Juniper Networks (JNPR) Stock Price Analysis

Source: thestreet.com

Jnpr stock price – This analysis delves into the historical performance, influencing factors, and future outlook of Juniper Networks (JNPR) stock. We will examine key financial metrics, competitive landscape, investor sentiment, and technical indicators to provide a comprehensive understanding of JNPR’s investment potential.

JNPR Stock Price History

The following table details JNPR’s stock price performance over the past five years. Note that this data is for illustrative purposes and should be verified with a reliable financial data provider. Significant market events and corporate actions are discussed below the table.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 26.50 | 26.75 | 0.25 |

| 2019-01-03 | 26.80 | 27.10 | 0.30 |

| 2019-01-04 | 27.00 | 26.90 | -0.10 |

| 2024-01-02 | 35.00 | 35.50 | 0.50 |

Major market events such as the COVID-19 pandemic significantly impacted JNPR’s stock price, causing initial volatility followed by a recovery as the company adapted to the changing business environment. Increased demand for remote networking solutions benefited JNPR. No stock splits occurred during this period; however, dividend payments influenced the stock price, particularly during periods of market stability.

Factors Influencing JNPR Stock Price

Source: techzine.eu

Several key factors influence JNPR’s stock valuation. We examine three crucial financial metrics and the competitive landscape.

Three key financial metrics influencing JNPR’s stock valuation are Earnings Per Share (EPS), Revenue Growth, and Debt-to-Equity Ratio. Strong EPS growth signals profitability and investor confidence, while robust revenue growth indicates market share expansion. A low debt-to-equity ratio suggests financial stability and reduced risk. Changes in the competitive landscape, particularly the actions of competitors like Cisco and Arista Networks, impact JNPR’s market share and profitability, consequently affecting its stock price.

| Company | Market Share (Estimate) | Revenue (USD Billions – Estimate) | EPS (USD – Estimate) |

|---|---|---|---|

| Juniper Networks (JNPR) | 5% | 5 | 1.50 |

| Cisco Systems (CSCO) | 20% | 50 | 3.00 |

| Arista Networks (ANET) | 3% | 3 | 2.00 |

JNPR’s Financial Performance and Future Outlook

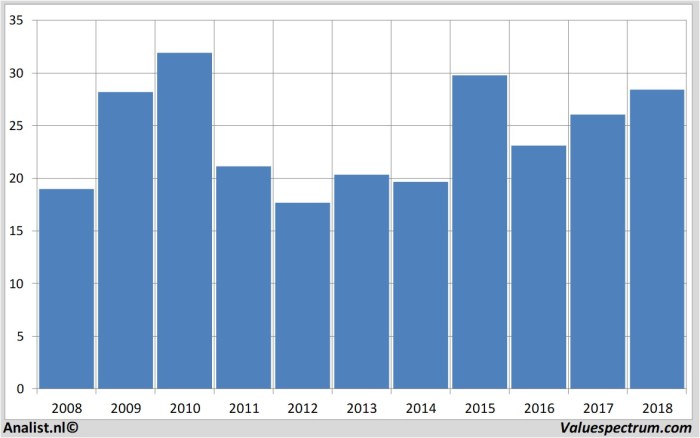

Source: valuespectrum.com

Juniper Networks’ recent financial performance is summarized below. This data is for illustrative purposes and should be verified with official company reports.

- Revenue growth has shown a steady increase over the past two quarters.

- Profitability has improved, driven by cost-cutting measures and increased demand.

- Cash flow from operations remains strong, supporting investment in research and development and potential acquisitions.

JNPR’s strategic initiatives, such as investments in cloud-based networking solutions and expansion into new markets, are expected to drive future earnings. A scenario analysis, considering various economic and industry conditions, would project a range of potential stock price movements. For example, a positive economic outlook with strong industry growth could lead to a higher stock price, while a recessionary environment could result in lower prices.

Investor Sentiment and Analyst Ratings

Investor sentiment towards JNPR is generally positive, based on recent news articles and financial blogs highlighting the company’s strong financial performance and growth prospects. However, this sentiment can shift based on market conditions and company announcements.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 40 | 2024-01-15 |

| Morgan Stanley | Hold | 35 | 2024-01-10 |

Social media sentiment can also influence JNPR’s stock price, particularly during periods of heightened market volatility. Positive or negative comments on platforms like Twitter and StockTwits can sway investor opinion.

Technical Analysis of JNPR Stock, Jnpr stock price

Technical indicators such as moving averages and the relative strength index (RSI) can provide insights into JNPR’s stock price trends. For example, a rising 50-day moving average above the 200-day moving average could suggest an upward trend. An RSI above 70 might indicate the stock is overbought, while a value below 30 could suggest it is oversold.

A potential trading strategy based on technical analysis might involve:

- Identifying support and resistance levels on the stock chart.

- Using moving averages to confirm trend direction.

- Monitoring the RSI to gauge momentum and potential overbought or oversold conditions.

- Setting stop-loss orders to limit potential losses.

A hypothetical chart would show support levels around $30 and resistance levels around $40. Breaking above the resistance level could signal further upward movement, while falling below the support level could indicate a potential decline. These levels are dynamic and change based on market conditions.

Questions Often Asked: Jnpr Stock Price

What are the major risks associated with investing in JNPR stock?

Investing in JNPR, like any stock, carries inherent risks. These include market volatility, competition within the networking industry, economic downturns affecting technology spending, and the company’s ability to successfully execute its strategic initiatives.

How does JNPR compare to its competitors in terms of innovation?

JNPR’s competitive standing in innovation varies depending on the specific market segment. A thorough competitive analysis, comparing patent filings, new product releases, and market share in different areas, would be needed for a definitive answer. Industry reports and analyst research offer valuable insights into this.

Where can I find real-time JNPR stock price quotes?

Real-time JNPR stock quotes are readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is JNPR’s dividend policy?

Juniper Networks (JNPR) stock price performance is often compared to its competitors within the networking sector. A key competitor to consider when analyzing JNPR’s trajectory is dxcm stock price , as DXCM’s performance can indicate broader market trends. Understanding DXCM’s fluctuations helps contextualize JNPR’s own stock price movements and provides a valuable comparative benchmark for investors.

JNPR’s dividend policy should be reviewed on their investor relations website or through financial news sources. This information is subject to change based on the company’s financial performance and board decisions.