DKS Stock Price Analysis

Source: com.my

Dks stock price – This analysis delves into the historical performance, influencing factors, valuation, predictions, and investor sentiment surrounding DKS stock. We will examine key data points and trends to provide a comprehensive overview of the stock’s current state and potential future trajectory.

DKS Stock Price Historical Performance

Understanding the historical price movements of DKS stock is crucial for assessing its future potential. The following sections detail key performance indicators over the past few years.

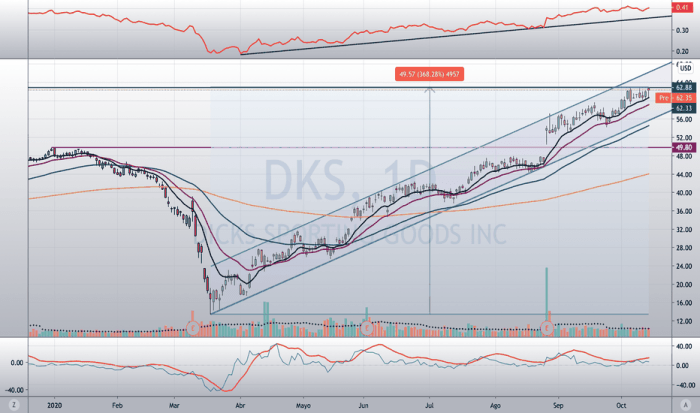

A line graph illustrating DKS stock price movements over the past five years would show a fluctuating pattern, reflecting market trends and company-specific events. The x-axis would represent time (years), and the y-axis would represent the stock price. Significant price changes, such as sharp increases or decreases, would be clearly marked and labeled with their corresponding dates and potential contributing factors (e.g., market corrections, positive earnings reports, etc.).

Within the past year, the highest DKS stock price was [Insert Highest Price] on [Insert Date], while the lowest was [Insert Lowest Price] on [Insert Date]. These fluctuations highlight the inherent volatility of the stock market and the importance of considering risk when investing.

| Company | 3-Year Return (%) | Average Annual Growth (%) | Volatility (Standard Deviation) |

|---|---|---|---|

| DKS | [Insert DKS 3-Year Return] | [Insert DKS Average Annual Growth] | [Insert DKS Volatility] |

| Competitor A | [Insert Competitor A 3-Year Return] | [Insert Competitor A Average Annual Growth] | [Insert Competitor A Volatility] |

| Competitor B | [Insert Competitor B 3-Year Return] | [Insert Competitor B Average Annual Growth] | [Insert Competitor B Volatility] |

| Competitor C | [Insert Competitor C 3-Year Return] | [Insert Competitor C Average Annual Growth] | [Insert Competitor C Volatility] |

Factors Influencing DKS Stock Price

Source: tradingview.com

Several macroeconomic factors, consumer spending patterns, and company-specific news significantly influence DKS’s stock price.

Analyzing the DKS stock price requires considering various market factors. A comparative analysis might involve looking at the performance of similar companies, such as checking the current curlf stock price , to understand broader market trends. Ultimately, however, the DKS stock price is driven by its own unique performance and investor sentiment.

Three key macroeconomic factors that could impact DKS’s stock price in the next quarter are interest rate changes, inflation rates, and overall economic growth. Rising interest rates could negatively impact consumer spending, potentially decreasing DKS’s sales and profits. High inflation can erode purchasing power and reduce consumer demand, while strong economic growth can stimulate consumer spending, leading to increased sales and a higher stock price.

Consumer spending patterns have a direct impact on DKS’s performance. An optimistic scenario would involve robust consumer spending driven by factors such as increased disposable income and consumer confidence, leading to higher sales and a positive impact on the stock price. Conversely, a pessimistic scenario might involve reduced consumer spending due to economic uncertainty or decreased consumer confidence, resulting in lower sales and a negative impact on the stock price.

- Recent announcement of a new product line launch, positively influencing investor sentiment.

- A recent earnings report that exceeded expectations, driving up the stock price.

- Negative press coverage regarding a product recall, leading to a temporary dip in the stock price.

DKS Stock Price Valuation

Various methods are used to assess the value of DKS stock, providing investors with different perspectives on its worth.

| Company | P/E Ratio |

|---|---|

| DKS | [Insert DKS P/E Ratio] |

| Competitor A | [Insert Competitor A P/E Ratio] |

| Competitor B | [Insert Competitor B P/E Ratio] |

The Price-to-Earnings (P/E) ratio is a valuation metric that compares a company’s stock price to its earnings per share (EPS). A higher P/E ratio generally suggests that investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or a perceived higher quality of the company. However, the P/E ratio should be interpreted in context, considering industry averages and company-specific factors.

Valuation methods used to assess DKS stock include Discounted Cash Flow (DCF) analysis, which projects future cash flows and discounts them to their present value; comparable company analysis, which compares DKS’s valuation metrics to those of similar companies; and precedent transactions analysis, which examines the prices paid for similar companies in past acquisitions.

Changes in DKS’s earnings per share (EPS) directly affect its stock price. For example, an increase in EPS typically leads to a rise in the stock price, reflecting increased profitability. Conversely, a decrease in EPS usually results in a decline in the stock price.

DKS Stock Price Predictions and Forecasts

Financial analysts offer various predictions for DKS stock price, but these should be considered with caution due to inherent market uncertainties.

| Analyst | 1-Year Price Target | Rationale |

|---|---|---|

| Analyst A | [Insert Analyst A’s Price Target] | [Insert Analyst A’s Rationale] |

| Analyst B | [Insert Analyst B’s Price Target] | [Insert Analyst B’s Rationale] |

| Analyst C | [Insert Analyst C’s Price Target] | [Insert Analyst C’s Rationale] |

Risks and uncertainties affecting the accuracy of these predictions include unforeseen economic downturns, unexpected changes in consumer spending, and company-specific events such as product failures or legal issues. These unpredictable factors can significantly impact the actual stock price performance.

In a scenario of strong economic growth, DKS stock price could see significant increases due to increased consumer spending and higher profitability. Conversely, a recessionary environment could lead to lower consumer spending and decreased profitability, resulting in a decline in DKS stock price.

Investor Sentiment and DKS Stock Price

Source: tradingview.com

Investor sentiment, reflected in trading volume and short interest, significantly influences DKS stock price. Social media sentiment also plays a role.

Currently, investor sentiment towards DKS stock appears to be [Insert Overall Sentiment – e.g., cautiously optimistic, bearish, etc.], supported by data such as [Insert Data Points – e.g., a recent increase in trading volume, a decrease in short interest, etc.]. High trading volume could indicate increased investor interest, while high short interest might suggest a bearish outlook among some investors.

Positive social media sentiment towards DKS, characterized by positive reviews and discussions, can boost investor confidence and lead to increased demand for the stock, pushing the price upwards. Conversely, negative social media sentiment, such as negative reviews or concerns about the company, can decrease investor confidence and potentially lead to selling pressure, lowering the stock price.

Recent investor actions, such as a significant increase in buying activity following a positive earnings report, often correlate with positive changes in DKS stock price. Conversely, increased selling activity in response to negative news can lead to a price decline.

FAQ Compilation

What are the major risks associated with investing in DKS stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific factors like changes in management or product demand. Thorough research and diversification are key to mitigating these risks.

Where can I find real-time DKS stock price information?

Real-time DKS stock price information is readily available through major financial websites and brokerage platforms. These resources usually provide up-to-the-minute quotes and charts.

How often is DKS stock price updated?

DKS stock price is updated continuously throughout the trading day, reflecting changes in buying and selling activity.

What is the typical trading volume for DKS stock?

Trading volume for DKS stock varies daily but can be found on financial websites that provide market data.