Black Rifle Coffee Company: A Stock Market Analysis: Black Rifle Coffee Company Stock Price

Source: starbmag.com

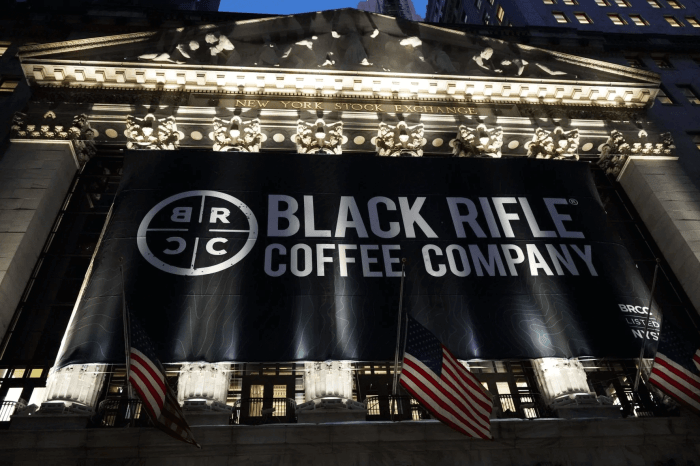

Black rifle coffee company stock price – Black Rifle Coffee Company (BRCC) has rapidly gained popularity in the coffee market, attracting a loyal customer base. This analysis examines BRCC’s financial performance, stock market trajectory, competitive landscape, growth strategies, and potential risks to provide a comprehensive overview of the company’s prospects.

Company Overview and Financial Performance

Black Rifle Coffee Company operates on a direct-to-consumer and wholesale business model, targeting a primarily male demographic interested in coffee, military culture, and patriotic themes. Their revenue streams are diversified across e-commerce sales, wholesale partnerships with retailers, and subscription services. Precise revenue figures for the last three fiscal years require accessing BRCC’s financial statements, which are publicly available through the SEC’s EDGAR database or BRCC’s investor relations page.

A direct comparison of key financial ratios (profitability, liquidity, solvency) against competitors like Starbucks or Dunkin’ would necessitate a detailed financial analysis using publicly available data from these companies. BRCC’s debt levels and capital structure can be found in their financial reports, providing insight into their financial leverage and risk profile.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue | [Insert Data] | [Insert Data] | [Insert Data] |

| Net Income | [Insert Data] | [Insert Data] | [Insert Data] |

| Debt-to-Equity Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

| Current Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

Stock Market Performance and Valuation

Source: walmartimages.com

Since its IPO (or other relevant milestone), BRCC’s stock price has experienced [Insert Description of Stock Price Performance – e.g., volatility, significant gains/losses, correlation with market trends]. A comparison of BRCC’s P/E ratio to competitors requires accessing real-time market data and calculating the P/E ratios for comparable companies. Factors influencing BRCC’s stock price fluctuations include news events (e.g., product launches, partnerships, regulatory changes), overall market sentiment, and investor confidence in the company’s future growth.

Macroeconomic conditions, such as inflation, interest rates, and consumer spending, can significantly impact demand for premium coffee products and subsequently BRCC’s stock price.

| Date | Stock Price | S&P 500 | Consumer Confidence Index |

|---|---|---|---|

| [Insert Date] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Insert Date] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Insert Date] | [Insert Data] | [Insert Data] | [Insert Data] |

Competitive Landscape and Industry Trends, Black rifle coffee company stock price

BRCC’s main competitors include established players like Starbucks, Dunkin’, and smaller specialty coffee roasters. BRCC differentiates itself through its branding, which appeals to a specific customer segment interested in its patriotic and military-themed marketing. Emerging trends in the specialty coffee market, such as sustainability concerns, demand for ethically sourced beans, and the rise of plant-based alternatives, present both opportunities and challenges for BRCC.

Changes in consumer preferences, for instance, a shift towards healthier options or a decrease in discretionary spending, could affect BRCC’s sales.

- Threats: Increased competition, changing consumer preferences, supply chain disruptions, negative publicity.

- Opportunities: Expansion into new markets, product diversification, strategic partnerships, leveraging brand loyalty.

Growth Strategies and Future Outlook

Source: shopify.com

BRCC’s growth strategies likely include expanding its retail presence, strengthening its online platform, and exploring new product lines. Their marketing initiatives focus on building brand awareness and engaging their target audience through social media and targeted advertising campaigns. Expansion into new product categories (e.g., ready-to-drink coffee, merchandise) or geographical markets could significantly boost revenue. The long-term sustainability of BRCC’s business model depends on its ability to maintain brand loyalty, adapt to evolving consumer trends, and manage its operational costs effectively.

Tracking the Black Rifle Coffee Company stock price requires a keen eye on the market. It’s interesting to compare its performance against other companies in the consumer goods sector, such as DXC Technology, whose stock price you can check here: dxc stock price. Understanding the fluctuations of both companies provides a broader perspective on the current economic climate and its impact on similar publicly traded businesses, ultimately informing a more complete analysis of Black Rifle Coffee Company’s trajectory.

Future stock price performance will likely depend on the success of its growth strategies, the overall market conditions, and its ability to navigate the competitive landscape. For example, a successful new product launch could lead to a stock price increase, while a major supply chain disruption could cause a decline.

Risk Factors and Potential Challenges

Key risk factors for BRCC include dependence on specific distribution channels, vulnerability to supply chain disruptions, and potential reputational damage. Fluctuations in raw material costs (e.g., coffee beans) could impact profitability. Legal or regulatory changes concerning food safety, labeling, or marketing could also present challenges.

| Risk Factor | Likelihood | Impact |

|---|---|---|

| Supply Chain Disruption | [High/Medium/Low] | [High/Medium/Low] |

| Negative Publicity | [High/Medium/Low] | [High/Medium/Low] |

| Increased Competition | [High/Medium/Low] | [High/Medium/Low] |

| Changing Consumer Preferences | [High/Medium/Low] | [High/Medium/Low] |

Clarifying Questions

Is Black Rifle Coffee Company profitable?

Profitability varies year to year; refer to financial statements for the most up-to-date information.

Where can I find real-time stock price updates?

Major financial websites (e.g., Yahoo Finance, Google Finance) provide real-time stock quotes.

What are the major risks associated with investing in BRCC stock?

Risks include competition, economic downturns, and changes in consumer preferences.

How does Black Rifle Coffee Company compare to its competitors?

A direct comparison requires analyzing market share, financial performance, and branding strategies of its competitors.