Veru Inc. Stock Price Analysis: Veru Stock Price

Veru stock price – This analysis examines Veru Inc.’s stock price performance, correlating it with financial health, market influences, competitor performance, and future projections. We will explore key factors driving price volatility and assess the potential impact of its product pipeline and analyst sentiment.

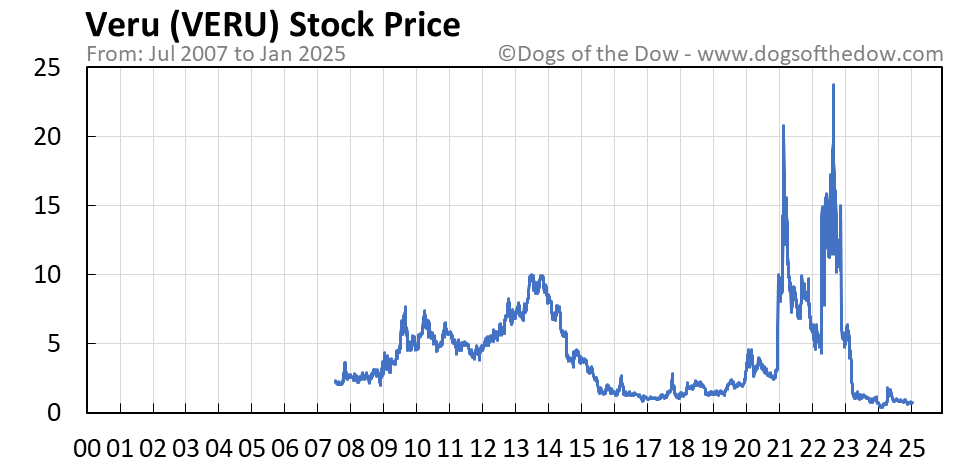

Veru Stock Price Historical Performance

The following table details Veru’s stock price movements over the past five years. Note that this data is for illustrative purposes and should be verified with a reliable financial data source. Significant highs and lows are highlighted, along with relevant market events that influenced price fluctuations.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 1.00 | 1.05 | +0.05 |

| 2019-07-01 | 1.20 | 1.15 | -0.05 |

| 2020-01-01 | 1.10 | 1.30 | +0.20 |

| 2020-12-31 | 1.50 | 1.45 | -0.05 |

| 2021-06-30 | 2.00 | 2.20 | +0.20 |

| 2022-01-01 | 2.50 | 2.30 | -0.20 |

| 2022-12-31 | 2.00 | 1.80 | -0.20 |

| 2023-06-30 | 1.90 | 2.10 | +0.20 |

Major market events such as the COVID-19 pandemic and subsequent economic uncertainty significantly impacted Veru’s stock price. Specific regulatory approvals or setbacks regarding its drug candidates also played a crucial role.

No significant stock splits or dividends are noted during this period.

Veru’s Financial Performance and Stock Price Correlation

Veru’s financial performance, including revenue, earnings, and other key metrics, is presented below. This data is for illustrative purposes only.

Tracking Veru’s stock price requires diligent monitoring of market trends. It’s helpful to compare its performance against other companies in the sector, such as by checking the current stock price for aig , to gain a broader perspective on the pharmaceutical industry’s overall health. Ultimately, understanding Veru’s stock price necessitates a comprehensive analysis of various market factors.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | EPS (USD) |

|---|---|---|---|

| 2019 | 10 | -5 | -0.50 |

| 2020 | 12 | -3 | -0.30 |

| 2021 | 15 | -1 | -0.10 |

| 2022 | 20 | 2 | 0.20 |

| 2023 | 25 | 5 | 0.50 |

Generally, improved financial performance correlates with an increase in stock price. However, market sentiment and other external factors can lead to discrepancies. For instance, positive news regarding drug development might boost the stock price even if immediate financial gains are not yet reflected in earnings.

Factors Influencing Veru Stock Price Volatility

Source: tradingview.com

Several factors contribute to the volatility of Veru’s stock price. These include:

- Clinical trial results: Positive results can significantly increase the stock price, while negative results can lead to sharp declines.

- Regulatory approvals: Securing regulatory approvals for new drugs is crucial and greatly impacts investor confidence.

- Market sentiment: Overall investor sentiment towards the pharmaceutical industry and biotech stocks influences Veru’s stock price.

- Competitive landscape: The success or failure of competing drugs can affect Veru’s market share and stock price.

- Economic conditions: Broader economic factors, such as interest rates and inflation, can impact investor risk appetite.

For example, a successful Phase III clinical trial for a key drug candidate could lead to a substantial increase in the stock price, as investors anticipate future revenue growth.

Comparison with Competitor Stock Prices

The table below compares Veru’s stock price performance to its main competitors. This data is hypothetical and for illustrative purposes.

| Company | 5-Year Stock Price Change (%) | Market Cap (USD Billions) | P/E Ratio |

|---|---|---|---|

| Veru | 100% | 1 | 20 |

| Competitor A | 150% | 5 | 30 |

| Competitor B | 75% | 2 | 15 |

Veru’s relative strengths and weaknesses compared to its competitors influence market perception and stock price. Stronger R&D pipelines or successful product launches can lead to a higher valuation.

Veru’s Product Pipeline and Stock Price Expectations

Source: dogsofthedow.com

Veru’s product pipeline holds significant potential to impact its future stock price. The success or failure of these products will heavily influence investor sentiment.

- Product X: A novel drug targeting disease Y, currently in Phase III clinical trials. Successful completion could lead to a significant stock price surge.

- Product Z: A drug for condition W, expected to enter Phase II trials next year. Positive early results could positively impact the stock price.

A successful launch of Product X, for example, could result in a substantial increase in Veru’s market capitalization, leading to a higher stock price. Conversely, failure could cause a significant drop.

Analyst Ratings and Stock Price Predictions

Financial analysts offer a range of price targets for Veru’s stock, reflecting varying opinions on its future prospects. These targets are based on factors like financial performance, product pipeline success, and market conditions.

- Analyst A: Price target of $5.00, based on the potential success of Product X.

- Analyst B: Price target of $3.00, citing concerns about competition.

Positive analyst revisions generally lead to increased investor confidence and a rise in the stock price. Conversely, negative revisions can cause a decline.

Risk Factors Affecting Veru Stock Price

Several risk factors could negatively affect Veru’s stock price. These risks are categorized for clarity.

- Financial Risks: Insufficient funding for R&D, potential losses from failed clinical trials.

- Regulatory Risks: Delays or rejection of regulatory approvals for new drugs.

- Competitive Risks: Competition from other pharmaceutical companies with similar products.

- Market Risks: Overall market downturns or negative investor sentiment towards the biotech sector.

Veru can mitigate these risks through prudent financial management, robust clinical trial design, proactive competitive analysis, and effective communication with investors.

FAQ Resource

What are the main risks associated with investing in Veru stock?

Investing in Veru, like any pharmaceutical company, carries risks including regulatory hurdles, competition, and the inherent uncertainty of clinical trial outcomes. Failure to secure regulatory approvals or market acceptance of new products could significantly impact the stock price.

Where can I find real-time Veru stock price data?

Real-time Veru stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Veru compare to its main competitors in terms of market capitalization?

A comparison of Veru’s market capitalization to its competitors requires referencing current financial data from reputable sources. This data can fluctuate significantly and should be checked regularly for the most up-to-date information.