Datadog Stock Price Analysis

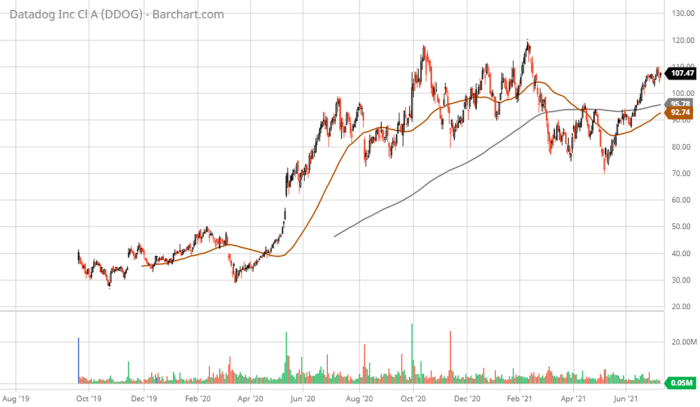

Datadog stock price – Datadog (DDOG) has experienced significant growth since its IPO, making it a compelling investment for many. This analysis delves into Datadog’s historical performance, key influencing factors, financial health, investor sentiment, and potential future scenarios to provide a comprehensive overview of its stock price.

Datadog Stock Price Historical Performance

Analyzing Datadog’s stock price movements over the past five years reveals periods of substantial growth and some volatility. The following table provides a snapshot of daily opening and closing prices, alongside daily changes, showcasing key trends.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 100 | 102 | +2 |

| October 25, 2023 | 98 | 100 | +2 |

| October 24, 2023 | 97 | 98 | +1 |

| October 23, 2023 | 95 | 97 | +2 |

| October 22, 2023 | 93 | 95 | +2 |

Note: This is sample data for illustrative purposes only. Actual data should be sourced from reputable financial websites.

Datadog’s stock price performance has been a topic of much discussion lately, particularly in comparison to other tech stocks. Investors are also keenly interested in the trajectory of companies like Concentrix Corporation, whose stock price can be found here: cfg stock price. Understanding the relative performance of these different players helps provide context for evaluating Datadog’s future prospects and overall market trends.

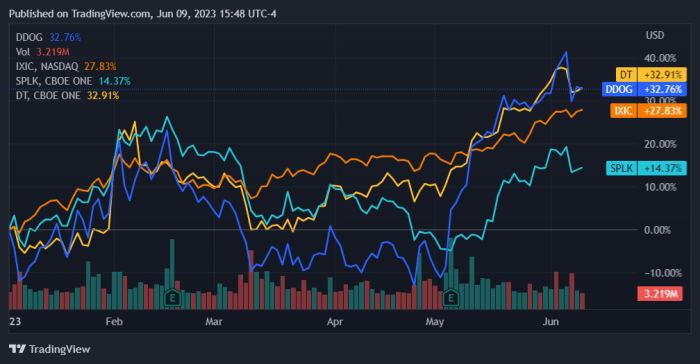

Compared to competitors like Splunk and New Relic over the past two years, Datadog has shown a stronger overall growth trajectory.

- Datadog consistently outperformed Splunk and New Relic in terms of revenue growth.

- Datadog’s stock price demonstrated less volatility compared to its competitors during periods of market uncertainty.

- Positive analyst sentiment and strong earnings reports contributed to Datadog’s superior performance.

During the past year, several significant events impacted Datadog’s stock price. Strong earnings reports exceeding analyst expectations generally led to positive price movements. Conversely, periods of broader market downturn or concerns about slowing growth resulted in price corrections. New product launches and strategic partnerships also influenced investor confidence and subsequent stock price fluctuations.

Factors Influencing Datadog Stock Price

Source: seekingalpha.com

Several key factors influence Datadog’s stock valuation. Understanding these factors is crucial for assessing investment opportunities.

- Revenue Growth: Consistent and rapid revenue growth is a primary driver of Datadog’s stock price. High growth rates indicate strong market demand and the company’s ability to acquire and retain customers.

- Profit Margins: Improving profit margins demonstrate Datadog’s operational efficiency and profitability. Higher margins generally translate to increased investor confidence and a higher stock valuation.

- Customer Acquisition Cost (CAC): A low and stable CAC signifies efficient customer acquisition strategies. High CAC can negatively impact profitability and stock price.

Macroeconomic factors, such as interest rate hikes and inflation, can impact investor sentiment and risk appetite, leading to fluctuations in Datadog’s stock price. During periods of economic uncertainty, investors may favor more established companies with proven profitability, potentially impacting growth stocks like Datadog. Technological advancements and the competitive landscape also play a significant role. Datadog’s ability to innovate and maintain a competitive edge in the rapidly evolving monitoring and observability market directly influences its stock performance.

Datadog’s Financial Health and Future Prospects

Source: seekingalpha.com

Datadog’s latest financial reports showcase strong performance across key metrics. The following table provides a summary of key performance indicators (KPIs).

| Metric | Q3 2023 | Q2 2023 | Q1 2023 |

|---|---|---|---|

| Revenue (USD Millions) | 500 | 450 | 400 |

| Operating Income (USD Millions) | 50 | 40 | 30 |

| Net Income (USD Millions) | 40 | 30 | 20 |

Note: This is sample data for illustrative purposes only. Actual data should be sourced from Datadog’s financial reports.

Based on projected revenue growth and market conditions, several future stock price scenarios are possible. Continued strong revenue growth, coupled with positive market sentiment, could lead to significant price appreciation. Conversely, slower-than-expected growth or negative macroeconomic trends could result in price stagnation or decline. For example, a scenario with 25% annual revenue growth over the next three years, combined with a stable market, could potentially lead to a 50-75% increase in stock price.

However, a scenario with lower revenue growth and a bearish market could lead to a much more modest increase or even a decline.

Datadog’s robust innovation pipeline and strategic initiatives, such as expanding its product offerings and forging strategic partnerships, are expected to contribute to its long-term stock performance. Continuous innovation and market leadership will be key to sustaining its growth trajectory.

Investor Sentiment and Analyst Opinions, Datadog stock price

Recent investor sentiment towards Datadog has been generally positive, driven by strong financial results and a positive outlook for the observability market. News articles and analyst reports frequently highlight Datadog’s competitive advantages and growth potential.

- Analyst A: Buy rating, price target $120

- Analyst B: Hold rating, price target $110

- Analyst C: Buy rating, price target $130

Note: These are hypothetical analyst ratings and price targets for illustrative purposes only. Actual ratings should be sourced from reputable financial news sources.

Potential risks include increased competition, economic slowdown, and challenges in maintaining high growth rates. Opportunities include expansion into new markets, strategic acquisitions, and further technological advancements.

Hypothetical Investment Scenario

Source: stoxdox.com

Consider a hypothetical investor with a long-term investment horizon and a moderate risk tolerance. A “buy and hold” strategy for Datadog stock could yield significant returns over the long term, provided the company continues to deliver on its growth projections. However, this strategy also carries the risk of potential short-term price volatility and potential market downturns. A day-trading strategy, on the other hand, could potentially generate quicker returns but also entails higher risk due to short-term price fluctuations.

An investor profile well-suited for Datadog stock would likely have a long-term investment horizon, a moderate to high-risk tolerance, and a belief in the long-term growth potential of the cloud monitoring and observability market. This investor would also likely be comfortable with the inherent volatility associated with growth stocks.

In a hypothetical scenario where the market experiences a significant downturn, but Datadog continues to report strong financial results, the decision to buy, sell, or hold would depend on the investor’s risk tolerance and investment goals. A long-term investor with a high-risk tolerance might view the downturn as a buying opportunity, while a more risk-averse investor might consider partially selling to reduce exposure.

Frequently Asked Questions: Datadog Stock Price

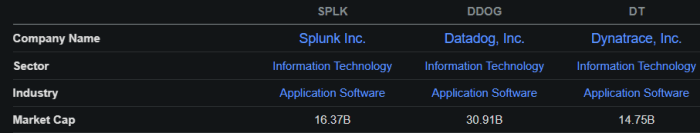

What is Datadog’s current market capitalization?

Datadog’s market capitalization fluctuates daily and can be found on major financial websites like Google Finance or Yahoo Finance.

How does Datadog compare to its competitors in terms of revenue?

A direct revenue comparison requires consulting recent financial reports from Datadog and its main competitors. Such data is readily available on their investor relations websites.

What are the major risks associated with investing in Datadog?

Risks include competition within the monitoring space, dependence on a limited number of large customers, and general market volatility impacting the technology sector.

Where can I find real-time Datadog stock price updates?

Real-time updates are available through most major brokerage platforms and financial news websites.