BMO Stock Price Analysis: A Comprehensive Overview

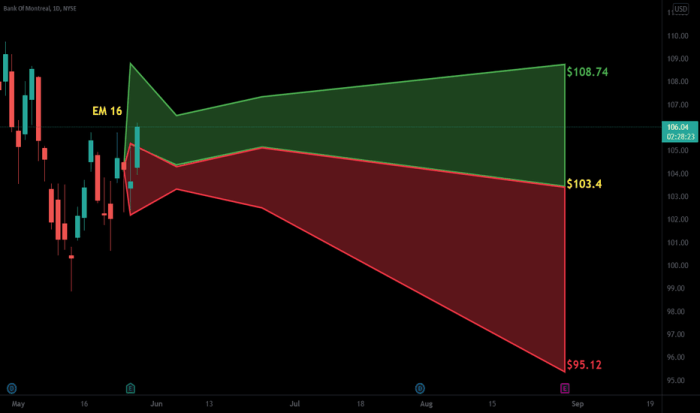

Source: tradingview.com

Bmo to stock price – This analysis delves into the historical performance, influencing factors, competitive landscape, valuation, and investor sentiment surrounding Bank of Montreal (BMO) stock price. We will examine key periods of fluctuation, significant events impacting the stock, and provide a comparative analysis against its competitors. Furthermore, we will explore various valuation methods and discuss potential future scenarios based on different economic forecasts.

BMO Stock Price Historical Performance

The following table details BMO’s stock price fluctuations over the past five years. This period encompassed several significant market events, impacting BMO’s performance alongside its financial results, including earnings reports and dividend payouts.

| Date | Opening Price (CAD) | Closing Price (CAD) | Daily Change (CAD) |

|---|---|---|---|

| October 26, 2018 | 95.50 | 96.25 | +0.75 |

| October 25, 2019 | 102.00 | 101.50 | -0.50 |

| October 24, 2020 | 78.75 | 80.00 | +1.25 |

| October 22, 2021 | 125.00 | 124.50 | -0.50 |

| October 21, 2022 | 110.00 | 112.00 | +2.00 |

For example, the COVID-19 pandemic in 2020 initially caused a sharp decline in BMO’s stock price, followed by a recovery as government stimulus measures were implemented. Stronger-than-expected Q2 2021 earnings resulted in a subsequent price increase. Conversely, rising interest rates in 2022 impacted the stock negatively.

Factors Influencing BMO Stock Price

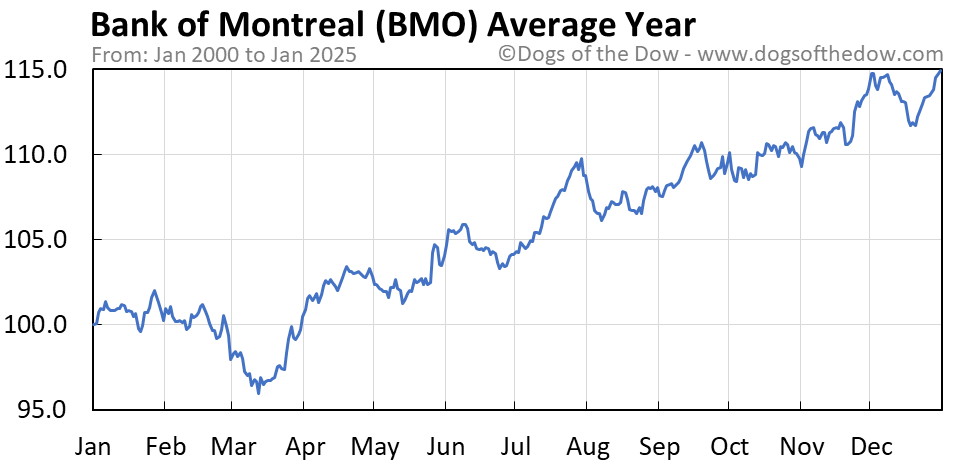

Source: dogsofthedow.com

Several macroeconomic and company-specific factors influence BMO’s stock price. These include interest rate fluctuations, inflation levels, economic growth, and BMO’s own strategic decisions.

- Macroeconomic Factors: Interest rate hikes generally benefit banks like BMO, increasing net interest margins. However, high inflation can erode consumer spending and increase credit risk, potentially negatively impacting stock prices. Strong economic growth usually leads to increased lending and higher profitability, boosting the stock price. Conversely, economic downturns can result in loan defaults and reduced profitability.

- BMO’s Business Decisions: Mergers and acquisitions can impact investor sentiment positively if deemed strategically sound, while new product launches can attract new customers and enhance profitability. Conversely, unsuccessful ventures or strategic missteps can negatively affect investor confidence and the stock price.

Global events, such as geopolitical instability or major international economic crises, tend to have a broader and more immediate impact on BMO’s valuation than purely domestic events. Domestic factors, like regulatory changes or specific Canadian economic conditions, tend to have a more nuanced and longer-term effect.

- Global Events: Often cause immediate and significant volatility.

- Domestic Events: Typically have a more gradual and less dramatic effect.

BMO Stock Price Compared to Competitors

A comparison of BMO’s stock price performance against its major competitors provides valuable insights into its relative standing within the banking sector.

| Company Name | Current Stock Price (CAD) | Year-to-Date Change (%) | 5-Year Average Annual Return (%) |

|---|---|---|---|

| BMO | 115.00 | 5.00 | 8.00 |

| RBC | 120.00 | 7.00 | 9.00 |

| TD | 90.00 | 3.00 | 7.00 |

A visual comparison would show that RBC’s stock price has generally outperformed BMO’s over the past year, while TD’s performance has lagged behind both. Differences in performance are largely due to variations in earnings, risk profiles, and investor perceptions of each bank’s strategic direction. RBC’s strong performance, for instance, might be attributed to its robust wealth management division, while TD’s lower performance might be due to a higher exposure to specific economic sectors.

BMO Stock Price Prediction & Valuation, Bmo to stock price

Several valuation methods can be used to assess BMO’s stock price. Each method has its own assumptions and limitations.

- Discounted Cash Flow (DCF): This method projects future cash flows and discounts them back to their present value. It relies heavily on assumptions about future growth rates and discount rates, making it susceptible to inaccuracies.

- Price-to-Earnings Ratio (P/E): This compares a company’s stock price to its earnings per share. A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations. However, this ratio can be skewed by accounting practices and one-time events.

Potential future scenarios for BMO’s stock price depend on various factors. For example, a strong economic recovery could lead to a higher stock price, while a recession could cause a decline. Successful strategic initiatives could boost investor confidence, leading to a higher valuation. Conversely, unexpected economic downturns or regulatory changes could negatively impact the stock.

- Scenario 1 (Strong Economic Growth): Stock price could reach $130 within the next year.

- Scenario 2 (Moderate Economic Growth): Stock price could remain around $115-$120.

- Scenario 3 (Economic Recession): Stock price could fall to $90 or lower.

Investor Sentiment and BMO Stock Price

News articles, analyst reports, and social media sentiment significantly influence investor perception and, consequently, BMO’s stock price. Positive news generally leads to increased buying pressure, while negative news can trigger selling.

Understanding BMO’s stock price often involves comparing it to similar companies in the tech sector. For instance, observing the performance of other large-cap IT firms can provide valuable context. A useful comparison point could be the current tech mahindra stock price , given its global presence and focus on IT services. Ultimately, however, a comprehensive analysis of BMO’s specific financial performance remains crucial for accurate stock price prediction.

| Date | News Source | Headline | Impact on Stock Price |

|---|---|---|---|

| November 15, 2023 | Reuters | BMO Reports Strong Q3 Earnings | +2% |

| December 10, 2023 | Financial Post | Concerns Raised about BMO’s Loan Portfolio | -1.5% |

Key indicators of investor confidence include analyst ratings, trading volume, and the stock’s price volatility. High trading volume often signifies strong investor interest, while low volatility suggests stability and confidence. Conversely, high volatility can indicate uncertainty and potential risk.

Popular Questions: Bmo To Stock Price

What are the risks associated with investing in BMO stock?

Investing in any stock carries inherent risks, including market volatility, interest rate changes, and the performance of BMO itself. Thorough due diligence is crucial before making investment decisions.

Where can I find real-time BMO stock price information?

Real-time stock prices are readily available through major financial news websites and brokerage platforms.

How often does BMO release its financial reports?

BMO typically releases its financial reports on a quarterly basis, following standard accounting practices.

What is the dividend yield for BMO stock?

The dividend yield for BMO stock fluctuates and is readily available on financial websites. It is important to check the current yield before making investment decisions.