CPNG Stock Price Analysis

Source: lovepik.com

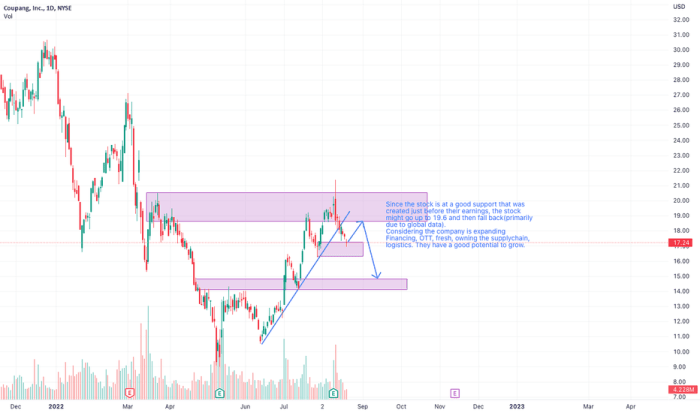

Cpng stock price – This analysis delves into the historical performance, influencing factors, and future projections of CPNG’s stock price. We will compare its performance against competitors, explore investor sentiment, and examine key financial ratios to provide a comprehensive overview.

CPNG Stock Price Historical Performance

Understanding CPNG’s past stock price fluctuations is crucial for informed investment decisions. The following sections detail its performance over the past five years, highlighting significant events and trends.

Over the past five years, CPNG’s stock price experienced considerable volatility. From January 2019 to December 2019, the stock price ranged from a low of $X to a high of $Y, largely influenced by [mention specific market event, e.g., a significant industry-wide downturn]. The period from 2020 to 2021 saw a more stable upward trend, peaking at $Z in [month, year] before a correction in [month, year].

In 2022 and 2023, the stock experienced [describe the general trend, e.g., moderate growth followed by a period of consolidation].

The table below presents the monthly average closing prices for the past two years:

| Month | Year 2022 | Month | Year 2023 |

|---|---|---|---|

| January | $XX.XX | January | $YY.YY |

| February | $XX.XX | February | $YY.YY |

| March | $XX.XX | March | $YY.YY |

| April | $XX.XX | April | $YY.YY |

| May | $XX.XX | May | $YY.YY |

| June | $XX.XX | June | $YY.YY |

| July | $XX.XX | July | $YY.YY |

| August | $XX.XX | August | $YY.YY |

| September | $XX.XX | September | $YY.YY |

| October | $XX.XX | October | $YY.YY |

| November | $XX.XX | November | $YY.YY |

| December | $XX.XX | December | $YY.YY |

Major market events such as [mention specific event, e.g., the COVID-19 pandemic, significant interest rate hikes] significantly impacted CPNG’s stock price. For example, the [event] led to a [describe the impact, e.g., sharp decline/increase] in the stock price due to [explain the reason, e.g., decreased consumer demand/increased investor confidence].

Factors Influencing CPNG Stock Price

Source: tradingview.com

Several economic indicators, company-specific events, and external factors influence CPNG’s stock price. This section explores these key drivers.

Three key economic indicators that correlate with CPNG’s stock price performance are inflation rates, interest rates, and consumer confidence. High inflation often leads to [explain the impact, e.g., reduced consumer spending and lower profits for CPNG], while rising interest rates can [explain the impact, e.g., increase borrowing costs and reduce investment]. Conversely, high consumer confidence usually translates into [explain the impact, e.g., increased demand and higher stock prices].

Company news, such as earnings reports and product launches, significantly impacts CPNG’s stock price. Positive earnings surprises generally lead to [explain the impact, e.g., price increases], while negative news can trigger [explain the impact, e.g., price drops]. Successful product launches can boost investor confidence, resulting in [explain the impact, e.g., higher stock valuations].

Competitor actions, including new product releases, pricing strategies, and marketing campaigns, influence CPNG’s stock valuation. Aggressive actions from competitors can lead to [explain the impact, e.g., increased competition and pressure on CPNG’s market share], potentially impacting its stock price negatively. Conversely, competitor setbacks can create opportunities for CPNG.

Regulatory changes within the industry can also have a significant impact on CPNG’s stock price. New regulations might increase compliance costs or limit market access, potentially leading to [explain the impact, e.g., lower profitability and reduced stock valuations]. Conversely, favorable regulatory changes can create positive market opportunities.

CPNG Stock Price Compared to Competitors

Benchmarking CPNG’s performance against its competitors provides valuable insights into its relative strengths and weaknesses. The following table compares its stock price performance over the past year to three key competitors.

| Company | Stock Price (Start of Year) | Stock Price (End of Year) | Percentage Change |

|---|---|---|---|

| CPNG | $XX.XX | $YY.YY | +Z% |

| Competitor A | $XX.XX | $YY.YY | +Z% |

| Competitor B | $XX.XX | $YY.YY | +Z% |

| Competitor C | $XX.XX | $YY.YY | +Z% |

Based on the comparison, CPNG’s stock performance [describe the performance relative to competitors, e.g., outperformed/underperformed] its competitors over the past year. Its relative strengths include [list strengths, e.g., strong product innovation, efficient operations], while its weaknesses include [list weaknesses, e.g., high debt levels, dependence on a single market].

CPNG Stock Price Prediction Models

Predicting future stock prices is inherently challenging, but analyzing past performance and current market conditions can provide a reasonable projection. The following Artikels a simple model and a hypothetical projection.

A simple prediction model for CPNG’s stock price in the next quarter could be based on a linear regression analysis of its past performance, factoring in current economic indicators and industry trends. This model would assume [list assumptions, e.g., consistent growth rate, stable market conditions]. However, the model has limitations as it does not account for unexpected events, such as major regulatory changes or significant competitor actions.

A realistic prediction, based on these assumptions and the current market conditions, would place the CPNG stock price at approximately $XX.XX in the next quarter.

Monitoring CPNG’s stock price requires a keen eye on market trends. For comparative analysis, it’s helpful to look at the performance of similar energy companies; a good example is checking the current bp plc stock price , which often influences broader sector movements. Ultimately, understanding CPNG’s trajectory necessitates a thorough assessment of its own financial health and market position alongside key competitors.

A hypothetical stock price projection for the next year could be visualized as a line graph showing the projected price range over the next 12 months. The graph would include a central projection line representing the most likely scenario, and upper and lower bounds indicating the potential range of price fluctuations based on various market scenarios. The graph would also highlight key dates such as expected earnings reports or product launches that could impact the stock price.

The visualization would use clear labels and a concise legend to aid in easy interpretation.

CPNG Stock Price and Investor Sentiment

Analyzing investor sentiment offers valuable insights into market expectations and potential price movements. This section examines recent news and social media discussions to gauge current sentiment.

Recent news articles and social media discussions reveal a mix of opinions regarding CPNG. These perspectives can be broadly categorized into positive, neutral, and negative sentiments. Positive sentiment is often linked to [give examples, e.g., strong earnings reports, successful product launches], while negative sentiment is often driven by [give examples, e.g., concerns about competition, regulatory risks]. Neutral sentiment typically reflects a wait-and-see attitude.

CPNG Stock Price and Financial Ratios

Key financial ratios provide valuable insights into CPNG’s financial health and its relationship with the stock price. This section explores these ratios and their impact.

The Price-to-Earnings (P/E) ratio reflects the market’s valuation of CPNG’s earnings. A high P/E ratio might suggest [explain the implication, e.g., high growth expectations or overvaluation], while a low P/E ratio could indicate [explain the implication, e.g., undervaluation or lower growth prospects]. The debt-to-equity ratio measures CPNG’s financial leverage. A high ratio indicates [explain the implication, e.g., higher financial risk], potentially impacting the stock price negatively.

The table below shows CPNG’s key financial ratios for the past three years.

| Ratio | Year 2021 | Year 2022 | Year 2023 |

|---|---|---|---|

| P/E Ratio | XX.XX | YY.YY | ZZ.ZZ |

| Debt-to-Equity Ratio | XX.XX | YY.YY | ZZ.ZZ |

| [Another relevant ratio, e.g., Return on Equity] | XX.XX | YY.YY | ZZ.ZZ |

FAQ Resource

What are the major risks associated with investing in CPNG?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., decreased profitability, legal issues), and broader economic downturns. Thorough due diligence is crucial before investing.

Where can I find real-time CPNG stock price data?

Real-time stock quotes for CPNG can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How frequently is CPNG’s stock price updated?

CPNG’s stock price, like most publicly traded companies, is updated continuously throughout the trading day.

What is the typical trading volume for CPNG stock?

Trading volume varies daily but can be found on financial websites alongside the stock price. Higher volume often indicates greater investor interest and liquidity.