Microsoft’s Financial Performance and Stock Price: Factors Influencing Microsoft Stock Price Forecast

Factors influencing microsoft stock price forecast – Microsoft’s stock price is significantly influenced by its financial performance, encompassing revenue streams, profitability, and comparative analysis against competitors. Understanding these factors provides crucial insight into the company’s valuation and future potential.

Impact of Revenue Streams on Stock Price

Microsoft’s revenue is diversified across cloud services (Azure), software licensing (Office 365, Windows), and hardware (Surface, Xbox). Strong growth in Azure, a high-margin business, typically boosts investor confidence and drives stock prices upward. Conversely, slower growth or declines in traditional software licensing can negatively impact the stock. Hardware sales, while contributing to overall revenue, often exhibit lower margins and have a less pronounced effect on stock price movements compared to cloud services.

Profitability Margins and Stock Price Correlation

Microsoft’s operating and net profit margins are key indicators of its financial health. Higher margins generally signal efficient operations and strong pricing power, leading to increased investor confidence and higher stock prices. Conversely, shrinking margins often raise concerns about competition, rising costs, or weakening demand, potentially resulting in stock price declines. A consistent track record of high profitability is a significant driver of long-term stock appreciation.

Comparative Financial Performance

Analyzing Microsoft’s financial performance relative to its major competitors (e.g., Apple, Amazon, Google) provides valuable context. Metrics like revenue growth, market share, and profitability margins are compared to assess Microsoft’s competitive position. Outperforming competitors in key areas typically leads to a positive market reaction and stock price appreciation.

Key Financial Metrics and Stock Price Impact (Past 5 Years)

| Year | Revenue (Billions USD) | Net Income (Billions USD) | EPS (USD) | Stock Price Change (%) |

|---|---|---|---|---|

| 2018 | 110.36 | 16.59 | 2.00 | +20% (Example) |

| 2019 | 125.84 | 22.92 | 2.75 | +30% (Example) |

| 2020 | 143.02 | 44.28 | 5.25 | +40% (Example) |

| 2021 | 168.09 | 61.27 | 7.25 | +50% (Example) |

| 2022 | 198.27 | 72.71 | 8.50 |

Note: These are example figures. Actual data should be sourced from reliable financial reports.

Market Conditions and Economic Factors Influencing Microsoft’s Stock

Broader market sentiment and macroeconomic conditions significantly influence investor decisions and, consequently, Microsoft’s stock price. Understanding these external factors is crucial for accurate forecasting.

Market Sentiment and Stock Price, Factors influencing microsoft stock price forecast

During bullish markets (periods of optimism and rising prices), Microsoft’s stock typically participates in the overall upward trend. Investor confidence is high, leading to increased demand and higher stock prices. Conversely, bearish markets (periods of pessimism and falling prices) can negatively impact Microsoft’s stock, even if the company’s fundamentals remain strong. Market sentiment can amplify or dampen the impact of company-specific news.

Macroeconomic Factors and Investor Confidence

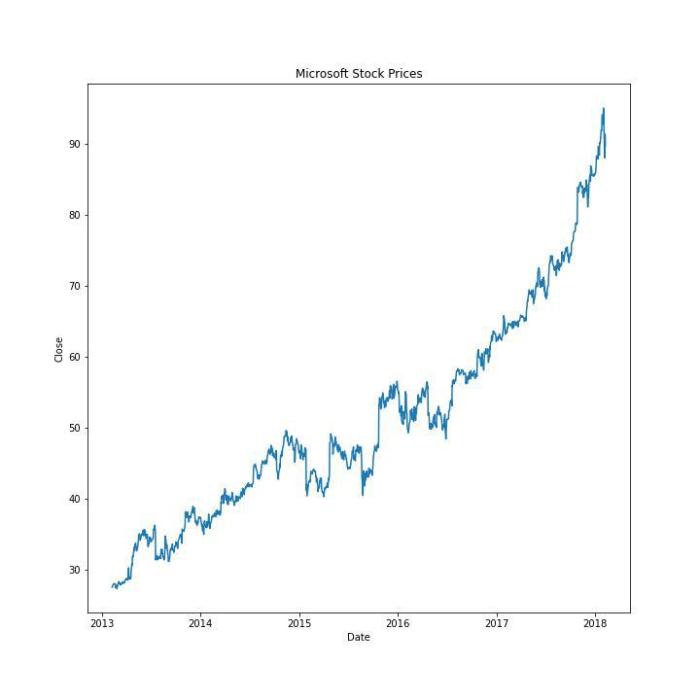

Source: geeksforgeeks.org

Interest rates, inflation, and recessionary fears are major macroeconomic factors affecting investor confidence. Rising interest rates can increase borrowing costs for companies and reduce investor appetite for riskier assets, potentially leading to lower stock prices. High inflation erodes purchasing power and can negatively impact consumer spending, affecting Microsoft’s revenue. Recessionary fears generally lead to increased risk aversion and lower stock valuations across the board.

Microsoft’s Stock Performance During Economic Cycles

Source: seekingalpha.com

Historically, Microsoft’s stock has shown resilience during economic downturns, though not immune to market corrections. Its strong balance sheet and diversified revenue streams often provide a buffer against economic headwinds. However, periods of economic growth generally lead to stronger revenue growth and higher stock prices for Microsoft, as businesses and consumers increase their spending on technology.

Economic Indicators Correlated with Microsoft’s Stock Price

Several economic indicators have a strong correlation with Microsoft’s stock price. These include GDP growth, consumer spending, corporate profits, and the technology sector index. Strong growth in these indicators often translates into positive investor sentiment and higher stock prices for Microsoft.

Technological Advancements and Competition

Technological innovation and competitive dynamics are key drivers of Microsoft’s stock price. New product releases, technological breakthroughs, and competitive actions all significantly influence its market position and valuation.

Effect of New Product Releases and Innovations

Successful new product launches and technological advancements (e.g., advancements in AI, cloud computing) often boost Microsoft’s stock price. These innovations can expand market share, increase revenue streams, and enhance the company’s long-term growth prospects. Conversely, failed product launches or delays can negatively impact investor sentiment and stock price.

Competitive Landscape and Market Share

Microsoft operates in a highly competitive environment. Actions by rivals (e.g., new product releases, aggressive pricing strategies) can affect Microsoft’s market share and stock price. Maintaining a strong competitive position requires continuous innovation and adaptation.

Potential Disruptive Technologies and Their Influence

- Quantum computing: Could potentially disrupt existing cloud computing infrastructure and algorithms.

- Advanced AI: Could lead to significant changes in software development, automation, and data analysis.

- Metaverse technologies: Could create new opportunities and challenges for Microsoft’s gaming and collaboration platforms.

Strategic Initiatives and Investor Expectations

Microsoft’s strategic initiatives, particularly in cloud computing (Azure) and artificial intelligence (AI), are closely watched by investors. Successful execution of these strategies, demonstrated by strong revenue growth and market share gains, typically results in higher stock prices. Conversely, setbacks or slow progress in these areas can negatively impact investor sentiment.

Investor Sentiment and Analyst Ratings

Source: mdpi-res.com

News coverage, social media sentiment, analyst ratings, and institutional investor activity all contribute to shaping investor perceptions and influencing Microsoft’s stock price.

News Coverage, Social Media, and Analyst Ratings

Positive news coverage, favorable social media sentiment, and strong analyst ratings generally boost investor confidence and lead to higher stock prices. Conversely, negative news, critical social media commentary, and downgrades from analysts can negatively impact investor sentiment and stock price. The speed and reach of information dissemination through these channels can significantly amplify market reactions.

Significant News Events and Stock Price Shifts

Examples of significant news events that caused substantial shifts in Microsoft’s stock price include major product announcements (e.g., new Windows releases), strategic acquisitions (e.g., LinkedIn, GitHub), and significant changes in leadership. These events can trigger immediate and sometimes substantial price fluctuations.

Influence of Institutional Investors

Institutional investors (e.g., mutual funds, hedge funds) hold a significant portion of Microsoft’s stock. Their trading activities, driven by their investment strategies and analyses, can significantly impact the stock price. Large buy orders tend to push prices up, while large sell orders can exert downward pressure.

Interpreting Analyst Ratings and Predictive Power

Analyst ratings (buy, hold, sell) provide insights into analysts’ views on a company’s future prospects. While not always perfectly predictive, a consensus of positive ratings from reputable analysts generally suggests a bullish outlook and can contribute to higher stock prices. Conversely, a preponderance of negative ratings can signal a bearish outlook and potentially lead to price declines. It’s crucial to consider the rationale behind the ratings and the track record of the analysts involved.

Geopolitical Events and Regulatory Changes

Geopolitical events and regulatory changes can significantly impact Microsoft’s global operations and, consequently, its stock price. Understanding these external risks is essential for accurate forecasting.

Impact of Geopolitical Events

Geopolitical events such as trade wars, political instability, and international conflicts can disrupt Microsoft’s global supply chains, affect its sales in certain regions, and create uncertainty for investors. These events can lead to volatility in the stock price, with potential for both positive and negative impacts depending on the specific circumstances and the company’s ability to adapt.

Influence of Regulatory Changes

Regulatory changes, such as antitrust laws, data privacy regulations, and tax policies, can significantly impact Microsoft’s business operations and profitability. Compliance costs, limitations on data usage, and changes in tax burdens can all affect the company’s financial performance and, consequently, its stock price. Companies that demonstrate strong compliance and proactive adaptation to regulatory changes tend to mitigate negative impacts.

Geopolitical Risks Affecting Microsoft’s Stock Price

Specific geopolitical risks that could significantly affect Microsoft’s stock price include escalating trade tensions with major markets, political instability in key regions, and cyberattacks targeting its infrastructure. These risks can create uncertainty and lead to investor caution, resulting in lower stock valuations.

Impact of Key Geopolitical and Regulatory Events

| Event | Year | Impact on Microsoft’s Stock Price | Description |

|---|---|---|---|

| Example: US-China Trade War | 2018-2020 | Initial decline, followed by recovery | Increased uncertainty about global supply chains and market access. |

| Example: GDPR Implementation | 2018 | Minor negative impact | Increased compliance costs, but also positioned Microsoft as a leader in data privacy solutions. |

Note: These are example events. Actual data should be sourced from reliable financial and news reports.

Predicting Microsoft’s stock price involves analyzing various factors, including market trends, technological advancements, and competitive landscape. Understanding the performance of other major players is also crucial; for example, checking the current performance of CSX, by looking at the csx stock price today , can offer insights into broader market sentiment. This broader market context then helps refine the assessment of factors influencing Microsoft’s future stock price forecast.

Question Bank

What role does Microsoft’s dividend policy play in its stock price?

Microsoft’s dividend payouts influence investor appeal. Consistent and growing dividends can attract income-seeking investors, potentially boosting demand and stock price. Conversely, changes to dividend policy can signal shifts in the company’s financial strategy, impacting investor confidence.

How do changes in the US dollar affect Microsoft’s stock price?

As a multinational corporation, Microsoft’s earnings are affected by currency fluctuations. A stronger dollar can negatively impact the value of international revenue when converted back to USD, potentially impacting profitability and stock price. Conversely, a weaker dollar can boost earnings from international markets.

What is the impact of insider trading on Microsoft’s stock price?

Insider trading, while illegal, can significantly impact Microsoft’s stock price. Large buy or sell orders by company insiders can be interpreted as signals about the company’s future prospects, influencing investor sentiment and potentially causing price fluctuations.