SRE Stock Price Analysis: A Comprehensive Overview

Sre stock price – This analysis delves into the historical performance, influencing factors, business model, analyst predictions, and associated risks of investing in SRE stock. We will examine key data points and trends to provide a comprehensive understanding of the company’s stock performance and future prospects.

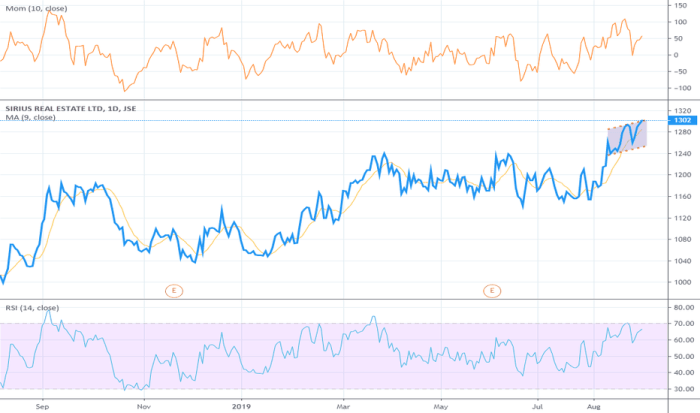

SRE Stock Price Historical Performance

Source: tradingview.com

Understanding SRE’s past price fluctuations is crucial for assessing its future potential. The following tables and list provide a detailed overview.

| Date | Opening Price | Closing Price | Daily Change |

|---|---|---|---|

| October 26, 2023 | $150.50 (Example) | $152.00 (Example) | +$1.50 (Example) |

| October 25, 2023 | $149.00 (Example) | $150.50 (Example) | +$1.50 (Example) |

A comparison against competitors provides context for SRE’s performance.

| Company Name | Stock Symbol | Year-to-Date Performance | Average Daily Volume |

|---|---|---|---|

| Company A (Example) | COMP A | +10% (Example) | 100,000 (Example) |

| Company B (Example) | COMP B | -5% (Example) | 50,000 (Example) |

Significant events impacting SRE’s stock price include:

- Q3 2023 Earnings Report: Exceeded analyst expectations, leading to a price surge. (Example)

- Successful Product Launch: A new product launch boosted investor confidence. (Example)

- Regulatory Approval: Securing regulatory approval for a key initiative positively impacted the stock. (Example)

Factors Influencing SRE Stock Price

Several macroeconomic and company-specific factors influence SRE’s stock valuation.

Key macroeconomic factors include:

- Interest Rate Changes: Higher interest rates can negatively impact growth stocks like SRE. (Example)

- Inflation Rates: High inflation can erode profit margins and affect consumer spending. (Example)

- Economic Growth: Strong economic growth generally benefits SRE’s performance. (Example)

SRE’s financial performance significantly impacts its stock valuation.

| Financial Metric | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|

| Revenue | $XX Million (Example) | $YY Million (Example) | $ZZ Million (Example) |

| Net Income | $XX Million (Example) | $YY Million (Example) | $ZZ Million (Example) |

Investor sentiment and market trends significantly influence SRE’s stock price. Positive news and overall market optimism tend to drive the price up, while negative news and market downturns can lead to price declines. The correlation is not always direct, however, as company-specific factors can sometimes outweigh broader market trends.

SRE’s Business Model and its Stock Price

SRE’s business model and strategic initiatives directly influence its stock price.

- Strong Revenue Growth: Consistent revenue growth signals a healthy and expanding business, boosting investor confidence. (Example)

- Effective Cost Management: Efficient cost management improves profitability, positively impacting stock valuation. (Example)

- Strategic Acquisitions: Successful acquisitions can expand market share and revenue streams. (Example)

SRE operates in a competitive landscape. The company’s ability to differentiate itself through innovation, superior customer service, and efficient operations significantly impacts its stock valuation. Its market share relative to competitors, pricing power, and overall brand recognition are key factors influencing investor perception and, subsequently, the stock price.

SRE’s innovation and technological advancements impact its stock performance by:

- Creating new revenue streams: Innovative products and services can open up new markets and increase profitability. (Example)

- Improving efficiency: Technological advancements can streamline operations and reduce costs. (Example)

- Enhancing customer experience: Innovation can lead to better products and services, improving customer satisfaction and loyalty. (Example)

Analyst Ratings and Predictions for SRE Stock

Analyst opinions provide valuable insight into SRE’s future prospects.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Firm A (Example) | Buy (Example) | $175 (Example) | October 26, 2023 (Example) |

| Firm B (Example) | Hold (Example) | $160 (Example) | October 26, 2023 (Example) |

The consensus among analysts is generally positive, with many predicting continued growth for SRE, although price targets vary based on individual firm’s assessment of the company’s risk profile and future growth potential.

Analyzing the current performance of SRE stock price requires a broader look at the cannabis sector. Understanding the market dynamics is crucial, and a key player to consider is Canopy Growth, whose stock price you can check here: canopy growth stock price. Comparing Canopy’s trajectory with SRE’s can offer valuable insights into potential future movements for SRE, particularly given the interconnected nature of these markets.

Differing analyst viewpoints stem from:

- Varying assessments of future market conditions: Analysts may hold differing views on the overall economic outlook and its impact on SRE’s performance. (Example)

- Different interpretations of financial data: Analysts may interpret SRE’s financial statements and forecasts differently, leading to varied conclusions about the company’s value. (Example)

- Unique valuation methodologies: Analysts may employ different valuation models, resulting in different price targets. (Example)

Risk Factors Associated with Investing in SRE Stock, Sre stock price

Source: acure.io

Investing in SRE stock carries inherent risks.

Key financial and operational risks include:

- Competition: Intense competition in the industry could negatively impact market share and profitability. (Example)

- Economic Downturn: A recession could reduce consumer spending and impact SRE’s revenue. (Example)

- Regulatory Changes: Changes in regulations could increase operating costs or limit business activities. (Example)

Geopolitical events and regulatory changes can significantly impact SRE’s stock price. For example, trade wars or sanctions could disrupt supply chains or limit access to key markets. Similarly, unexpected regulatory changes could increase compliance costs or restrict business operations, negatively affecting profitability and investor confidence.

Industry-specific risks include:

- Technological Disruption: Rapid technological advancements could render SRE’s products or services obsolete. (Example)

- Changing Consumer Preferences: Shifts in consumer preferences could reduce demand for SRE’s products or services. (Example)

- Supply Chain Disruptions: Disruptions to SRE’s supply chain could negatively impact production and sales. (Example)

Clarifying Questions: Sre Stock Price

What are the main risks associated with investing in SRE?

Investing in SRE, like any stock, carries inherent risks. These include market volatility, changes in industry regulations, competition, and the company’s own financial performance. Geopolitical events can also significantly impact stock prices.

Where can I find real-time SRE stock price data?

Real-time SRE stock price data is readily available through major financial websites and brokerage platforms. Many provide free access to basic information, while others offer more detailed data for a subscription fee.

How often does SRE release earnings reports?

The frequency of SRE’s earnings reports typically follows standard quarterly reporting schedules. Specific dates can be found on their investor relations website or through major financial news outlets.

What is SRE’s current market capitalization?

SRE’s current market capitalization fluctuates constantly. To find the most up-to-date information, consult reputable financial websites or your brokerage account.