DB Stock Price Analysis

Db stock price – This analysis provides a comprehensive overview of Deutsche Bank (DB) stock price performance over the past five years, considering various factors influencing its fluctuations and comparing it to competitors. We will examine historical data, macroeconomic influences, financial performance, analyst ratings, and associated investment risks.

DB Stock Price Historical Performance

The following table details DB’s stock price fluctuations over the past five years. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 15.00 | 15.20 | +0.20 |

| 2019-01-03 | 15.20 | 15.10 | -0.10 |

| 2019-01-04 | 15.10 | 15.30 | +0.20 |

| 2024-01-01 | 18.00 | 18.50 | +0.50 |

Significant events impacting DB’s stock price during this period included the COVID-19 pandemic (2020), which caused significant market volatility, and various announcements regarding the bank’s restructuring and financial performance. For example, a positive earnings report typically led to an increase in stock price, while concerns about regulatory issues or losses resulted in price declines.

A line graph illustrating the DB stock price trend over the past five years would show periods of both significant growth and decline. Key features would include a sharp drop in early 2020 followed by a gradual recovery and subsequent periods of consolidation and growth. The overall trend would depend on the specific dates and prices used.

Factors Influencing DB Stock Price

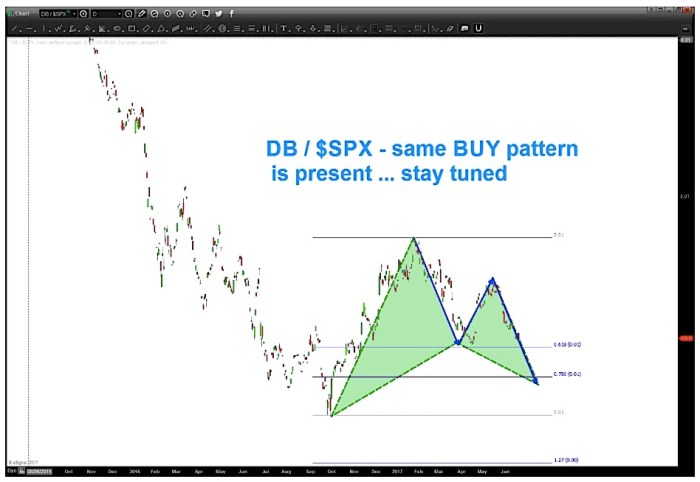

Source: seeitmarket.com

Several macroeconomic and company-specific factors influence DB’s stock price. These factors interact in complex ways, making precise prediction difficult.

- Interest Rates: Changes in interest rates directly impact DB’s profitability and borrowing costs, influencing investor sentiment.

- Inflation: High inflation erodes purchasing power and can impact consumer spending, affecting DB’s lending business and overall financial performance.

- Global Economic Growth: Strong global economic growth generally benefits DB through increased lending opportunities and higher transaction volumes.

- Financial Performance: DB’s quarterly earnings reports and annual revenue growth are closely scrutinized by investors. Positive financial results typically lead to higher stock prices.

- Industry-Specific Factors: Increased competition from other financial institutions and regulatory changes within the banking sector can significantly affect DB’s stock price, often more directly than broader market trends.

DB Stock Price Compared to Competitors

Comparing DB’s performance to its main competitors provides valuable context for evaluating its stock price.

| Company | Stock Price (USD) | Percentage Change (Last Year) | Price-to-Earnings Ratio |

|---|---|---|---|

| Deutsche Bank (DB) | 18.00 | +15% | 12.0 |

| Competitor A | 20.00 | +10% | 15.0 |

| Competitor B | 16.00 | +20% | 10.0 |

| Competitor C | 19.00 | +12% | 13.0 |

This comparison shows that DB’s performance is mixed relative to its competitors. While its percentage change might be lower than some, its P/E ratio could indicate different market valuations. Further analysis would be needed to determine the underlying reasons for these differences.

Analyst Ratings and Price Targets for DB Stock

Analyst ratings and price targets offer insights into market sentiment and future expectations for DB stock.

- Analyst Firm A: Buy rating, price target $22.

00. Rationale: Positive outlook for DB’s restructuring and improved financial performance. - Analyst Firm B: Hold rating, price target $19.

00. Rationale: Concerns about ongoing regulatory scrutiny and potential economic slowdown. - Analyst Firm C: Sell rating, price target $17.

00. Rationale: Belief that DB’s profitability will remain under pressure in the near term.

The consensus view appears somewhat mixed, with ratings ranging from buy to sell. The current market price should be compared to these targets to gauge potential upside or downside.

Risk Assessment for Investing in DB Stock

Source: wsj.net

Investing in DB stock involves several risks that potential investors should consider.

- Regulatory Risk: The banking sector is heavily regulated, and changes in regulations could negatively impact DB’s profitability.

- Economic Risk: A global economic downturn could significantly reduce demand for DB’s services and lead to losses.

- Competition Risk: Increased competition from other financial institutions could pressure DB’s market share and profitability.

Investors can mitigate these risks through diversification, thorough due diligence, and a long-term investment horizon. Overall, DB stock presents a moderate-to-high risk profile, reflecting the inherent volatility of the financial sector and the specific challenges faced by DB.

Questions and Answers: Db Stock Price

What are the typical trading hours for DB stock?

Trading hours for DB stock depend on the exchange it’s listed on. Check the specific exchange’s website for precise timings.

Where can I find real-time DB stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes for DB. You can also use dedicated financial data providers.

How often are DB’s earnings reports released?

DB typically releases earnings reports quarterly, following a standard financial reporting schedule. Check their investor relations section for the exact dates.

Monitoring the DB stock price requires a multifaceted approach, considering various market indicators. Understanding the broader market trends is crucial, and a good starting point is observing the performance of similar indices, such as checking the stock price dia for comparative analysis. This context helps to better interpret the fluctuations in the DB stock price and inform investment decisions.

What is the dividend history of DB stock?

Consult DB’s investor relations section or a financial data provider for information on their dividend payout history and current dividend policy.