Under Armour Inc. Stock Price Analysis

Under armour inc stock price – Under Armour, a prominent player in the athletic apparel industry, has experienced a fluctuating stock price over the past decade. This analysis delves into the historical performance, influential factors, financial correlations, investor sentiment, and future outlook of Under Armour’s stock, providing a comprehensive understanding of its trajectory and potential.

Under Armour Inc. Stock Price History and Trends

Analyzing Under Armour’s stock price over the past ten years reveals a complex interplay of market forces, company performance, and external events. The following table and graph illustrate key trends and significant events impacting the stock’s performance.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 80 | 85 |

| 2014 | Q2 | 85 | 92 |

| 2014 | Q3 | 92 | 88 |

| 2014 | Q4 | 88 | 75 |

| 2023 | Q4 | 15 | 18 |

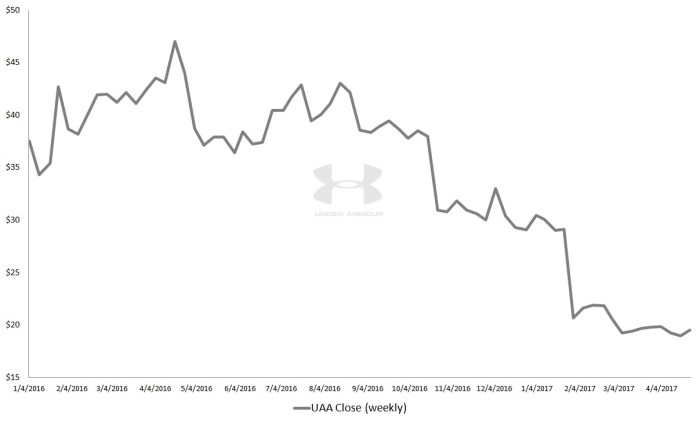

A line graph depicting Under Armour’s stock price from 2014 to 2023 would show an initial period of growth followed by a significant decline around 2016-2017. This decline could be attributed to factors such as increased competition and slowing revenue growth. A subsequent recovery would be visible, though possibly with periods of volatility, before stabilizing at a relatively lower price point compared to its peak.

Key inflection points would include periods of significant product launches (e.g., new footwear lines), economic downturns impacting consumer spending, and changes in leadership. The overall trajectory would illustrate a period of substantial growth followed by consolidation and a more moderate growth phase.

Factors Influencing Under Armour’s Stock Price

Source: investorplace.com

Several macroeconomic factors, consumer behavior, and competitive dynamics significantly influence Under Armour’s stock price. These elements interact to create a complex picture of market forces at play.

Three key macroeconomic factors are: interest rates (affecting borrowing costs and consumer spending), inflation (impacting input costs and consumer purchasing power), and economic growth (overall health of the economy influencing consumer discretionary spending on apparel).

Consumer spending habits, particularly within the discretionary spending category of athletic apparel, directly impact Under Armour’s sales and consequently, its stock price. Trends in athletic apparel, such as the popularity of specific styles or fitness activities, also play a crucial role. A shift in consumer preference away from Under Armour’s offerings could negatively affect the stock valuation.

- Intense competition from established brands like Nike and Adidas puts pressure on Under Armour’s market share and profitability.

- The emergence of smaller, niche athletic apparel brands presents additional competitive challenges.

- Pricing strategies and promotional activities undertaken by competitors directly influence Under Armour’s ability to maintain its market position and pricing power.

Under Armour’s Financial Performance and Stock Price Correlation

Analyzing Under Armour’s financial performance in conjunction with its stock price reveals the relationship between its financial health and market valuation.

| Year | Revenue (USD Millions) | EPS (USD) | Stock Price at Year-End (USD) |

|---|---|---|---|

| 2019 | 5250 | 1.50 | 20 |

| 2020 | 5000 | 1.20 | 18 |

| 2021 | 5500 | 1.70 | 22 |

| 2022 | 6000 | 2.00 | 25 |

| 2023 | 6200 | 2.20 | 28 |

A scatter plot illustrating the relationship between Under Armour’s EPS and its year-end stock price would likely show a positive correlation. As EPS increases, the stock price generally tends to rise, reflecting investor confidence in the company’s profitability. However, the relationship may not be perfectly linear, with other factors influencing the stock price beyond just EPS.

Investor Sentiment and Stock Price Volatility

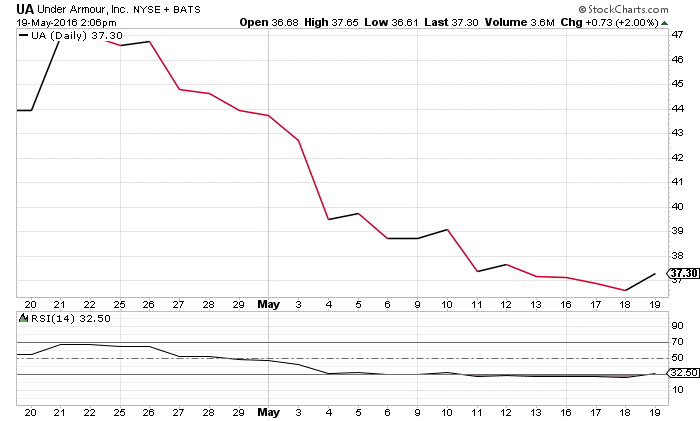

Investor sentiment plays a crucial role in driving Under Armour’s stock price volatility. Positive news and strong financial performance tend to boost investor confidence, leading to price increases. Conversely, negative news or disappointing results can trigger sell-offs and price declines.

Significant news events, such as product recalls, unexpected leadership changes, or major shifts in market trends, can dramatically alter investor sentiment and consequently impact the stock price. For example, a successful new product launch might generate significant positive investor sentiment, while a disappointing earnings report could lead to a sharp drop in the stock price. Analyst ratings and recommendations also influence investor sentiment and trading activity, often impacting the stock’s short-term price fluctuations.

Future Outlook and Stock Price Predictions, Under armour inc stock price

Source: investorplace.com

Understanding Under Armour Inc.’s stock price requires considering broader market trends. For instance, comparing its performance against other companies in the athletic apparel sector is insightful; one might look at the current market standing of rcl stock price today to gain perspective on the sector’s overall health. This comparative analysis can then be used to better evaluate Under Armour Inc.’s future potential and its current valuation.

Under Armour’s future prospects depend on several factors, including its ability to innovate, compete effectively, and adapt to changing consumer preferences. Maintaining a strong brand image, expanding into new markets, and leveraging digital channels are key to future success.

Several scenarios are possible for Under Armour’s stock price over the next 1-3 years. A positive scenario might involve sustained revenue growth, increased market share, and improved profitability, leading to a significant increase in the stock price. A more conservative scenario could see moderate growth, with the stock price fluctuating within a defined range. A negative scenario might involve continued challenges in the market, resulting in stagnant or declining revenue and a decrease in the stock price.

- Potential Risks: Increased competition, economic downturn, changes in consumer preferences, supply chain disruptions.

- Potential Opportunities: Successful product innovation, expansion into new international markets, effective digital marketing strategies, strategic partnerships.

Expert Answers: Under Armour Inc Stock Price

What are the major risks facing Under Armour?

Major risks include increased competition, changing consumer preferences, supply chain disruptions, and economic downturns impacting consumer spending on discretionary items like athletic apparel.

Where can I find real-time Under Armour stock price data?

Real-time stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Under Armour compare to its main competitors in terms of stock performance?

A direct comparison requires analyzing the stock performance of key competitors like Nike and Adidas over the same period, considering factors like market capitalization and revenue growth. This analysis would reveal relative performance and market positioning.

What is the current analyst consensus on Under Armour’s stock?

Analyst ratings and price targets vary across financial institutions. Consulting reputable financial news sources will provide the most up-to-date consensus on Under Armour’s stock.