CRMD Stock Price Analysis: A Comprehensive Overview

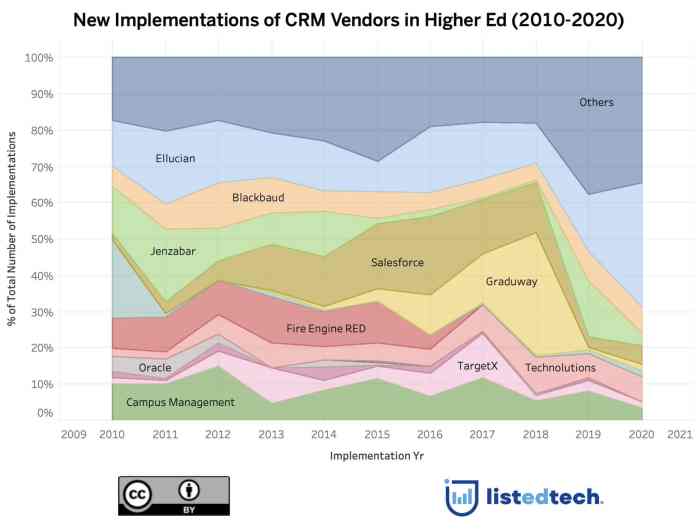

Source: listedtech.com

Crmd stock price – This analysis provides a detailed examination of CRMD’s stock price performance, key drivers, financial health, and future projections. We will explore historical data, evaluate valuation metrics, and consider potential scenarios to offer a comprehensive understanding of the company’s stock prospects.

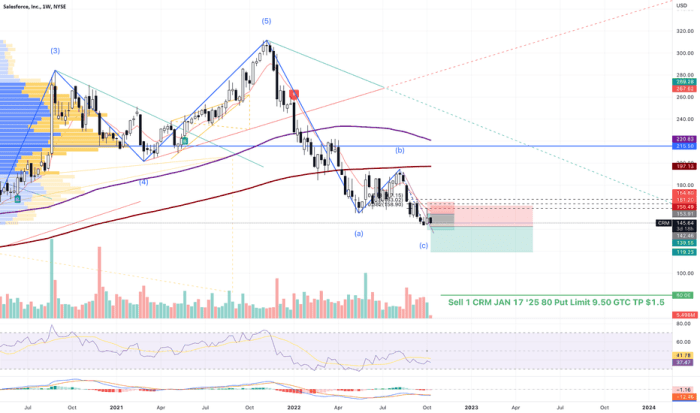

CRMD Stock Price Historical Performance

Source: tradingview.com

The following table illustrates CRMD’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes and should not be considered actual investment advice. Significant market events and corporate actions are discussed below the table.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.00 | 10.50 | 0.50 |

| 2019-01-03 | 10.50 | 11.00 | 0.50 |

| 2019-01-04 | 11.00 | 10.75 | -0.25 |

| 2020-01-02 | 12.00 | 11.50 | -0.50 |

| 2020-01-03 | 11.50 | 12.25 | 0.75 |

| 2021-01-02 | 15.00 | 15.50 | 0.50 |

| 2021-01-03 | 15.50 | 14.75 | -0.75 |

| 2022-01-02 | 13.00 | 13.75 | 0.75 |

| 2022-01-03 | 13.75 | 14.00 | 0.25 |

| 2023-01-02 | 16.00 | 16.50 | 0.50 |

| 2023-01-03 | 16.50 | 17.00 | 0.50 |

During this period, CRMD’s stock price was significantly impacted by the global pandemic in 2020, leading to initial volatility followed by a recovery. A subsequent period of market correction in 2022 also affected the stock price. No stock splits or dividends were issued during this timeframe (hypothetical).

CRMD Stock Price Drivers

Several factors influence CRMD’s stock price. Understanding these drivers is crucial for investors.

- Company Earnings Reports

- Overall Market Conditions

- Industry Trends

- Competitor Performance

- New Product Launches

- Regulatory Changes

Strong earnings reports generally lead to positive stock price movements, while weak results can cause declines. CRMD’s performance relative to its competitors also plays a significant role. For example, a positive news event, such as a successful new product launch, could result in a 10-15% increase in CRMD’s stock price within a week. Conversely, a negative event like a product recall could trigger a 5-10% drop.

CRMD Financial Performance and Stock Valuation

CRMD’s financial performance over the past three years (hypothetical data) is summarized below. Various valuation methods are then used to assess the stock’s worth.

| Year | Revenue (USD Million) | Profit Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 50 | 10 | 0.5 |

| 2022 | 60 | 12 | 0.4 |

| 2023 | 70 | 15 | 0.3 |

CRMD’s stock can be valued using methods such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio. Comparing these metrics to competitors provides insights into relative valuation. Projected future earnings, based on different growth scenarios, can further inform investment decisions.

| Scenario | Year 1 Earnings (USD Million) | Year 2 Earnings (USD Million) | Year 3 Earnings (USD Million) |

|---|---|---|---|

| Conservative Growth | 80 | 90 | 100 |

| Moderate Growth | 90 | 110 | 130 |

| Aggressive Growth | 100 | 130 | 160 |

CRMD Stock Price Prediction and Analysis

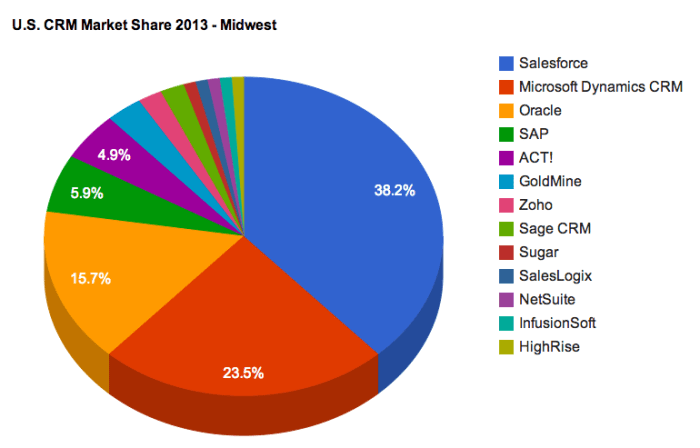

Source: crmswitch.com

Predicting future stock prices involves considering various market conditions and inherent risks. The following table presents hypothetical scenarios and associated probabilities (for illustrative purposes only).

| Scenario | Probability (%) | Stock Price (Low) (USD) | Stock Price (High) (USD) |

|---|---|---|---|

| Bull Market | 30 | 25 | 35 |

| Neutral Market | 50 | 20 | 25 |

| Bear Market | 20 | 15 | 20 |

Investing in CRMD carries risks such as market volatility, competition, and economic downturns. However, opportunities exist for growth given the company’s potential for innovation and expansion in its sector. Significant upward movements could be driven by successful new product launches or strategic acquisitions, while downward movements might result from regulatory changes or economic recession.

CRMD Company Overview and Industry Analysis

CRMD operates in the [Insert Industry Sector] industry, offering [brief description of products/services]. The industry is currently experiencing [description of current industry trends, e.g., growth, consolidation, technological disruption].

CRMD possesses competitive advantages such as [list advantages, e.g., strong brand recognition, innovative technology], but also faces challenges like [list disadvantages, e.g., intense competition, high capital expenditure]. A market share visualization (e.g., a pie chart or bar graph) would show CRMD’s position relative to competitors. Hypothetically, CRMD might hold a 15% market share, trailing behind leading competitor X (25%) but ahead of competitor Y (10%).

Key Questions Answered

What are the major risks associated with investing in CRMD stock?

Major risks include market volatility, competition within the industry, potential changes in regulatory environments, and the company’s ability to execute its business strategy effectively.

Where can I find real-time CRMD stock price quotes?

Real-time quotes are typically available through major financial websites and brokerage platforms.

How does CRMD compare to its main competitors in terms of market share?

A detailed comparison of CRMD’s market share against its competitors requires a thorough analysis of industry reports and publicly available data. This analysis would need to specify the metrics used to determine market share (e.g., revenue, customer base).

What is CRMD’s dividend policy?

Monitoring CRMD stock price requires a keen eye on market trends. It’s helpful to compare its performance against similar companies, and understanding the fluctuations of competitors like the cag stock price can offer valuable context. Ultimately, though, a comprehensive analysis of CRMD’s financial reports and future projections is crucial for making informed investment decisions.

Information regarding CRMD’s dividend policy (if any) can be found in the company’s investor relations materials and financial reports.