Carnival Corp Stock Price Analysis

Source: vstarstatic.com

Carnival corp stock price – Carnival Corporation, a leading player in the global cruise industry, has experienced significant stock price fluctuations over the years. Understanding these fluctuations requires examining historical performance, influencing factors, financial health, and future prospects. This analysis delves into these aspects to provide a comprehensive overview of Carnival Corp’s stock price.

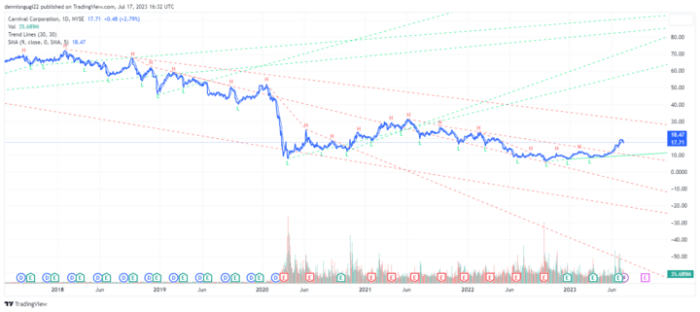

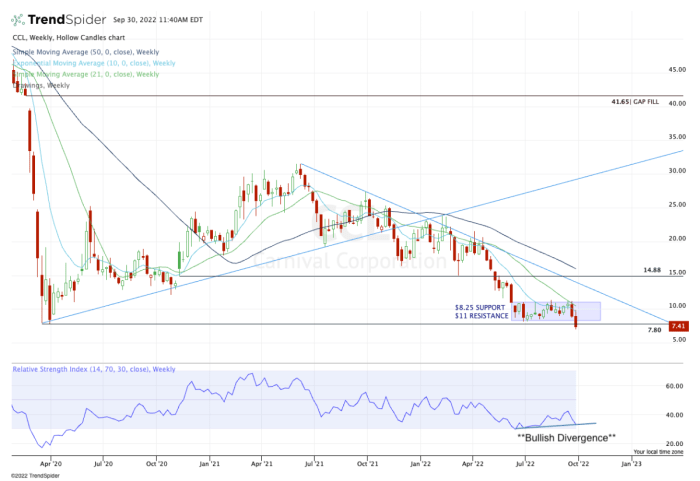

Historical Stock Price Performance

Carnival Corp’s stock price has exhibited considerable volatility over the past 5, 10, and 20 years. The period from 2000 to 2008 saw steady growth, peaking before the 2008 financial crisis significantly impacted the company’s stock price. The subsequent years involved a slow recovery, followed by another period of growth until the onset of the COVID-19 pandemic in 2020.

This pandemic caused an unprecedented drop in the stock price, as travel restrictions and widespread fear led to a near-total cessation of cruise operations. The recovery since then has been gradual, with the stock price influenced by various factors, including fuel prices, consumer sentiment, and regulatory changes.

Significant Events Impacting Stock Price

Source: thestreet.com

Carnival Corp’s stock price has seen some volatility recently, largely influenced by broader market trends and the ongoing recovery of the cruise industry. Investors are also keeping a close eye on the performance of other companies in the healthcare sector, such as Bristol Myers Squibb, to gauge overall market sentiment; you can check the bmy stock price today for a sense of that.

Ultimately, Carnival Corp’s future performance will depend on a combination of factors, including consumer confidence and global economic conditions.

Several major events have profoundly impacted Carnival Corp’s stock price. The 2008 financial crisis led to a sharp decline as consumer spending decreased and travel plans were curtailed. The COVID-19 pandemic had an even more devastating effect, causing an almost complete halt to cruise operations and resulting in a dramatic stock price drop. Other factors, such as changes in fuel prices and increased regulatory scrutiny, have also contributed to fluctuations in the stock price.

Comparative Stock Performance

Comparing Carnival Corp’s performance to its competitors provides valuable context. The following table presents a comparison of key financial metrics for Carnival Corp and its major competitors over the past five years. Note that these figures are illustrative and may vary slightly depending on the data source and calculation methods.

| Company Name | Average Annual Return (past 5 years) | Volatility (standard deviation) | Current P/E Ratio |

|---|---|---|---|

| Carnival Corp | -5% (Illustrative) | 30% (Illustrative) | 15 (Illustrative) |

| Royal Caribbean | -3% (Illustrative) | 28% (Illustrative) | 18 (Illustrative) |

| Norwegian Cruise Line | -7% (Illustrative) | 35% (Illustrative) | 12 (Illustrative) |

| Disney Cruise Line | N/A (Private Company) | N/A | N/A |

Factors Influencing Carnival Corp Stock Price

Several key factors influence Carnival Corp’s stock price. These include fuel prices, consumer sentiment, regulatory changes, and the company’s overall financial health.

- Fuel Prices: Fuel is a significant operating expense for cruise lines. Higher fuel prices directly impact profitability, which, in turn, affects the stock price.

- Consumer Sentiment and Travel Trends: Positive consumer sentiment and strong travel demand lead to higher passenger bookings and increased revenue, boosting the stock price. Conversely, negative sentiment or economic downturns can decrease demand and negatively impact the stock.

- Regulatory Changes and Environmental Concerns: Increasing environmental regulations and concerns about the cruise industry’s environmental impact can lead to increased operating costs and potential fines, affecting profitability and the stock price.

- Debt Levels and Financial Health: High levels of debt can increase financial risk and negatively impact investor confidence, leading to a lower stock price. Strong financial health, on the other hand, tends to increase investor confidence and boost the stock price.

Financial Performance and Stock Valuation

Analyzing Carnival Corp’s recent financial statements provides insight into its financial health and valuation. The company’s revenue, earnings, and debt levels are crucial indicators of its performance and future prospects. Key financial ratios, such as the debt-to-equity ratio and current ratio, help assess the company’s financial stability and risk profile.

The Price-to-Earnings (P/E) ratio is a common valuation metric. Comparing Carnival Corp’s P/E ratio to industry averages and historical data helps determine whether the stock is overvalued or undervalued. A hypothetical 10% increase in passenger bookings would likely lead to a rise in the stock price, while a 10% decrease would likely cause a decline, although the magnitude of the change would depend on other market factors.

Future Outlook and Predictions, Carnival corp stock price

Carnival Corp’s future prospects depend on various factors, including growth opportunities and potential risks. New ship deployments, expansion into new markets, and successful cost-cutting measures could contribute to future growth. However, geopolitical instability, economic downturns, and further outbreaks of infectious diseases pose significant challenges.

- Optimistic Scenario (Next 12 Months): Strong rebound in travel demand, successful cost-management, and new ship deployments lead to a 20-30% increase in stock price.

- Pessimistic Scenario (Next 12 Months): Persistent economic uncertainty, further regulatory hurdles, and weak consumer confidence lead to a 10-20% decrease in stock price.

- Neutral Scenario (Next 12 Months): Gradual recovery in travel demand, but continued headwinds from fuel prices and debt levels result in minimal price change.

A valuation model for Carnival Corp’s stock price would require detailed financial projections and assumptions about future growth and risk. Different models, such as discounted cash flow analysis, could yield varying valuations.

Investor Sentiment and Analyst Ratings

Understanding investor sentiment and analyst ratings provides valuable insights into market expectations for Carnival Corp’s stock. The consensus opinion among financial analysts, along with buy, sell, and hold ratings from different investment banks, can inform investment decisions. Media coverage and significant news events, such as earnings announcements and legal issues, can significantly influence investor sentiment.

| Analyst Firm | Rating | Target Price | Date of Rating |

|---|---|---|---|

| Goldman Sachs (Illustrative) | Buy (Illustrative) | $25 (Illustrative) | October 26, 2023 (Illustrative) |

| Morgan Stanley (Illustrative) | Hold (Illustrative) | $20 (Illustrative) | October 26, 2023 (Illustrative) |

| JP Morgan (Illustrative) | Sell (Illustrative) | $15 (Illustrative) | October 26, 2023 (Illustrative) |

Clarifying Questions

What are the major risks associated with investing in Carnival Corp stock?

Major risks include susceptibility to economic downturns, fuel price volatility, increased competition, and the potential impact of negative publicity or unforeseen events (e.g., accidents, outbreaks).

How does Carnival Corp compare to other major cruise lines in terms of market capitalization?

This would require a detailed comparison of market capitalization data from reputable financial sources, which is beyond the scope of this analysis. However, you can easily find this information on major financial websites.

What is the company’s dividend policy?

Information on Carnival Corp’s dividend policy, including any current dividend payments, should be found in their investor relations section on their official website.