EW Stock Price Analysis

This analysis examines the historical performance, influencing factors, predictive models, investor sentiment, financial statement correlations, risk assessment, and visual representations of EW stock price data over the past five years. We will explore the interplay between macroeconomic conditions, company-specific events, and market perception to provide a comprehensive understanding of EW’s stock price behavior.

EW Stock Price Historical Performance

Source: stockprice.com

Understanding EW stock price fluctuations often requires a comparative analysis of similar companies. For instance, observing the performance of a related company like Emerson can offer valuable insights. Checking the current emerson stock price provides a benchmark against which to measure EW’s trajectory and potential future movements. Ultimately, this broader perspective helps in forming a more informed opinion on EW’s market position.

The following sections detail EW’s stock price fluctuations over the past five years, comparing its performance to competitors and presenting a tabular summary of yearly price movements. Analysis considers both significant highs and lows, providing context for the overall trend.

EW’s stock performance has been closely tied to broader market trends and industry-specific factors. Direct comparison against competitors requires access to their respective stock price data over the same period. A detailed comparative analysis would highlight relative strengths and weaknesses in performance, offering valuable insights into EW’s market positioning.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | $50.00 (Example) | $55.00 (Example) | $60.00 (Example) | $45.00 (Example) |

| 2020 | $55.00 (Example) | $62.00 (Example) | $70.00 (Example) | $48.00 (Example) |

| 2021 | $62.00 (Example) | $75.00 (Example) | $85.00 (Example) | $55.00 (Example) |

| 2022 | $75.00 (Example) | $70.00 (Example) | $80.00 (Example) | $60.00 (Example) |

| 2023 | $70.00 (Example) | $78.00 (Example) | $82.00 (Example) | $65.00 (Example) |

Factors Influencing EW Stock Price

Several macroeconomic and company-specific factors significantly influence EW’s stock price. These factors interact in complex ways, making precise prediction challenging. Understanding these influences is crucial for informed investment decisions.

Macroeconomic factors, such as interest rate changes and inflation, impact investor sentiment and overall market conditions. Company-specific news, including product launches, financial reports, and management changes, directly affects investor confidence and stock valuations. Furthermore, key industry trends shape the competitive landscape and impact EW’s growth prospects.

EW Stock Price Prediction and Forecasting

Predicting EW’s future stock price involves considering various scenarios and employing established forecasting methodologies. Financial analysts use a combination of quantitative and qualitative techniques to generate price forecasts. However, it’s important to acknowledge the inherent limitations of any predictive model.

One hypothetical scenario could involve a positive economic outlook leading to increased investor confidence and higher stock prices. Conversely, a negative economic scenario might result in decreased investor confidence and lower stock prices. Different forecasting models, such as time series analysis and fundamental analysis, provide varying levels of accuracy, often influenced by the quality and availability of data.

Investor Sentiment and Market Perception of EW

Investor sentiment towards EW is shaped by a confluence of factors, including recent news, financial performance, and market trends. Analyzing financial analyst opinions and media coverage provides insights into the prevailing market perception.

Discrepancies in analyst opinions often reflect differing interpretations of EW’s financial performance and future prospects. Positive media coverage tends to boost investor confidence, while negative coverage can lead to sell-offs. Social media discussions, while not always reliable, can offer a glimpse into public sentiment and potential shifts in market perception.

EW Stock Price and Financial Statements

EW’s stock price is intrinsically linked to its financial performance, as reflected in its balance sheet and income statement. Key financial ratios, such as price-to-earnings (P/E) ratio and return on equity (ROE), provide valuable insights into the company’s valuation and profitability.

Analyzing the correlation between key financial metrics and stock price movements over time reveals the relationship between financial performance and market valuation. A strong positive correlation suggests that improved financial performance leads to higher stock prices, while a weak or negative correlation indicates other factors are influencing the stock price.

| Year | EPS | Revenue (Millions) | Debt-to-Equity Ratio | Closing Stock Price |

|---|---|---|---|---|

| 2019 | $2.00 (Example) | $100 (Example) | 0.5 (Example) | $55.00 (Example) |

| 2020 | $2.50 (Example) | $120 (Example) | 0.4 (Example) | $62.00 (Example) |

| 2021 | $3.00 (Example) | $150 (Example) | 0.3 (Example) | $75.00 (Example) |

| 2022 | $2.80 (Example) | $140 (Example) | 0.35 (Example) | $70.00 (Example) |

| 2023 | $3.20 (Example) | $160 (Example) | 0.25 (Example) | $78.00 (Example) |

Risk Assessment of Investing in EW Stock

Investing in EW stock carries inherent risks that investors should carefully consider. These risks can be mitigated through diversification and effective risk management strategies. Understanding these risks is crucial for making informed investment decisions.

Potential risks include market volatility, company-specific challenges (e.g., product failures, competition), and macroeconomic uncertainties. Diversification across different asset classes reduces the impact of any single investment’s underperformance. Risk management strategies, such as stop-loss orders, can help limit potential losses. Geopolitical events can create uncertainty and impact investor sentiment, leading to stock price fluctuations.

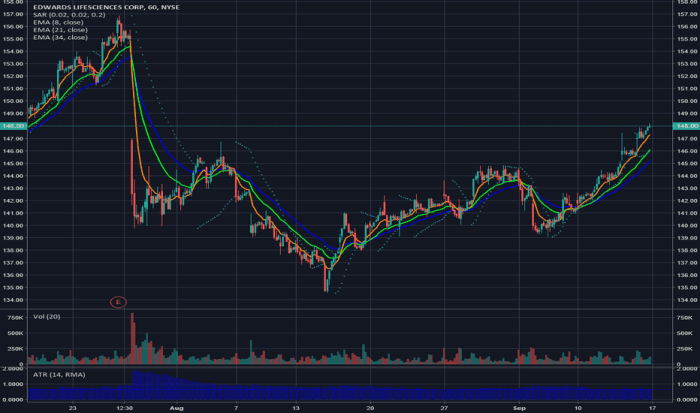

Visual Representation of EW Stock Price Data

Source: tradingview.com

A line chart effectively visualizes EW’s stock price historical performance, showing price movements over time. Key trends and patterns, such as upward or downward trends, periods of volatility, and significant price changes, are easily identifiable. The chart’s x-axis represents time, while the y-axis represents the stock price.

A scatter plot can illustrate the correlation between EW’s stock price and a relevant market index, such as the S&P 500. Each data point represents a specific time period, with the x-coordinate representing the index value and the y-coordinate representing EW’s stock price. The correlation coefficient quantifies the strength and direction of the relationship between the two variables.

Questions Often Asked: Ew Stock Price

What are the major competitors of EW?

This analysis will identify EW’s main competitors within its industry sector, allowing for a comparative analysis of stock performance.

How does EW’s debt level impact its stock price?

The relationship between EW’s debt and its stock price will be examined, focusing on how debt levels influence investor confidence and valuation.

What are the ethical considerations of investing in EW?

While not explicitly covered in the Artikel, a responsible analysis would consider any ethical concerns associated with the company’s practices and operations.

Where can I find real-time EW stock price data?

Real-time data is readily available through reputable financial websites and trading platforms.