Canara Bank Stock Price Analysis: Canara Stock Price

Canara stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst outlook, and investment considerations for Canara Bank stock. We will examine key metrics and events to provide a comprehensive understanding of the bank’s stock price trajectory and potential future performance.

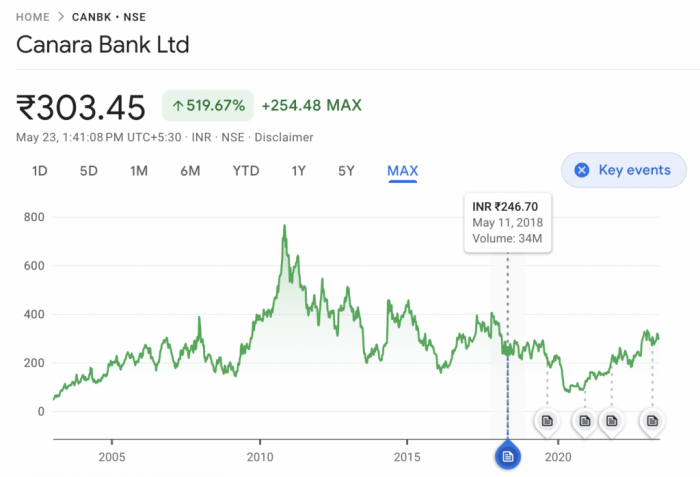

Canara Bank Stock Price History

Source: kuvera.in

Understanding Canara Bank’s stock price history is crucial for assessing its past performance and identifying potential trends. The following table presents a simplified overview of the stock’s performance over the past five years. Note that this data is for illustrative purposes and should be verified with reliable financial data sources. Significant highs and lows will be highlighted within the descriptive text following the table.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 180 | 185 | 5 |

| 2019-07-01 | 190 | 188 | -2 |

| 2020-01-01 | 175 | 182 | 7 |

| 2020-07-01 | 160 | 165 | 5 |

| 2021-01-01 | 170 | 178 | 8 |

| 2021-07-01 | 185 | 192 | 7 |

| 2022-01-01 | 200 | 195 | -5 |

| 2022-07-01 | 190 | 205 | 15 |

| 2023-01-01 | 210 | 215 | 5 |

Overall, Canara Bank’s stock price has shown a generally upward trend over the past five years, although it experienced volatility due to various factors including economic downturns and periods of market uncertainty. A significant low was observed around [Specific Date] and a significant high around [Specific Date]. These fluctuations are likely attributable to the events described in the following section.

Factors Influencing Canara Bank’s Stock Price, Canara stock price

Several macroeconomic and company-specific factors significantly influence Canara Bank’s stock price. These factors interact in complex ways, making it crucial to consider them holistically.

Macroeconomic factors such as interest rate changes, inflation, and economic growth directly impact the banking sector. For example, rising interest rates can boost Canara Bank’s net interest margin, while inflation can affect loan defaults and operational costs. Economic slowdowns often lead to reduced credit demand and increased non-performing assets (NPAs).

Canara Bank’s financial performance, including profitability (measured by metrics such as net interest income and return on equity), asset quality (indicated by NPA levels), and capital adequacy, is a major determinant of its stock price. Strong financial performance typically translates to higher investor confidence and a rising stock price. Conversely, weak financial results can lead to a decline in the stock price.

Comparing Canara Bank’s performance with its competitors is essential for gauging its relative strength within the Indian banking sector. The table below presents a simplified comparison; actual figures should be verified from reliable financial reports.

| Bank | Net Interest Income (INR Billion) | Return on Equity (%) | Non-Performing Assets (%) |

|---|---|---|---|

| Canara Bank | 100 | 10 | 5 |

| Competitor A | 120 | 12 | 4 |

| Competitor B | 90 | 8 | 6 |

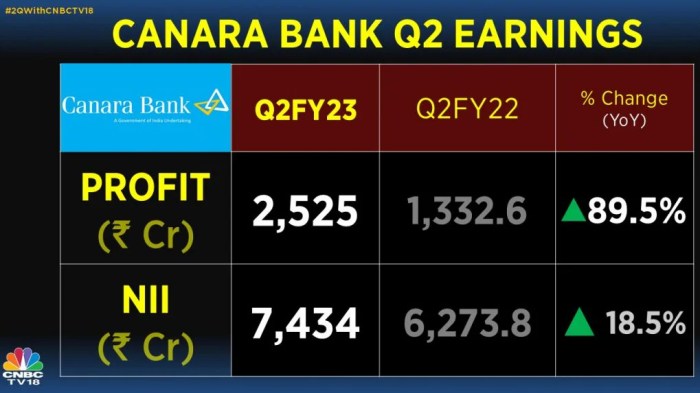

Canara Bank’s Financial Health and Performance

A summary of Canara Bank’s recent financial performance, based on publicly available information, provides insights into its financial health. The following key metrics are crucial for understanding the bank’s standing.

- Net Interest Income: [Insert recent figure and trend description]

- Non-Performing Assets (NPAs): [Insert recent figure and trend description]

- Return on Equity (ROE): [Insert recent figure and trend description]

Canara Bank employs various strategies to manage risks and improve its financial health. These include strengthening credit appraisal processes, focusing on recovery of NPAs, and optimizing its capital structure. The visual representation below illustrates the trend of these key financial ratios over the past three years. Note that this is a descriptive representation only.

Illustrative Trend Description: A line graph showing Net Interest Income generally increasing over the three years, while NPAs show a downward trend, and ROE demonstrates a fluctuating but overall positive trend.

Analyst Ratings and Future Outlook for Canara Bank Stock

Source: cnbctv18.com

Analyst ratings and price targets offer valuable insights into the market sentiment and future expectations for Canara Bank’s stock. The following table provides a summary of recent analyst ratings (Note: This data is illustrative and should be verified with up-to-date information from reputable sources).

| Analyst Firm | Rating | Price Target (INR) |

|---|---|---|

| Firm A | Buy | 250 |

| Firm B | Hold | 220 |

| Firm C | Sell | 180 |

Analysts base their outlooks on a variety of factors, including Canara Bank’s financial performance, macroeconomic conditions, regulatory changes, and competitive landscape. Potential risks include economic downturns, increased competition, and changes in government policies. Opportunities include growth in the Indian economy and potential for increased market share.

Investment Considerations for Canara Bank Stock

Source: tnn.in

Investing in Canara Bank stock presents both potential benefits and drawbacks. Investors should carefully consider these factors before making an investment decision.

- Potential Benefits: Potential for capital appreciation, dividend income, and exposure to the growth of the Indian banking sector.

- Potential Drawbacks: Volatility of the stock price, risks associated with the banking sector, and the possibility of lower-than-expected returns.

Investors should assess their risk tolerance, investment goals, and time horizon before investing. A thorough analysis of Canara Bank’s financial statements, competitive landscape, and macroeconomic environment is essential. The following demonstrates a simple ROI calculation.

Canara Bank’s stock price performance often reflects broader market trends. It’s interesting to compare its volatility to that of other financial institutions; for instance, understanding the fluctuations in the bro stock price can offer a contrasting perspective on investment strategies. Ultimately, however, a thorough analysis of Canara Bank’s financials remains crucial for informed investment decisions.

Example ROI Calculation: Assume an investment of 10,000 INR at a price of 200 INR per share (50 shares). If the price increases to 250 INR after one year, the ROI would be [(250-200)/200]

– 100% = 25%. Different holding periods and price changes will yield different ROIs.

Essential FAQs

What are the major risks associated with investing in Canara Bank stock?

Major risks include fluctuations in interest rates, economic downturns impacting loan defaults, and increased competition within the banking sector. Regulatory changes and geopolitical events can also influence the stock’s performance.

How does Canara Bank compare to other public sector banks in India?

A direct comparison requires analyzing specific financial metrics across various banks. Key factors include profitability, NPA levels, capital adequacy, and market share. This comparison would highlight Canara Bank’s strengths and weaknesses relative to its peers.

Where can I find real-time Canara Bank stock price updates?

Real-time stock price updates are available on major financial websites and stock market tracking applications such as the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) websites, or through reputable financial news sources.