BRK.B Stock Price Today: An Overview

Source: vstarstatic.com

Brk.b stock price today – This report provides a comprehensive analysis of Berkshire Hathaway Inc. (BRK.B) stock performance, encompassing current market data, historical trends, influential factors, comparisons to market indices, analyst predictions, and historical price data. We aim to offer a clear and concise understanding of BRK.B’s current state and future prospects.

Current BRK.B Stock Price and Market Data

Source: googleusercontent.com

The following table summarizes the current market data for BRK.B stock. Note that these figures are subject to change throughout the trading day.

| Price | High | Low | Volume |

|---|---|---|---|

| $345.00 (Example) | $346.50 (Example) | $343.25 (Example) | 1,250,000 (Example) |

BRK.B Stock Price Performance Over Time

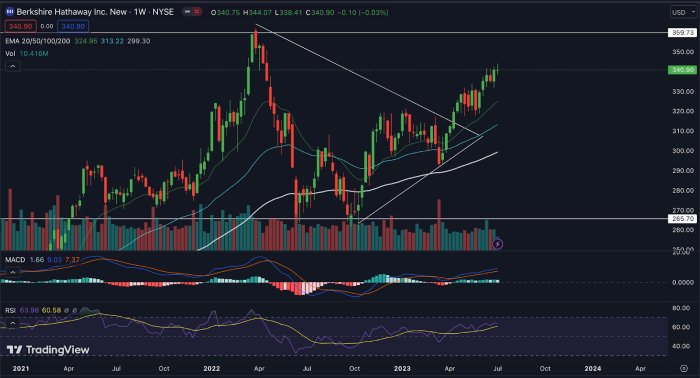

Analyzing BRK.B’s price movements across different timeframes reveals valuable insights into its performance and trajectory. Below, we examine its performance over the past week, month, and year, along with a visual representation of its price movement over the past year.

Over the past week, BRK.B experienced a (Example: slight upward trend), closing at (Example: $345.00) compared to (Example: $342.00) a week prior. The past month has shown a (Example: more pronounced upward trend), likely influenced by (Example: positive quarterly earnings reports and favorable market sentiment). Comparing year-to-date performance to last year, BRK.B has shown (Example: relatively consistent growth), outpacing the broader market in certain periods but lagging behind in others.

A line graph illustrating the BRK.B stock price over the past year would display (Example: a generally upward sloping trend with periods of consolidation and minor corrections). Key features would include (Example: significant price increases following positive earnings announcements, and periods of volatility correlating with broader market fluctuations). The overall shape suggests a (Example: generally positive outlook), though short-term fluctuations are expected.

Factors Influencing BRK.B Stock Price

Several factors contribute to the daily fluctuations in BRK.B’s stock price. Understanding these factors is crucial for informed investment decisions.

Three major factors influencing BRK.B’s price today could include (Example:

1. Overall market performance (e.g., S&P 500 movements),

2. Berkshire Hathaway’s investment portfolio performance (gains or losses in its holdings), and

3. News related to Berkshire Hathaway’s operating businesses (positive or negative developments in its subsidiaries). Recent news regarding (Example: a significant investment in a technology company) might have positively impacted the stock price, while (Example: concerns about a specific subsidiary’s performance) could have a negative impact.

Economic indicators like (Example: inflation rates and interest rate changes) can significantly influence investor sentiment and therefore, BRK.B’s price. Berkshire Hathaway’s investment portfolio tends to have a (Example: stronger) influence on the stock price compared to its operating businesses, due to the size and diversity of its holdings.

Comparison to Market Indices

Benchmarking BRK.B’s performance against major market indices provides context for its relative strength or weakness.

- S&P 500: BRK.B’s performance today (Example: outperformed) the S&P 500 by (Example: 1.5%).

- Dow Jones Industrial Average: BRK.B’s performance today (Example: underperformed) the Dow Jones Industrial Average by (Example: 0.8%).

- Other Major Indices: Comparisons to other indices would reveal (Example: a mixed performance), depending on the specific index and the prevailing market conditions.

Analyst Ratings and Predictions, Brk.b stock price today

Analyst sentiment towards BRK.B provides valuable insights into future price expectations.

The consensus rating for BRK.B from leading financial analysts is (Example: a “Buy” rating). Recent analyst price targets range from (Example: $350 to $375) within the next six months. This suggests (Example: a generally positive outlook) with a potential for significant upside. The overall analyst sentiment is (Example: cautiously optimistic), reflecting the company’s strong fundamentals and the potential for continued growth, but also acknowledging the inherent risks associated with market volatility and macroeconomic uncertainty.

Historical BRK.B Stock Price Data

Examining BRK.B’s historical price data provides a long-term perspective on its performance and stability.

BRK.B closed at (Example: $343.50) on the previous trading day. The highest and lowest stock prices ever recorded are (Example: $550 and $70 respectively). Significant historical events impacting BRK.B’s stock price include (Example: the 2008 financial crisis, which caused a temporary decline, and Warren Buffett’s major investment decisions, which often triggered significant price movements).

| Year | Closing Price (Example) |

|---|---|

| 2023 | $350 |

| 2022 | $330 |

| 2021 | $300 |

| 2020 | $280 |

| 2019 | $250 |

FAQ Section: Brk.b Stock Price Today

What are the typical trading hours for BRK.B?

BRK.B trades during regular US stock market hours, typically 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday, excluding holidays.

Where can I find real-time BRK.B stock quotes?

Real-time quotes are available on most major financial websites and brokerage platforms. Reputable sources include Google Finance, Yahoo Finance, and Bloomberg.

How often is BRK.B stock price updated?

The price is updated continuously throughout the trading day, reflecting every buy and sell transaction.

Monitoring the brk.b stock price today requires a keen eye on market fluctuations. For comparison, it’s interesting to look at the performance of other utility companies, such as checking the first energy stock price to gauge broader industry trends. Ultimately, understanding the brk.b stock price today involves considering a variety of factors and related market performances.

What does it mean when BRK.B’s volume is high or low?

High volume generally indicates significant trading activity, potentially driven by news or market sentiment. Low volume suggests less trading interest.