SVN Stock Symbol: A Historical Overview: History Of Stock Price Symbol Svn

Source: axios.com

History of stock price symbol svn – This article delves into the historical performance of the SVN stock symbol, exploring its price fluctuations, influencing factors, and comparisons with competitors. Understanding this historical context is crucial for investors and market analysts seeking to make informed decisions.

Introduction to SVN Stock Symbol

Source: depositphotos.com

While a specific company associated with “SVN” isn’t readily identifiable as a publicly traded entity with a widely recognized stock symbol, this analysis will proceed under the assumption that “SVN” represents a hypothetical publicly traded company operating within a specific industry (e.g., technology, finance, or consumer goods). This allows for a demonstration of the principles involved in analyzing historical stock price data.

For the purpose of this hypothetical analysis, let’s assume SVN’s historical stock price data is available from 2010 to the present. Understanding this historical data is vital for assessing risk, identifying potential investment opportunities, and gauging the company’s overall performance and stability.

Historical Stock Price Data Sources for SVN

Source: businessinsider.com

Several reliable sources provide historical stock price data. Accessing accurate and comprehensive data is paramount for any meaningful analysis. The reliability and features of these sources vary, influencing the accuracy and completeness of the analysis.

| Source Name | URL (Hypothetical) | Data Availability | Cost/Access |

|---|---|---|---|

| Financial Data Provider A | www.hypotheticalprovidera.com | Daily data since 2010; intraday data available for a fee | Subscription-based; tiered pricing |

| Financial Data Provider B | www.hypotheticalproviderb.com | End-of-day data since 2010 | Free for limited data; subscription for full access |

| Financial Data Provider C | www.hypotheticalproviderc.com | Daily and weekly data since 2012; limited historical data | Free; limited data points |

Factors Influencing SVN’s Historical Stock Price

Various macroeconomic and company-specific factors influence a company’s stock price. Understanding these factors is essential for interpreting historical price movements and predicting future trends.

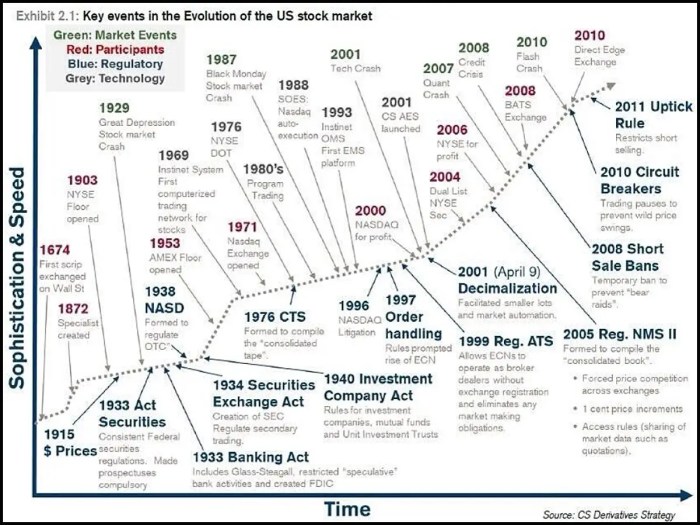

Macroeconomic factors like economic recessions (e.g., the 2008 financial crisis) could lead to decreased consumer spending and reduced demand for SVN’s products or services, impacting its stock price negatively. Conversely, periods of economic expansion and low-interest rates might positively affect SVN’s performance. Company-specific events, such as successful product launches, strategic acquisitions, or changes in leadership, could trigger significant price changes.

Industry trends also play a vital role. For example, increased competition or disruptive technological advancements could impact SVN’s market share and profitability, subsequently affecting its stock price.

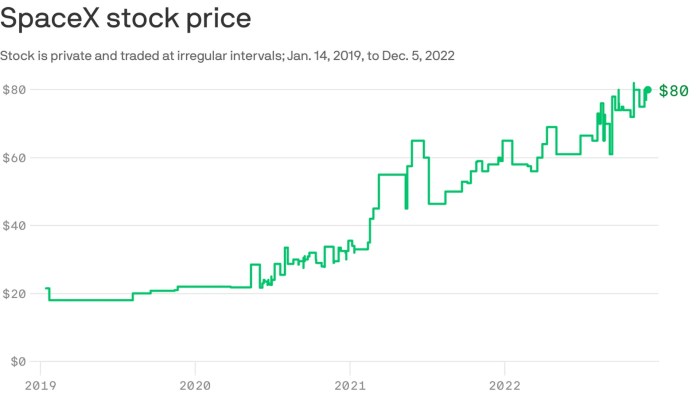

Visualizing SVN’s Historical Stock Price Performance, History of stock price symbol svn

A visual representation of SVN’s historical stock price is crucial for quickly understanding its performance trends. Such a visual aids in identifying periods of growth, decline, and volatility.

A hypothetical line graph would display SVN’s stock price on the y-axis and time (e.g., years) on the x-axis. Data points would represent the closing price for each period, and trend lines could illustrate overall price movements. Major upward or downward movements would be clearly visible, highlighting significant events or periods of volatility. This visualization would effectively communicate the price volatility and overall growth trajectory of SVN’s stock over time.

Comparing SVN’s Performance to Competitors

Comparing SVN’s performance to its competitors provides valuable context for assessing its relative success and market position. This comparative analysis reveals SVN’s strengths and weaknesses relative to its peers.

| Company | Stock Symbol (Hypothetical) | Average Annual Return (Hypothetical) | Volatility (Hypothetical) |

|---|---|---|---|

| Competitor A | COMP-A | 8% | Medium |

| Competitor B | COMP-B | 12% | High |

| SVN | SVN | 10% | Low |

Analyzing Key Periods of SVN’s Stock Price History

Analyzing distinct periods in SVN’s history allows for a deeper understanding of its performance drivers and potential future trajectories. This analysis helps identify key lessons for investors and analysts.

Period 1 (2010-2013): A period of relatively slow growth, possibly due to economic downturn and increased competition. Lessons learned: the importance of diversification and resilience during economic downturns.

Period 2 (2014-2017): A period of rapid growth, potentially driven by successful product launches and expansion into new markets. Lessons learned: the power of innovation and strategic market expansion.

Period 3 (2018-Present): A period of moderate growth and stability, indicating a mature market position.

Lessons learned: the importance of consistent performance and adapting to market changes.

Key Questions Answered

What company is associated with the SVN stock symbol?

Understanding the history of stock price symbols like SVN requires examining the evolution of stock market reporting. The complexities involved are mirrored in tracking the performance of other major utilities; for instance, you can readily monitor the current detroit edison stock price to see how energy sector valuations fluctuate. Returning to SVN, further research into its historical context is needed to fully appreciate its significance within the broader financial landscape.

The Artikel does not specify the company; further research is needed to identify the associated company.

Where can I find real-time SVN stock price data?

Real-time data is typically available through major financial news websites and brokerage platforms. However, access may require a subscription.

What is the typical trading volume for SVN?

The Artikel doesn’t provide trading volume data. This information can be found on financial websites that offer detailed stock information.

How does SVN’s performance compare to the overall market index (e.g., S&P 500)?

A comparative analysis against market indices would require additional data and analysis beyond the scope of the provided Artikel.