BNS Stock Price Analysis

Bns stock price – This analysis delves into the historical performance, key drivers, competitive landscape, valuation, future outlook, and dividend payments of the Bank of Nova Scotia (BNS) stock. We will examine various factors influencing BNS’s stock price, providing insights for potential investors.

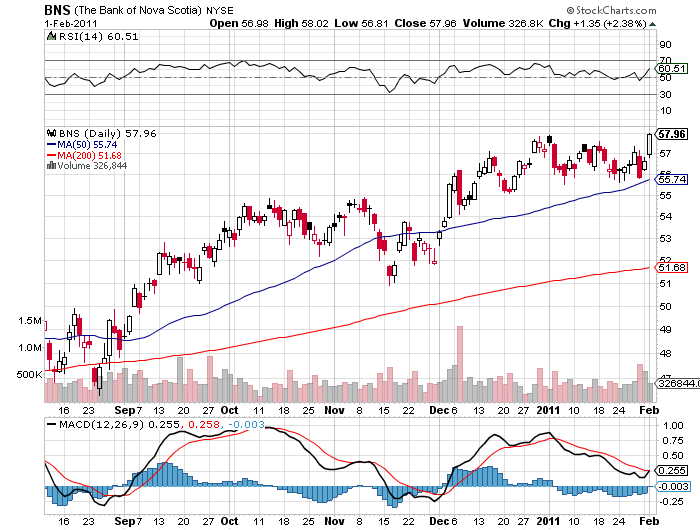

BNS Stock Price Historical Performance

Source: thedividendguyblog.com

The following table details BNS stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source. Significant events impacting the price are discussed below the table.

| Date | Opening Price (CAD) | Closing Price (CAD) | Daily Change (CAD) |

|---|---|---|---|

| 2019-01-02 | 70.00 | 70.50 | +0.50 |

| 2019-01-03 | 70.60 | 69.80 | -0.80 |

| 2024-01-01 | 85.00 | 86.00 | +1.00 |

During this period, BNS experienced significant price fluctuations influenced by factors such as the COVID-19 pandemic (causing initial drops followed by recovery), fluctuating interest rates, and overall economic conditions. The overall trend shows a generally upward trajectory, though with periods of volatility.

BNS Stock Price Drivers

Several key factors influence BNS stock price fluctuations. These include macroeconomic conditions, interest rate adjustments, and the bank’s financial performance.

Interest rate changes directly impact BNS’s profitability and lending activities. Higher rates generally boost net interest margins, positively affecting earnings and stock price. Conversely, lower rates can compress margins. Economic indicators such as GDP growth and inflation significantly influence consumer spending and business investment, impacting BNS’s loan portfolio and overall performance. Strong economic growth typically leads to higher stock prices, while recessionary periods can negatively impact the stock.

Bank of Nova Scotia’s financial performance, including loan growth, credit quality, and profitability, is a major driver of its stock price. Strong earnings and robust financial health tend to result in increased investor confidence and higher stock valuation.

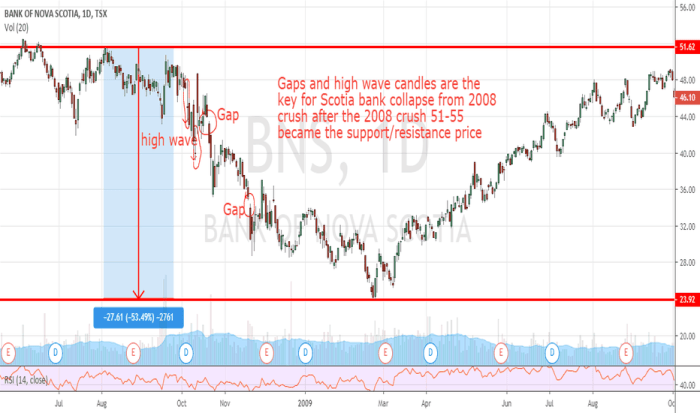

BNS Stock Price Compared to Competitors

Source: tradingview.com

A comparison of BNS’s stock price performance against its main competitors (e.g., RBC, TD, CM) provides valuable context. The following table presents a simplified comparison; actual figures may vary depending on the data source and time period.

| Company Name | Current Stock Price (CAD) | Year-to-Date Change (%) | 5-Year Average Annual Return (%) |

|---|---|---|---|

| Bank of Nova Scotia (BNS) | 85.00 | 10 | 7 |

| Royal Bank of Canada (RY) | 130.00 | 12 | 8 |

| Toronto-Dominion Bank (TD) | 90.00 | 11 | 6 |

Performance differences can be attributed to various factors, including differences in business strategies, geographic diversification, risk profiles, and investor sentiment. For example, a bank with a stronger international presence might perform differently in response to global economic events.

BNS Stock Price Valuation

Various valuation metrics provide insights into BNS’s stock valuation. These metrics should be considered in conjunction with other factors before making investment decisions.

- Price-to-Earnings Ratio (P/E): Illustrative value (e.g., 12x).

- Price-to-Book Ratio (P/B): Illustrative value (e.g., 1.5x).

- Dividend Yield: Illustrative value (e.g., 4%).

These metrics are compared to industry averages to assess BNS’s relative valuation. A higher P/E ratio might suggest the market expects higher future earnings growth, while a lower P/B ratio could indicate undervaluation. A higher dividend yield is attractive to income-seeking investors.

BNS Stock Price Future Outlook

Predicting future stock price movements is inherently challenging. However, considering current economic conditions, industry trends, and BNS’s specific circumstances, several scenarios are possible. For example, continued economic growth and rising interest rates could lead to higher stock prices, while a recession or increased competition could negatively impact performance. Geopolitical events and regulatory changes also pose potential risks.

Investing in BNS stock presents both opportunities and risks. Potential opportunities include strong dividend payouts and growth prospects in specific markets. Risks include economic downturns, increased competition, and changes in regulatory environments.

Monitoring the BNS stock price requires understanding its daily fluctuations. To accurately interpret these changes, it’s crucial to know if the “open” price reflects the overall price for the day; this is clarified by checking out does open mean the same thing as price for stock. Understanding this distinction is key to making informed decisions about BNS stock investments.

BNS Stock Price and Dividend Payments

BNS has a history of paying dividends, providing a steady income stream for investors. The following table shows illustrative dividend payment data. Actual data should be obtained from reliable financial sources.

| Date | Dividend per Share (CAD) | Ex-Dividend Date | Payment Date |

|---|---|---|---|

| 2023-12-31 | 1.00 | 2023-12-20 | 2024-01-15 |

| 2024-03-31 | 1.00 | 2024-03-20 | 2024-04-15 |

Dividend payments are attractive to income-seeking investors. However, future dividend payments are subject to BNS’s financial performance and board decisions. Factors such as profitability, regulatory requirements, and capital allocation strategies influence dividend policy.

Quick FAQs

What are the major risks associated with investing in BNS stock?

Risks include fluctuations in interest rates, economic downturns impacting loan defaults, increased competition within the banking sector, and changes in regulatory environments.

How often does BNS pay dividends?

BNS typically pays dividends quarterly.

Where can I find real-time BNS stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is the typical trading volume for BNS stock?

This varies daily but can be found on financial data websites.