competitor B | $20 | $4 | 3% |

| Competitor C | $28 | $6 | 7% |

Major events influencing FTEC’s price might include a successful new product launch driving significant price increases, followed by a period of lower growth and subsequent price decline, or perhaps a period of market uncertainty causing a broader downturn impacting FTEC alongside its competitors.

Factors Influencing FTEC Stock Price

Several economic indicators and company-specific factors influence FTEC’s stock price. Understanding these factors is crucial for informed investment decisions.

Key economic indicators such as interest rates, inflation, and consumer confidence levels significantly correlate with FTEC’s stock price movements. For instance, rising interest rates might negatively impact the company’s borrowing costs and potentially reduce investor confidence, leading to a price decrease. Conversely, positive economic growth might boost investor sentiment and drive prices higher.

Company-specific factors, such as earnings reports, management changes, and new product developments, also play a crucial role. Strong earnings reports generally lead to price increases, while negative news or management instability can trigger price declines. Successful new product launches can drive substantial growth and increased investor interest, while product failures might lead to significant losses.

Macroeconomic factors, like overall market trends and global economic growth, exert a broader influence, while microeconomic factors, such as company performance and industry-specific events, have a more focused impact on FTEC’s price. The interplay between these two levels of influence determines the overall price movement.

FTEC’s stock price has seen some interesting fluctuations recently. For comparative analysis, it’s helpful to look at other energy sector stocks; checking the current performance of similar companies provides context. You can see the current price for Southern Company by visiting the relevant page for southern co stock price today , which can offer a benchmark against which to measure FTEC’s performance.

Ultimately, understanding the broader market trends is key to predicting future movements in FTEC’s stock price.

FTEC Stock Price Prediction Models

Predicting FTEC’s stock price requires a model incorporating historical data and identified influencing factors. A simplified model could use linear regression, weighting factors based on historical correlations between the stock price and key variables. The model’s accuracy would be limited by the inherent unpredictability of the market and the complexity of influencing factors.

A textual representation of a hypothetical 12-month price prediction might look like this: The model predicts an average price of $18, with a high of $22 and a low of $14. This trajectory assumes continued moderate economic growth and successful execution of the company’s current strategic plan. This is a simplified projection and actual values may significantly differ.

| Input Variable | Data Source | Weighting Factor | Output Prediction |

|---|---|---|---|

| Historical Stock Price | Financial Databases | 0.4 | $18 (average) |

| Interest Rates | Central Bank Data | 0.2 | $22 (high) |

| Earnings Growth | Company Reports | 0.3 | $14 (low) |

| Competitor Performance | Market Data | 0.1 | – |

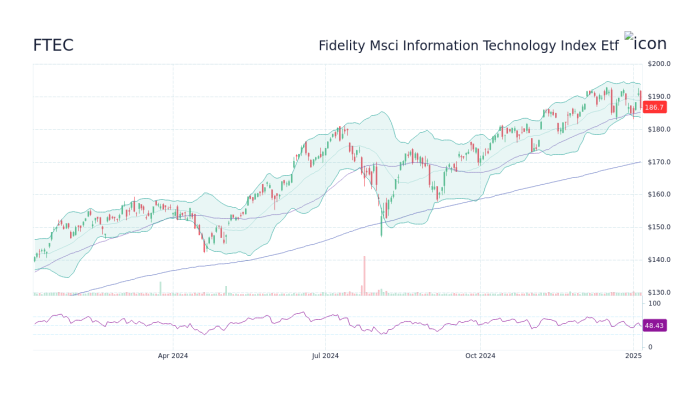

FTEC Stock Valuation and Investment Strategies, Ftec stock price

Source: googleapis.com

Valuing FTEC stock involves employing various methods, each with its own assumptions and limitations. Discounted cash flow (DCF) analysis projects future cash flows and discounts them back to their present value, while the price-to-earnings (P/E) ratio compares the stock’s price to its earnings per share.

Investment strategies range from long-term buy-and-hold, suitable for investors with a higher risk tolerance and a longer time horizon, to short-term trading, focusing on shorter-term price movements and requiring more active management. A long-term strategy might involve purchasing and holding the stock for several years, benefiting from potential long-term growth, while a short-term strategy could involve frequent buying and selling based on short-term price fluctuations.

Applying a simplified DCF analysis (using hypothetical data), we might assume a discount rate of 10% and project future cash flows for the next 5 years. By discounting these cash flows back to the present value and summing them, we arrive at an estimated intrinsic value. This value, compared to the current market price, indicates whether the stock is undervalued or overvalued.

The specific calculations are omitted here due to the hypothetical nature of the data.

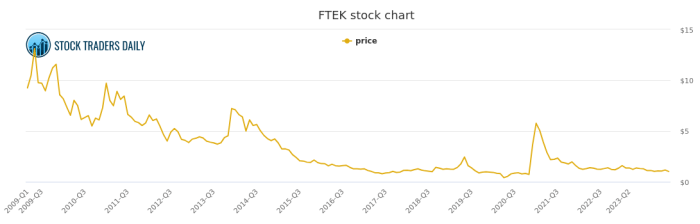

FTEC Stock Market Sentiment and News Analysis

Source: stocktradersdaily.com

Current market sentiment towards FTEC stock is generally cautiously optimistic, based on recent news and analyst reports. Recent positive news might include a successful product launch or strong earnings results, while negative news could involve regulatory challenges or supply chain disruptions. However, these are hypothetical examples and should not be taken as fact.

Investor opinions and expectations regarding FTEC’s future performance are diverse. Some analysts are bullish, predicting strong growth, while others are more cautious, citing potential risks and uncertainties. A consensus view is difficult to establish, given the varied perspectives and the inherent uncertainty of the market.

FAQ Overview: Ftec Stock Price

What are the major risks associated with investing in FTEC stock?

Investing in any stock carries inherent risk. For FTEC, risks could include market volatility, competition within its sector, and the company’s ability to meet its financial projections. Thorough due diligence is essential before making any investment decision.

Where can I find real-time FTEC stock price data?

Real-time FTEC stock price data is typically available through major financial websites and brokerage platforms. These platforms usually offer charts, historical data, and other relevant information.

How often does FTEC release earnings reports?

The frequency of FTEC’s earnings reports will depend on its reporting schedule, which is usually quarterly or annually. This information can be found on the company’s investor relations website.