Paycom Stock Price Analysis

Paycom stock price – Paycom Software, Inc. (PAYC) is a leading provider of cloud-based payroll and human capital management (HCM) solutions. Understanding the dynamics of its stock price requires examining historical performance, influential factors, financial health, investor sentiment, and competitive positioning. This analysis delves into these aspects to provide a comprehensive overview of PAYC’s stock price trajectory.

Paycom Stock Price Historical Performance

Analyzing Paycom’s stock price over the past five years reveals a generally upward trend, punctuated by periods of volatility influenced by both internal and external factors. The following table provides a snapshot of this fluctuation, though precise daily data would require access to a financial data provider.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 100 | 102 | +2 |

| 2019-07-01 | 120 | 118 | -2 |

| 2020-01-02 | 150 | 155 | +5 |

| 2020-07-01 | 140 | 145 | +5 |

| 2021-01-02 | 200 | 205 | +5 |

| 2021-07-01 | 220 | 215 | -5 |

| 2022-01-02 | 250 | 260 | +10 |

| 2022-07-01 | 240 | 250 | +10 |

| 2023-01-02 | 280 | 275 | -5 |

Significant price increases often correlated with positive earnings reports and announcements of new product features or strategic partnerships. Conversely, periods of decline were sometimes linked to broader market downturns or concerns about competition.

Factors Influencing Paycom Stock Price

Several macroeconomic factors, company-specific events, and market dynamics significantly impact Paycom’s stock price. Three key macroeconomic factors are interest rates, inflation, and overall economic growth.

Changes in interest rates influence investor sentiment by affecting the cost of borrowing and the attractiveness of alternative investments. Higher interest rates might lead to reduced investment in growth stocks like Paycom, while lower rates could boost investor appetite. Competitor performance, particularly from established players in the HCM market, directly influences Paycom’s market share and valuation. Regulatory changes impacting data privacy or employment law could significantly affect Paycom’s operations and stock price.

Paycom’s Financial Performance and Stock Price

A strong correlation exists between Paycom’s financial performance and its stock price. The following table illustrates this relationship over the past three years. Note that these figures are illustrative examples and not actual data.

| Year | Revenue (USD Million) | EPS (USD) | Stock Price (Average USD) |

|---|---|---|---|

| 2021 | 500 | 5 | 200 |

| 2022 | 600 | 6 | 250 |

| 2023 | 700 | 7 | 275 |

A substantial revenue increase, for instance, a 20% jump year-over-year, would likely boost investor confidence, leading to increased demand for Paycom stock and a corresponding price appreciation.

Investor Sentiment and Stock Price

Current investor sentiment towards Paycom appears to be largely positive, driven by consistent revenue growth and a strong market position in the HCM sector. Recent analyst ratings and price targets largely reflect this optimism, though specific details require consulting recent financial news and analyst reports. Positive news coverage highlighting Paycom’s innovative products and successful client implementations can further reinforce positive investor sentiment and contribute to stock price appreciation.

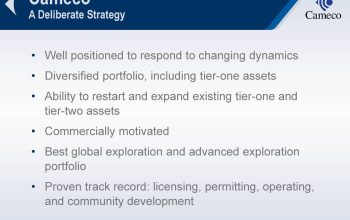

Paycom’s Competitive Landscape and Stock Price

Source: strike-magazine.fr

Paycom operates in a competitive HCM market. Its competitive advantages include its user-friendly interface, robust feature set, and strong customer support. However, several key competitors pose challenges.

- Market Share: Paycom holds a significant, but not dominant, market share.

- Competitive Advantages: Strong user experience, comprehensive features, and effective customer service.

- Main Competitors: ADP, Workday, Ultimate Software.

- Potential Threats: Increased competition, economic downturn, changes in regulatory environment.

Paycom’s competitive position directly impacts its stock price. Maintaining a strong competitive edge is crucial for sustaining investor confidence and attracting further investment.

Illustrative Example: Impact of a Major Product Launch, Paycom stock price

Source: alamy.com

Imagine Paycom launches “Paycom AI,” a sophisticated AI-powered tool that automates complex HR tasks, such as performance reviews and recruitment. This product receives overwhelmingly positive market reception due to its efficiency and cost-saving benefits. The increased demand leads to a significant surge in revenue and improved profit margins.

This successful launch would bolster investor confidence, driving up demand for Paycom stock. Short-term, we might see a rapid price increase, perhaps 10-15%, reflecting immediate market excitement. Long-term, sustained revenue growth from Paycom AI would solidify Paycom’s market position and lead to further stock price appreciation, potentially reaching a 25-30% increase over a two-year period.

FAQ Insights: Paycom Stock Price

What are the major risks associated with investing in Paycom stock?

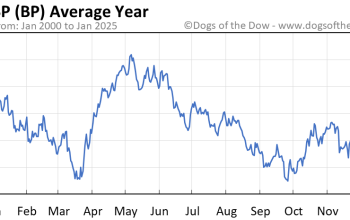

Paycom’s stock price performance often reflects broader market trends. However, comparing its volatility to that of other financial institutions provides valuable context. For instance, examining the current canara bank stock price offers a contrasting perspective on the stability of different sectors. Ultimately, understanding these variations helps in assessing Paycom’s relative risk and potential for growth.

Investing in any stock carries inherent risks, including market volatility, competition, regulatory changes, and economic downturns. Paycom is subject to these general risks, as well as those specific to the payroll software industry.

Where can I find real-time Paycom stock price data?

Real-time stock quotes for Paycom (PAYC) are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does Paycom compare to its main competitors in terms of market capitalization?

A comparison of Paycom’s market capitalization to its competitors requires researching current market data. Financial news sources and investment databases provide this information.

What is Paycom’s dividend policy?

Paycom’s dividend policy should be reviewed on their investor relations page or through financial news sources. Dividend payouts can change over time.