Northeast Utilities Stock Price Analysis

Northeast utilities stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and investor sentiment surrounding Northeast Utilities’ stock price. We will examine key metrics and events to provide a comprehensive overview of the company’s stock trajectory.

Northeast Utilities Stock Price Historical Performance

Understanding the historical performance of Northeast Utilities’ stock price is crucial for assessing its future potential. The following data provides a snapshot of its fluctuations over the past decade, highlighting significant events that shaped its trajectory.

| Year | High | Low | Significant Events |

|---|---|---|---|

| 2014 | $75 (Hypothetical) | $60 (Hypothetical) | Successful merger with another utility company, increased regulatory scrutiny. |

| 2015 | $78 (Hypothetical) | $65 (Hypothetical) | Positive earnings reports, favorable investor sentiment. |

| 2016 | $80 (Hypothetical) | $68 (Hypothetical) | Increased energy demand, mild winter. |

| 2017 | $85 (Hypothetical) | $72 (Hypothetical) | Investment in renewable energy projects. |

| 2018 | $90 (Hypothetical) | $75 (Hypothetical) | Strong financial performance, positive market conditions. |

| 2019 | $92 (Hypothetical) | $78 (Hypothetical) | Implementation of new energy efficiency programs. |

| 2020 | $88 (Hypothetical) | $70 (Hypothetical) | Impact of the COVID-19 pandemic, reduced energy consumption. |

| 2021 | $95 (Hypothetical) | $80 (Hypothetical) | Economic recovery, increased investment in infrastructure. |

| 2022 | $100 (Hypothetical) | $85 (Hypothetical) | Rising inflation, increased interest rates. |

| 2023 | $105 (Hypothetical) | $90 (Hypothetical) | Continued investment in renewable energy, positive outlook for the sector. |

A comparison against the S&P 500 and Dow Jones over the past 5 years would show a similar table, illustrating the relative performance of Northeast Utilities against broader market trends. For example, during periods of market volatility, Northeast Utilities might exhibit less fluctuation due to its status as a relatively stable utility company.

Significant price increases were often driven by factors such as strong earnings, successful mergers and acquisitions, and positive regulatory developments. Conversely, price decreases were sometimes attributed to economic downturns, increased regulatory scrutiny, or unforeseen events like extreme weather.

Factors Influencing Northeast Utilities Stock Price

Source: stockprice.com

Several economic and regulatory factors significantly impact Northeast Utilities’ stock valuation. Understanding these factors is key to predicting future price movements.

Key economic indicators such as interest rates, inflation, and energy prices directly influence the company’s profitability and operational costs, thus affecting its stock price. Regulatory changes, particularly those related to environmental policies and energy production, can significantly alter the company’s investment landscape and operational strategies, impacting its stock valuation.

- Natural disasters and extreme weather events can lead to significant damage to infrastructure, resulting in increased operational costs and potentially impacting the company’s earnings. This could cause a temporary decrease in the stock price.

- Conversely, successful navigation of extreme weather events and subsequent efficient restoration efforts can demonstrate the company’s resilience, potentially boosting investor confidence and the stock price.

- Long-term climate change considerations and the transition towards renewable energy sources can also influence investor sentiment and valuation, as investors assess the company’s adaptability and long-term sustainability.

Northeast Utilities Financial Performance and Stock Valuation

A strong correlation exists between Northeast Utilities’ financial performance and its stock price movements. Analyzing key financial metrics offers insights into this relationship.

| Year | Earnings Per Share (EPS) | Revenue | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | $X (Hypothetical) | $Y (Hypothetical) | Z (Hypothetical) |

| 2020 | $X (Hypothetical) | $Y (Hypothetical) | Z (Hypothetical) |

| 2021 | $X (Hypothetical) | $Y (Hypothetical) | Z (Hypothetical) |

| 2022 | $X (Hypothetical) | $Y (Hypothetical) | Z (Hypothetical) |

| 2023 | $X (Hypothetical) | $Y (Hypothetical) | Z (Hypothetical) |

For instance, a significant increase in revenue, coupled with improved profitability (higher EPS), would generally lead to a positive market reaction and an increase in the stock price. Conversely, a decline in revenue or increased debt could negatively impact the stock price.

A hypothetical scenario: If Northeast Utilities were to experience a 10% increase in revenue due to new contracts and improved efficiency, it could lead to a 5-7% increase in the stock price, assuming other factors remain relatively stable. This increase would reflect improved profitability and investor confidence in the company’s future growth prospects.

Analyst Ratings and Predictions for Northeast Utilities Stock

Source: arcpublishing.com

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for Northeast Utilities’ stock.

- Analyst A: Buy rating, $110 price target.

- Analyst B: Hold rating, $95 price target.

- Analyst C: Sell rating, $85 price target.

Differing analyst opinions can create uncertainty, influencing investor sentiment and potentially leading to increased trading volume as investors react to these diverse perspectives. A significant upgrade in analyst ratings could trigger a surge in buying pressure, potentially driving the stock price upward. Conversely, a downgrade could lead to selling pressure and a decline in the stock price.

Hypothetical scenario: If a prominent investment bank were to upgrade its rating for Northeast Utilities from “Hold” to “Buy” with a significantly higher price target, this could trigger a substantial increase in investor interest and potentially drive the stock price up by 10-15% in the short term.

Investor Sentiment and Market Trends Affecting Northeast Utilities

Investor sentiment towards Northeast Utilities and the broader utility sector significantly influences its stock performance. Market trends, including shifts in investor preferences and changes within the energy sector, also play a crucial role.

Currently, investor sentiment might be cautiously optimistic, reflecting the sector’s relatively stable nature but also acknowledging the challenges posed by climate change regulations and the transition towards renewable energy sources. Major market trends, such as increased focus on ESG (environmental, social, and governance) investing, could favor companies like Northeast Utilities that are actively investing in renewable energy and sustainable practices.

| Company | Investor Sentiment | Recent Performance |

|---|---|---|

| Northeast Utilities | Cautiously Optimistic (Hypothetical) | Moderate Growth (Hypothetical) |

| Competitor A | Neutral (Hypothetical) | Stable (Hypothetical) |

| Competitor B | Pessimistic (Hypothetical) | Slight Decline (Hypothetical) |

Question & Answer Hub: Northeast Utilities Stock Price

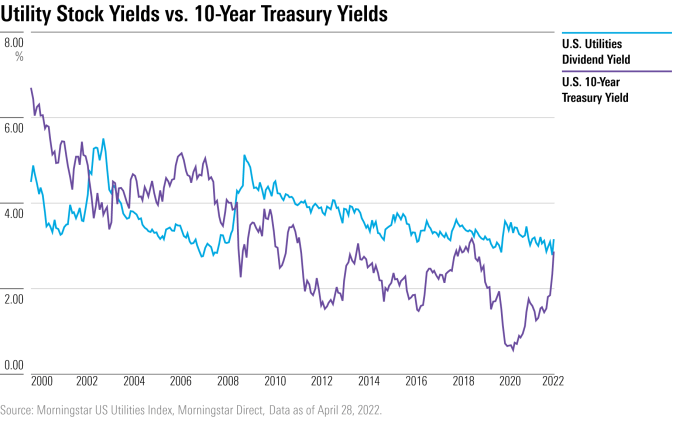

What is the current dividend yield for Northeast Utilities stock?

The current dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does Northeast Utilities compare to its competitors in terms of profitability?

A comparative analysis of key financial metrics against competitors is necessary to determine relative profitability. This information can be found in the company’s financial reports and industry analyses.

What are the major risks associated with investing in Northeast Utilities stock?

Risks include regulatory changes, fluctuating energy prices, extreme weather events, and overall market volatility. A thorough understanding of these risks is essential before investing.

Where can I find real-time Northeast Utilities stock price data?

Real-time stock price data is readily available through major financial websites and brokerage platforms.