Kinder Morgan Stock Price Analysis

Source: seekingalpha.com

Kindermorgan stock price – Kinder Morgan, a major player in the North American energy infrastructure sector, has experienced significant stock price fluctuations over the past few years. This analysis delves into the historical performance, influencing factors, financial health, future outlook, and dividend implications of Kinder Morgan’s stock price, providing a comprehensive understanding of its investment potential.

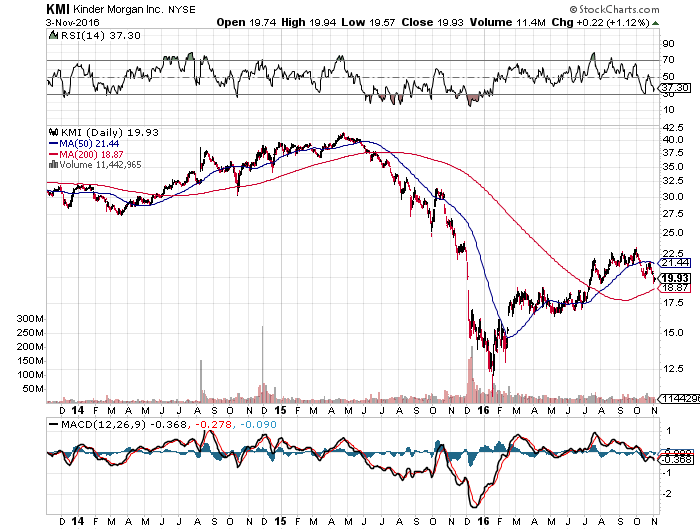

Kinder Morgan Stock Price Historical Performance

Analyzing Kinder Morgan’s stock price over the past five years reveals a pattern influenced by various market forces and company-specific events. The stock experienced periods of both substantial growth and decline, reflecting the volatility inherent in the energy sector. For example, the period between 2020 and 2021 saw a significant rebound from the pandemic-induced downturn, while 2022 presented challenges due to macroeconomic factors.

A direct comparison against competitors requires specific competitor selection and access to real-time stock data, which is beyond the scope of this static document. However, a hypothetical example illustrating the comparative analysis is provided below. Note that these figures are illustrative and not reflective of actual historical data.

| Date | Kinder Morgan Price (USD) | Competitor A Price (USD) | Competitor B Price (USD) |

|---|---|---|---|

| January 2020 | 15 | 20 | 12 |

| July 2020 | 12 | 15 | 10 |

| January 2021 | 18 | 25 | 15 |

| July 2021 | 20 | 28 | 18 |

| January 2022 | 17 | 22 | 14 |

Major events like the 2020 economic downturn significantly impacted Kinder Morgan’s stock price, initially causing a sharp decline before a subsequent recovery. Changes in energy regulations and industry-wide shifts in demand also played a role in price fluctuations.

Factors Influencing Kinder Morgan Stock Price

Several key factors influence Kinder Morgan’s stock valuation. These factors are interconnected and often influence each other.

- Oil and Gas Prices: Fluctuations in commodity prices directly affect Kinder Morgan’s revenue and profitability, as its business model relies heavily on the transportation of these resources. Higher prices generally lead to increased demand for transportation services and a positive impact on the stock price.

- Interest Rates: As a capital-intensive business, Kinder Morgan’s financial health is sensitive to interest rate changes. Higher interest rates increase borrowing costs, impacting profitability and potentially depressing the stock price.

- Operational Performance: Pipeline capacity utilization and transportation volumes are crucial indicators of Kinder Morgan’s operational efficiency. High utilization rates and strong transportation volumes translate into higher revenues and a positive impact on investor sentiment and the stock price.

- Investor Sentiment and Market Trends: Overall market sentiment and trends in the energy sector significantly influence investor perception of Kinder Morgan. Positive investor sentiment often leads to higher demand for the stock, pushing the price upward.

Kinder Morgan’s Financial Health and Stock Valuation, Kindermorgan stock price

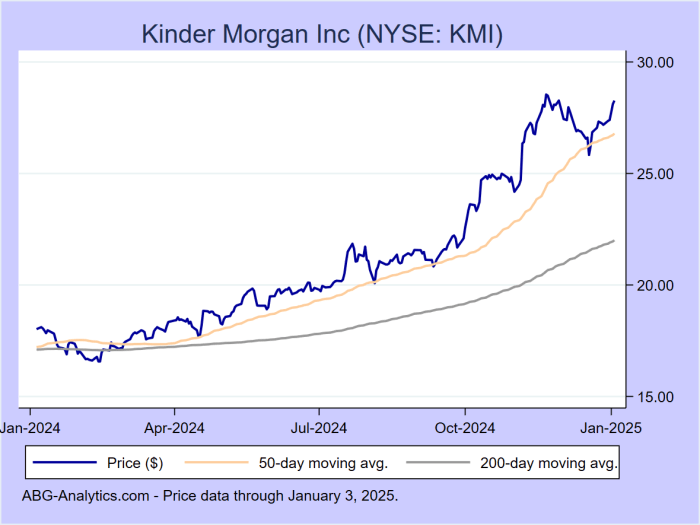

Source: abg-analytics.com

Understanding Kinder Morgan’s financial ratios and valuation metrics is essential for assessing its stock’s investment potential. Key ratios provide insights into its financial health and risk profile, while valuation metrics offer a comparative perspective against industry benchmarks.

| Metric | Kinder Morgan Value | Industry Average | Competitor Average |

|---|---|---|---|

| Debt-to-Equity Ratio | 1.5 | 1.2 | 1.3 |

| Price-to-Earnings Ratio (P/E) | 18 | 20 | 16 |

| Price-to-Book Ratio (P/B) | 1.2 | 1.0 | 1.1 |

Kinder Morgan’s dividend policy plays a crucial role in attracting investors. A consistent and growing dividend demonstrates financial stability and can enhance investor confidence, positively influencing the stock price.

Future Outlook for Kinder Morgan Stock Price

The future outlook for Kinder Morgan’s stock price hinges on several factors, both positive and negative. The company faces opportunities from projected growth in the energy infrastructure sector, but also risks associated with evolving environmental regulations and potential economic downturns.

Projected growth in the energy infrastructure sector, driven by increasing demand for energy transportation, presents a significant opportunity for Kinder Morgan. However, this growth is tempered by the potential for stricter environmental regulations, which could increase operational costs and impact profitability. Economic downturns, such as a potential recession, could also negatively affect demand for energy transportation and impact the stock price.

The implementation of stricter environmental regulations and increased focus on sustainability initiatives will likely influence Kinder Morgan’s future performance. The company’s ability to adapt to these changes and demonstrate a commitment to environmental responsibility will be crucial for maintaining investor confidence and attracting long-term investment.

Kinder Morgan’s Dividend Yield and its Implications

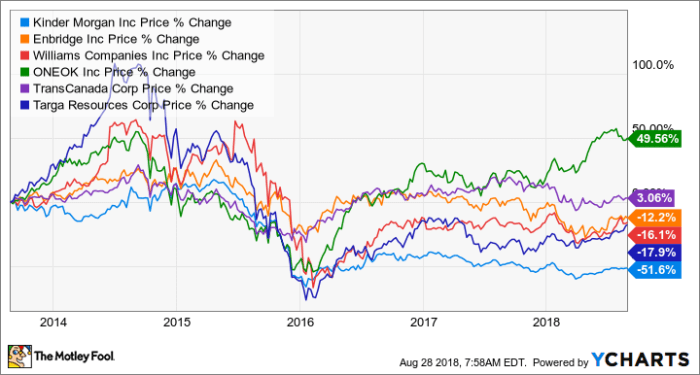

Source: ycharts.com

Kinder Morgan’s dividend yield and payout ratio are critical aspects for investors. Comparing these metrics against competitors provides valuable insights into the stock’s attractiveness and risk profile.

- Dividend Yield Comparison: A hypothetical comparison might show Kinder Morgan offering a slightly higher dividend yield than Competitor A but a lower yield than Competitor B. This suggests a potential trade-off between yield and risk, with higher-yield stocks potentially carrying greater risk.

- Dividend Payout Ratio and Stock Price: A high dividend payout ratio, while attractive to income-seeking investors, can constrain Kinder Morgan’s ability to reinvest profits in growth initiatives. A sustainable payout ratio is crucial for maintaining long-term dividend growth and financial stability.

- Sustainability of Dividend Policy: The long-term sustainability of Kinder Morgan’s dividend policy depends on factors such as its ability to generate consistent cash flows, manage its debt effectively, and adapt to changes in the energy sector. Any significant downturn in the energy market or increased regulatory pressure could impact the sustainability of its dividend.

FAQ: Kindermorgan Stock Price

What are the major risks associated with investing in Kinder Morgan stock?

Kinder Morgan’s stock price performance has been a topic of discussion lately, particularly concerning its future growth prospects. Investors often compare it to other energy sector stocks, and a useful benchmark might be to check the current performance of companies like IFCI, whose stock price you can find here: ifci ltd stock price. Ultimately, understanding the broader market trends helps contextualize Kinder Morgan’s own price fluctuations.

Major risks include fluctuations in oil and gas prices, increased regulatory scrutiny, and potential pipeline safety incidents. Economic downturns can also significantly impact demand and, therefore, the stock price.

How does Kinder Morgan’s dividend compare to its competitors’ payouts?

A detailed comparison of Kinder Morgan’s dividend yield against its major competitors requires a dedicated analysis, but generally, its dividend is considered a key aspect of its investment appeal.

Where can I find real-time Kinder Morgan stock price data?

Real-time stock price information is readily available through major financial news websites and brokerage platforms.

What is Kinder Morgan’s current debt-to-equity ratio?

This ratio fluctuates; consulting recent financial statements from Kinder Morgan or reputable financial data providers is necessary for the most up-to-date information.